SP500 LDN TRADING UPDATE 23/01/25

.png)

SP500 LDN TRADING UPDATE 23/01/25

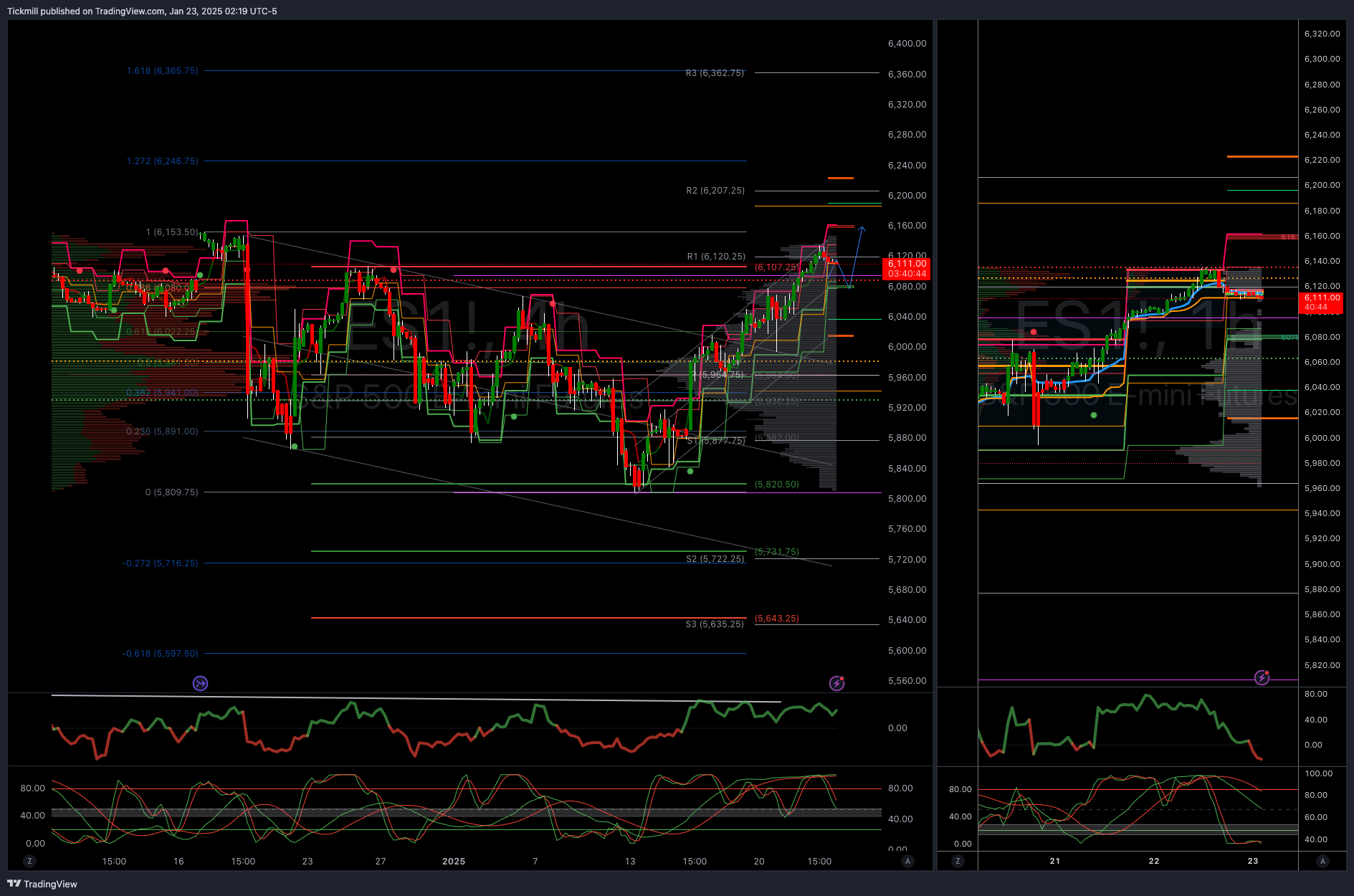

WEEKLY BULL BEAR ZONE 6070/80

WEEKLY RANGE RES 6119 SUP 5945

DAILY BULL BEAR ZONE 6105/5995

DAILY RANGE RES 6163 RANGE SUP 6077

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON ACCEPTANCE BELOW DAILY RANGE SUP TARGET 6040

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

SPX +61bps closing at 6086 with a MOC of $2.7bn to SELL. NDX +133bps at 21853, R2K -61bps at 2303, and Dow +30bps at 44156. A total of 13.78bn shares were traded across all US equity exchanges compared to a year-to-date daily average of 16bn shares. VIX increased by 27bps to 15.10, Crude decreased by 59bps to 75.38, US 10-year yield rose by 3bps to 4.60, gold increased by 38bps to 2755, DXY rose by 18bps to 108.25, and bitcoin fell by 282bps to 103777.

SPX and NDX were boosted by strength in technology, driven by generally positive earnings and ongoing significant global investments in AI. The S&P Equal Weight index outperformed its cap-weighted counterpart by approximately 1%, with 328 stocks declining during the session. ORCL surged by 7% (after a previous 7% rise) following more details about its partnership with Softbank and OpenAI, named “Strargate,” which will also include technology partners ARM (+15%), NVDA (+4%), and MSFT (+4%).

Other notable performers included STX (+7%) due to continued margin expansion, while the industrial tech sector saw solid results from both APH and TEL. PG rose by 2% on higher organic sales growth and better-than-expected volumes, and GEV increased by 2% on earnings, with some concerns about Q4/Q1 but overall positively received due to strong orders and an electrification backlog exceeding $20bn. TRV gained 3% driven by core underwriting growth, lower-than-expected catastrophe losses, favorable reserve development, and improved net interest income.

Our floor activity rated a 6 on a scale of 1-10 in terms of overall activity levels. Overall executed flow finished +650bps compared to a 30-day average of 30bps. LOs ended as net buyers with +$2b, primarily in tech, discretionary, and communication services. Hedge funds finished balanced with demand in tech and staples against supply in communication services and discretionary sectors.

CHASING CONSENSUS INTO & AFTER INAUGURATION:

We remain highly active in thematic baskets. Historically, clients have reduced policy-focused trades between elections and inaugurations, but this time we are witnessing clients significantly increase and initiate positions. Consequently, we are observing early upsizing across consensus themes: Long positions in AI, semiconductors, and data centers, while shorting election-sensitive renewables are being actively traded. (h/t Donna Charkhkar).

In derivatives, the floating strike volatility has remained stable throughout the day, while fixed strike volatility has notably increased. This development aligns well with the current market trend as we surge towards unprecedented highs. Consequently, there is a growing preference for long volatility positions, particularly in the near term and at higher strike levels, which are increasingly perceived as appealing opportunities. Market participants are shifting towards a more extended gamma exposure, reflected in the decreasing costs of SPX straddles.

The pricing dynamics indicate that tomorrow's straddle is valued at 50 basis points, signaling market expectations. Recent market performance has seen significant movements, surpassing this level in four out of the last five trading days and witnessing a substantial rally of 240 points over the past five trading sessions. These insights suggest a dynamic market environment characterized by escalating volatility and strategic positioning in response to evolving market conditions.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!