The Bar is too High for US CPI to Surprise on the Upside

The significance of today's US inflation report can hardly beoverestimated. Over the past few years there were few inflation reports, which drewas much attention as the January report. The Fed acknowledged in December thatit was wrong with its inflation forecasts, removing the word “temporary” fromthe wording. Additionally then signaled in January that getting a grip on pricegrowth becomes “goal # 1”, saying that labor market targets were met (fullemployment was achieved) and its margin of safety will be enough for areasonably large number of rate hikes.

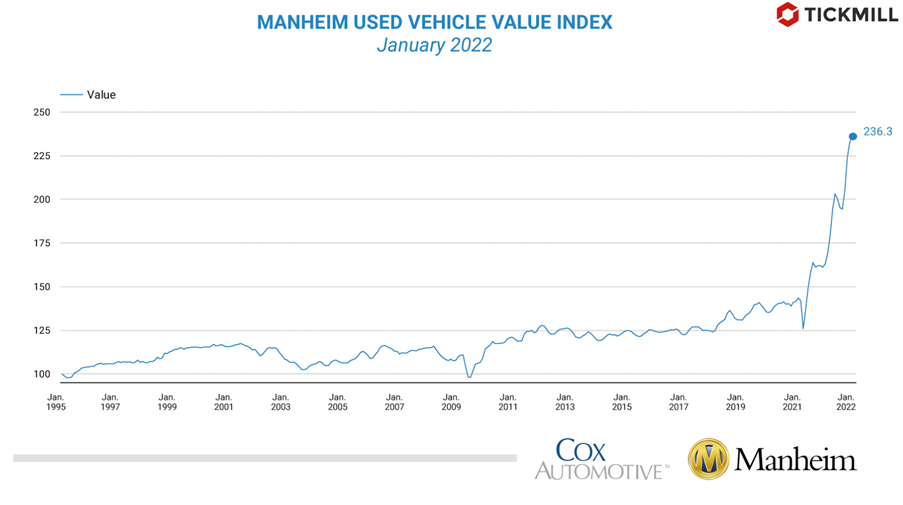

The bar for upside surprise is quite high - 7.3% for headlineinflation and 5.9% for core inflation in annual terms. Wage growth speaks infavor of strong inflation – MoM gain in January, as shown in NFP report, was0.7% beating quite strong consensus of 0.5%. Wage growth remains one of the keyinflation drivers and is often persistent, obviously because rising incomeaffects both short-term and long-term consumer expectations. Recent data showsthat demand for durable goods in the US has risen, with the lion’s sharefalling on cars demand. Manheim data shows that car price inflation hit a newhigh in January and amounted to 45% in annual terms, suggesting that keybullish inflation driver remains in place:

On the other hand, market expectations, expectations ofprofessional inflation forecasters, signs of easing in supply disruptions as wellas the current characteristics of componentwise growth in consumer prices favorweaker inflation print.

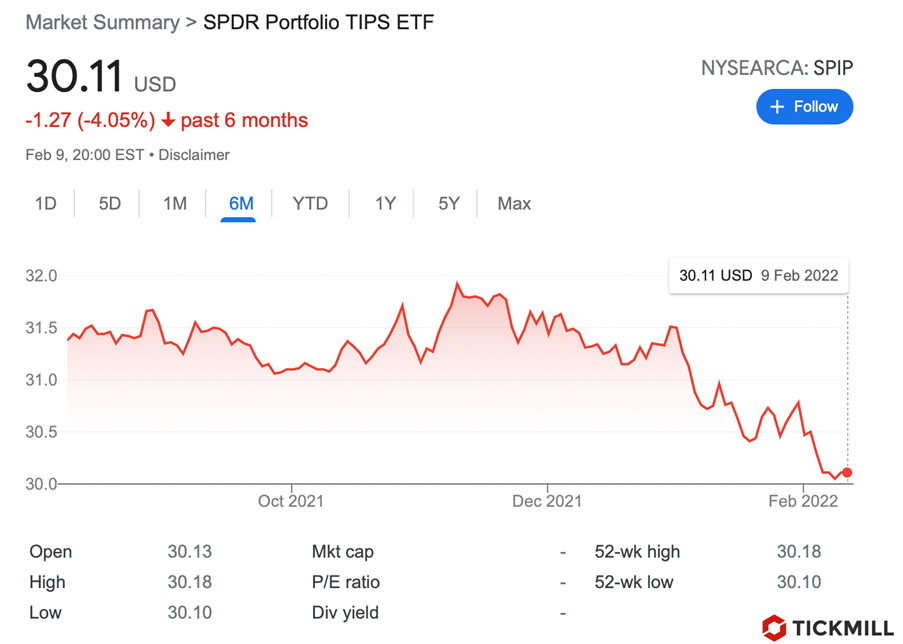

Speaking of the first argument, eight out of ten previous CPIestimates by Bloomberg experts was lower than the actual prints which couldnaturally lead to a hawkish bias and a higher chance of a late spotting ofreversal in the trend. Regarding market’s view on inflation, it is reasonableto assume that the demand for inflation protection reflects market expectationsand thankfully there are market instruments that can help to assess thatdemand. For example, returns of ETFs on TIPS (inflation-protected Treasuries), entereddownward trend since early January and the sell-off apparently intensified inFebruary:

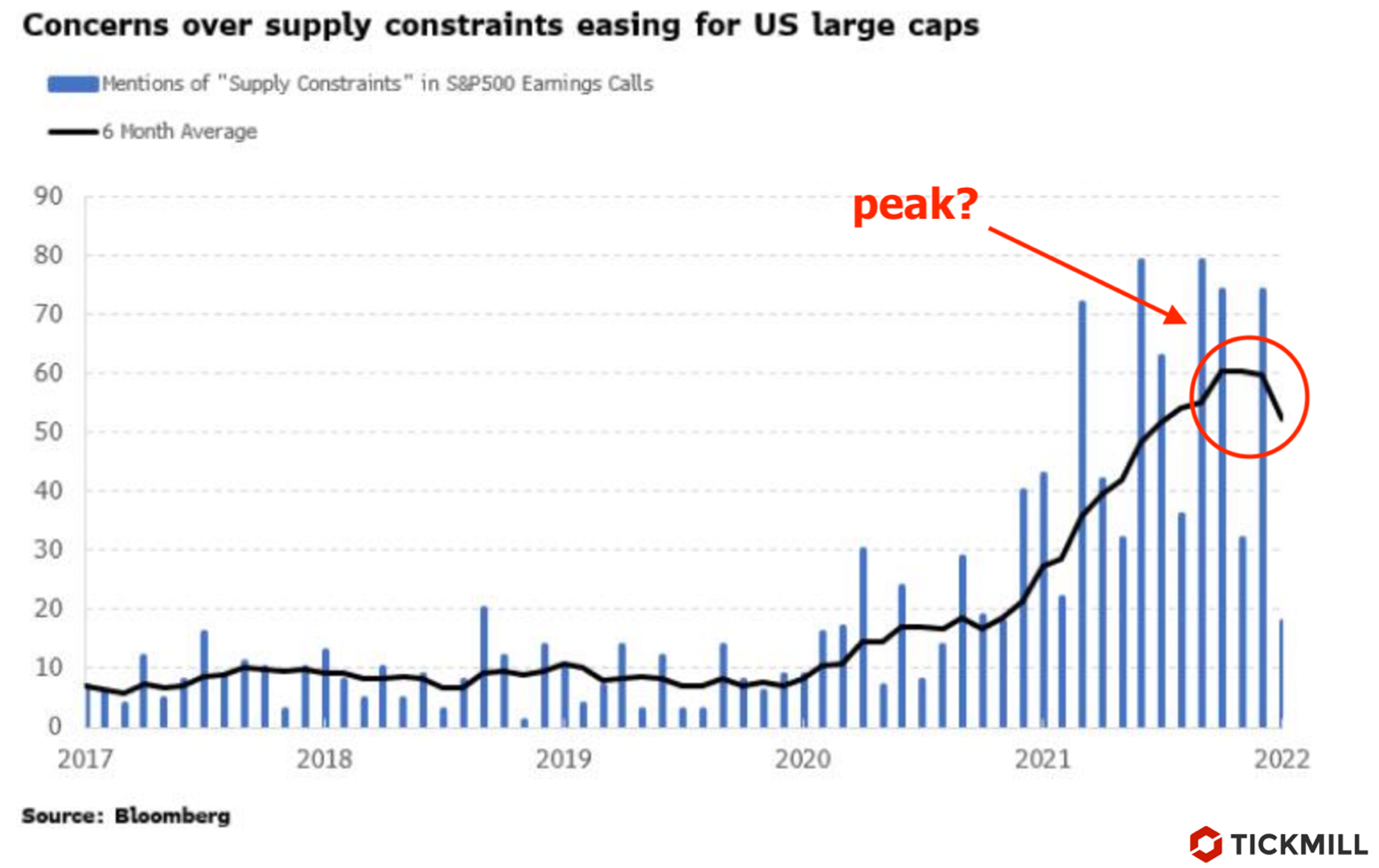

S&P 500 earnings call analysis shows that the number ofmentions of supply disruptions and delays peaked out in December 2021,suggesting that the contribution of cost inflation to consumer inflation mayhave begun to decline:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.