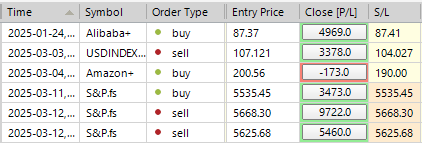

SP500 LDN TRADING UPDATE 13/03/25

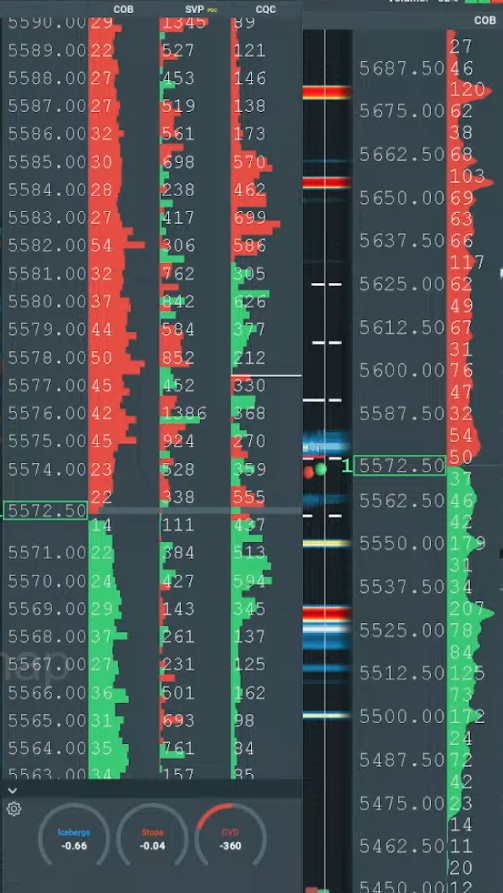

WEEKLY BULL BEAR ZONE 5850/60

WEEKLY RANGE RES 5928 SUP 5624

DAILY BULL BEAR ZONE 5535/45

DAILY RANGE RES 5639 SUP 5555

5550 10% COTTECTION FROM ATH’S

WEEKLY ACTION AREA VIDEO

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE 5663 TARGET 5680/5700/5735

SHORT ON ACCEPTANCE BELOW 5525 TARGET 5500/5485

GOLDMAN SACHS TRADING DESK VIEWS

.U.S. EQUITIES UPDATE: SIGNS OF STABILIZATION

FICC and Equities | 12 March 2025 |

Market Performance:

- S&P 500: +49bps, closing at 5,599 with $2.8B to sell at MOC.

- Nasdaq 100 (NDX): +113bps, ending at 19,596.

- Russell 2000 (R2K): Unchanged at 2,024.

- Dow Jones: -20bps, closing at 41,350.

- Trading Volume: 16.3B shares traded across all U.S. equity exchanges, exceeding the YTD daily average of 15.4B.

Volatility and Commodities:

- VIX: -9%, closing at 24.23.

- Crude Oil: +220bps, finishing at $67.69.

- U.S. 10-Year Yield: +3bps, at 4.32%.

- Gold: +75bps, reaching $2,942.

- DXY (Dollar Index): -16bps, at 103.58.

- Bitcoin: +29bps, trading at $83,035.

Despite a cooler CPI print, the market sentiment remains uneasy. However, there are emerging signs of stabilization in areas most impacted by "unwind flows" and in fundamental long/short (L/S) performance over the past two sessions. Notably, our Momentum Long basket rose another 3%, while hedge fund L/S strategies gained +78bps.

Sector and Flow Highlights:

- Long-only (LO) investors continued to sell across sectors, but there was an encouraging uptick in buy activity within the Semiconductors/AI space, potentially signaling a "buyers-live-higher" mentality amid index stabilization.

- Intel (INTC): +18% after-hours on news of Lip-Bu Tan's appointment as CEO.

- Our trading floor activity rated 6/10, with overall performance at -322bps versus a 30-day average of -50bps.

- LOs were net sellers at -$1.5B, driven by supply in financials and industrials. Hedge funds (HFs) remained balanced, with selling concentrated in discretionary and financials.

Liquidity remains a concern, with rapid evaporation intensifying price action in both directions. Today’s market liquidity hit $2.83mm, nearing the low mark of $2.02mm seen in 2021.

Goldman Sachs Adjustments:

Kostin and team revised the 2025 year-end S&P 500 target to 6,200 (down from 6,500), reflecting a 4% reduction in the modeled fair-value forward P/E multiple (20.6x from 21.5x). The 2025 EPS growth forecast was trimmed to 7% (from 9%), while the 2026 growth estimate remains at 7%.

Derivatives Insights:

Ahead of the CPI release, the implied daily move was 1.55%, the highest breakeven for a CPI print since March 2023. A softer-than-expected Core CPI (MoM) reading of +0.23% for February (vs. GS forecast of +0.29% and median forecast of +0.3%) triggered a brief market rally. During the day, volatility declined, and some upside buying emerged. Clients sought short-dated downside protection using SPX put spreads and VIX calls. The desk sees potential in "wingy" calls extending to June, anticipating a tactical bounce as the market approaches correction territory.

According to the details in the CPI report, we now estimate that the core PCE price index increased by 0.29% in February, slightly above our prior expectation of 0.25% before the CPI release. This corresponds to a year-over-year growth rate of 2.70%. Furthermore, we anticipate that the headline PCE price index rose by 0.27% in February, reflecting a 2.46% increase compared to the same period last year. Additionally, we project that the market-based core PCE climbed by 0.30% in February.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!