Technical signal triggers Dollar recovery but soft US labor market data weighs on sentiment

The US Dollar began a rebound on Thursday after the Dollar Index (DXY) touched a yearly low, triggering traders to capitalize on a strong and clear technical signal:

The latest revisions to the US Nonfarm Payrolls data revealed a staggering downward adjustment, with 818,000 fewer jobs than initially reported. This marks the most substantial revision in over a decade and underscores the growing concerns about the robustness of the US labor market. The upward revision of weekly US jobless claims—albeit marginal—added another layer of complexity, signaling potential weakness in the labor market.

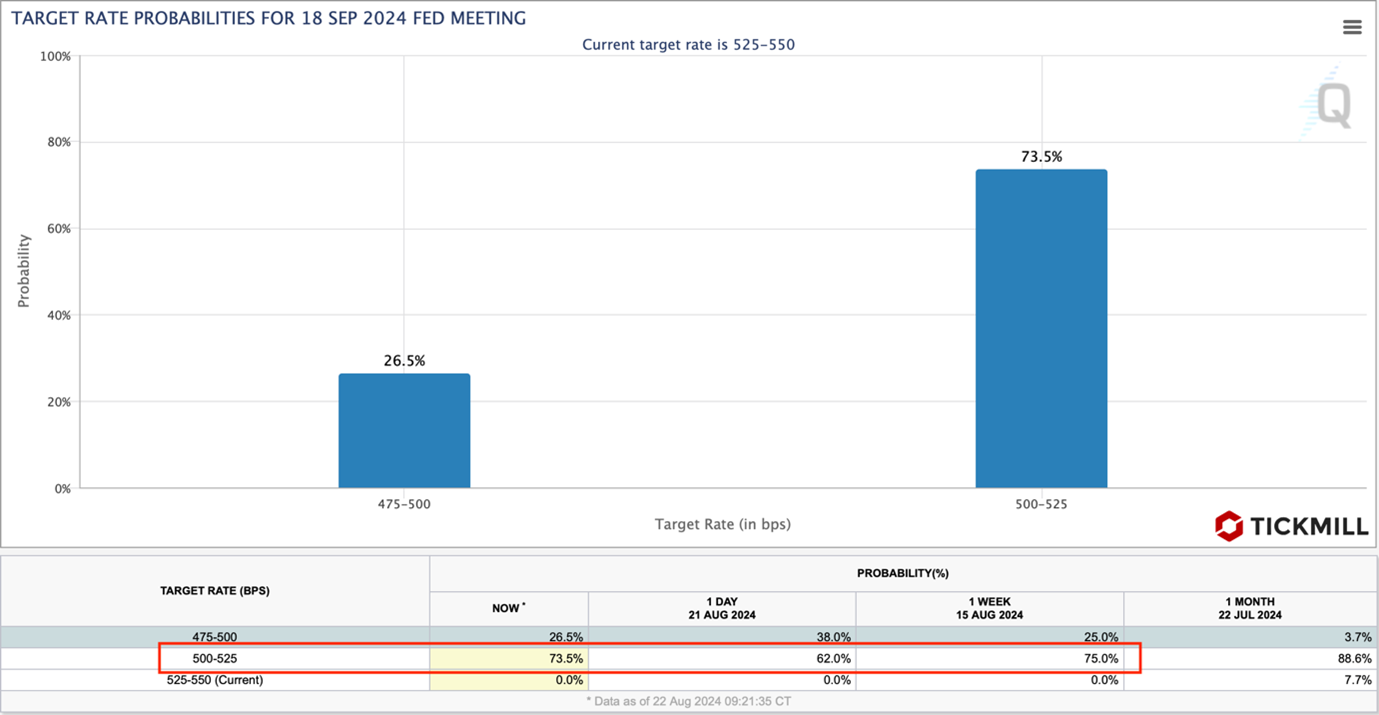

The FOMC minutes from the July meeting further amplified these concerns, with some members advocating for a rate cut—a move that now seems increasingly likely in September. Historically, the Federal Reserve has been cautious about easing monetary policy too soon, particularly in the face of persistent inflationary pressures. However, the latest data might force their hand, making the September FOMC meeting a pivotal moment for traders. CME Fedwatch Tool shows a 73.5% probability of a 25 basis points cut. The potential for further cuts in November may lend more heft to the bearish outlook for the Greenback:

Across the Atlantic, the European economic landscape presents a mixed picture, particularly when examining the latest PMI data. France has seen an uptick in its Services PMIs, bolstered by the ongoing preparations for the Olympic Games. This temporary boost, however, stands in stark contrast to Germany, where the Services PMIs fell short of expectations, and the Manufacturing PMI plunged deeper into contraction territory. For Europe’s largest economy, this is a worrying sign, and it raises questions about the overall stability of the Eurozone.

Meanwhile, in the Asia-Pacific region, the AUD has shown remarkable resilience, outpacing the USD over the past three weeks. This performance is largely driven by market speculation that the Reserve Bank of Australia (RBA) will maintain its current Cash Rate without any cuts this year. The RBA’s cautious stance, focused on countering inflationary risks, has provided the AUD with a solid foundation, even as other currencies struggle.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.