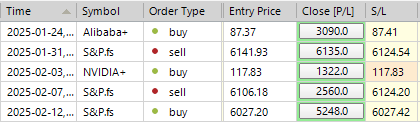

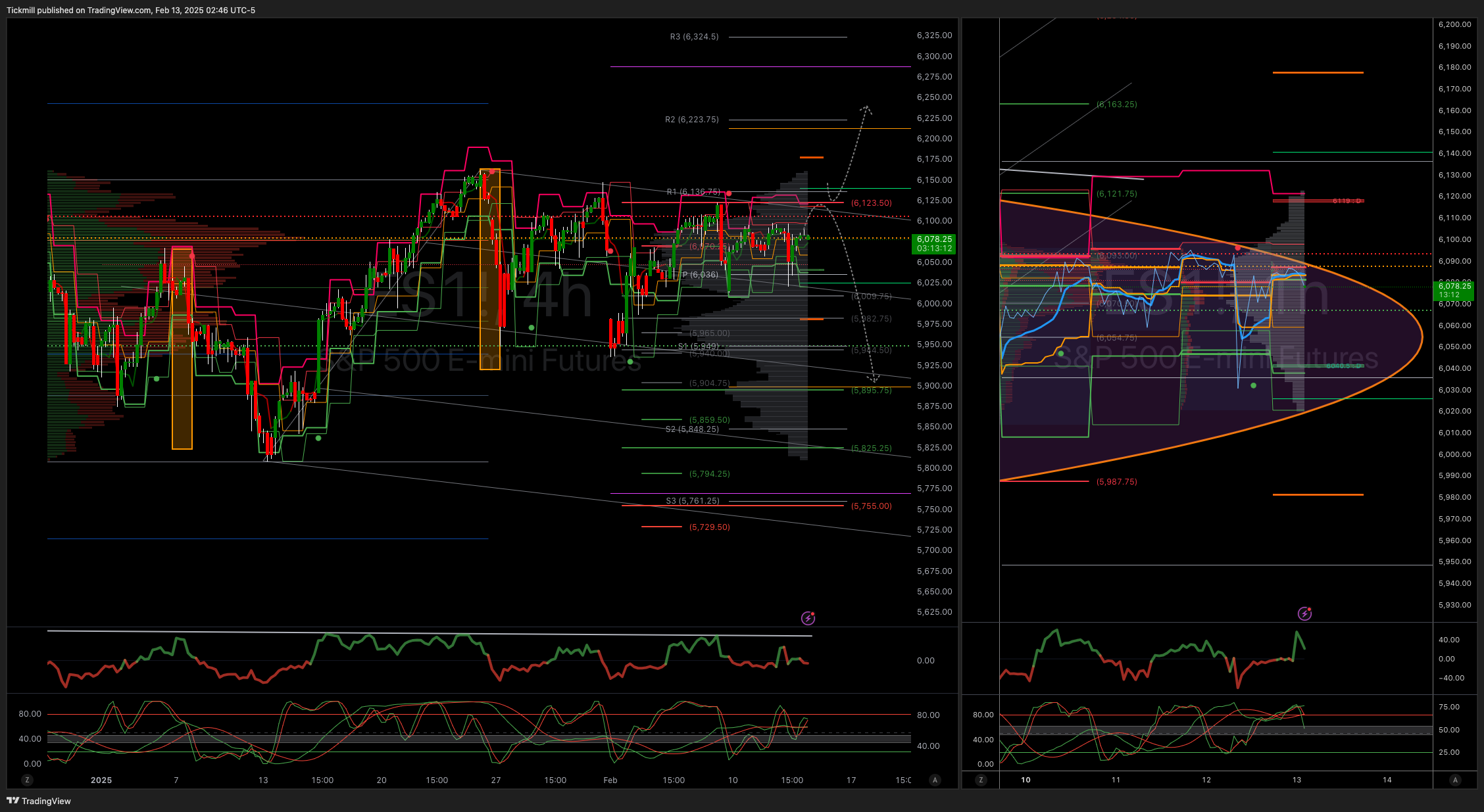

SP500 LDN TRADING UPDATE 13/02/25

WEEKLY BULL BEAR ZONE 6114/24

WEEKLY RANGE RES 6114 SUP 5918

DAILY BULL BEAR ZONE 6060/50

DAILY RANGE RES 6121 SUP 6037

TODAY'S TRADE LEVELS & TARGETS

LONG ON ACCEPTANCE ABOVE 6098 TARGET WEEKLY>DAILY RANGE RES

SHORT ON TEST/REJECT OF WEEKLY/DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST REJECT DAILY BULL BEAR ZONE TARGET WEEKLY/DAILY RANGE RES

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGETING 6147/61

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: CPI IMPACT

FICC and Equities | 12 February 2025 | 10:26 PM UTC

Market Performance:

- S&P 500: -27bps, closing at 6,051 with a MOC of $200mm to SELL.

- Nasdaq 100 (NDX): +12bps, ending at 21,719.

- Russell 2000 (R2K): -87bps, finishing at 2,255.

- Dow Jones: -50bps, closing at 44,368.

Trading Volume:

14.89 billion shares were traded across all U.S. equity exchanges, falling below the year-to-date daily average of 16 billion.

Volatility and Commodities:

- VIX: -81bps, closing at 15.89.

- Crude Oil: -285bps, settling at $71.24.

- Gold: +16bps, ending at $2,902.

- US 10-Year Yield: +9bps, reaching 4.62%.

- Dollar Index (DXY): +1bps, at 107.98.

- Bitcoin: +117bps, surging to 97,503.

Market Sentiment:

Despite a hot CPI print, markets took the news in stride. Equities initially dipped but saw steady buying throughout the session, leaving the Nasdaq slightly up and the S&P 500 marginally down. Gamma dynamics remain influential, stabilizing the market.

Macro Takeaways:

The CPI data underscores limited room for the Federal Reserve to ease policy, presenting a more challenging path forward. The U.S. 10-year yield rose by 9bps to 4.63%, reflecting market adjustments to inflationary pressures.

CPI Details:

- January core CPI rose +45bps MoM (consensus: +30bps).

- Year-on-year core CPI ticked up to 3.26%.

- Volatile components like used cars and airfares contributed +8bps to the core.

- Car insurance added another +7bps, though this category has been notably noisy in recent years. Premium increases are expected to slow as prices align with underlying costs.

Forecast Revision:

Based on the CPI report, the core PCE MoM inflation forecast for January was raised by 3bps to 0.35%, corresponding to a year-on-year rate of +2.64%.

CPI Commentary:

1. The size of the CPI beat outweighs category-specific caveats, with the overall level remaining uncomfortably high. Favorable base effects are now less likely.

2. January’s inflation data is significant, even after accounting for annual resets. Later months could still reflect underreported inflation.

3. Narrow surprises, such as car insurance and new fees, indicate persistent pricing power and longer-term inflationary echoes.

Trading Activity:

- Overall executed flow ended +150bps vs. the 30-day average of +63bps.

- Long-only funds were net sellers (-$1bn), driven by macro products and healthcare, with smaller demand in industrials.

- Hedge funds remained balanced, showing demand in macro products and discretionary sectors.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!