SP500 LDN TRADING UPDATE 26/02/25

WEEKLY BULL BEAR ZONE 6050/60

WEEKLY RANGE RES 6142 SUP 6061

DAILY BULL BEAR ZONE 6025/35

DAILY RANGE RES 6021 SUP 5938

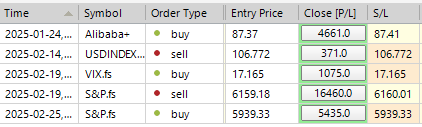

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TARGET WEEKLY BULL BEAR ZONE

LONG ON TEST/REJECT OF WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW THE WEEKLY ACTION AREA VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: MARKET DISCOMFORT PERSISTS

FICC and Equities | 25 February 2025

Market Overview:

- S&P 500: -47bps, closing at 5955, with a MOC of $430mm to BUY.

- Nasdaq 100 (NDX): -124bps, ending at 21087.

- Russell 2000 (R2K): -38bps, closing at 2170.

- Dow Jones: +37bps, finishing at 43621.

Volume & Volatility:

- 16.3bn shares traded across U.S. equity exchanges, above the YTD daily average of 15.2bn shares.

- VIX climbed +237bps to 19.43.

Commodities & FX:

- Crude Oil: -218bps to $69.15.

- U.S. 10-Year Yield: -10bps at 4.29%.

- Gold: -119bps at $2916.

- DXY (Dollar Index): -32bps at 106.26.

- Bitcoin: -636bps to $87,996.

Sentiment & Key Trends:

The market remains under pressure, with retail investors stepping back. Bitcoin fell 8% today and is down 27% over the last five sessions. Similarly, the GSXUMEME Index dropped 8% today and 27% over five sessions. A negative feedback loop is evident: retail inactivity has triggered a momentum unwind among hedge funds, with the GSCBHMOM index down 6% today and 17% over the last five sessions.

Technicals are adding to the headwinds. CTA selling totaled $11bn in S&P this week at current levels, and if the S&P breaches 5886 (medium-term momentum), this supply could double. The S&P broke its 50-day moving average yesterday and its 100-day moving average today (5945).

Consumer Confidence Data:

- February consumer confidence came in at 98.3, below the expected 102.5.

- The Expectations Index fell below 80 for the first time since June 2024, signaling potential recession risks.

- Inflation expectations for the next 12 months surged from 5.2% to 6%.

- Concerns about trade and tariffs have risen sharply, reaching levels not seen since 2019. Sentiment around the current administration and its policies dominated survey responses.

Trading Activity:

- Overall activity on the trading floor was rated a 7/10.

- The floor ended the day as net sellers (-5.8%), compared to a 30-day average of +114bps.

- Asset managers remain cautious, while hedge funds are actively de-grossing.

- Long-only funds finished as $1bn net sellers, driven by supply in Communication Services, Tech, Staples, and Industrials, with demand focused on macro products.

- Hedge funds closed the day as net buyers, concentrating demand in Tech and Macro products, while showing some supply in Staples.

NVDA Setup:

- Options imply a 10% move through Friday. Positioning is rated 7/10.

- The stock has been range-bound for ~8 months due to increased complexity (ASICs vs. Merchant, DeepSeek, Blackwell timing, contracting GMs q/q).

- Near-term expectations appear tempered, with investors bracing for a more modest beat/raise cadence compared to the typical ~$1-2bn beat and a q/q guide-up of +$2bn.

- Focus is shifting to commentary on the July quarter, including Blackwell product timing, China demand, and broader 2026+ guidance. Consensus estimates: January revenues ~$38.1bn, April revenues ~$42.2bn.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!