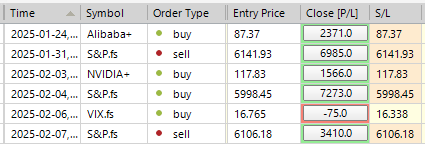

SP500 LDN TRADING UPDATE 11/02/25

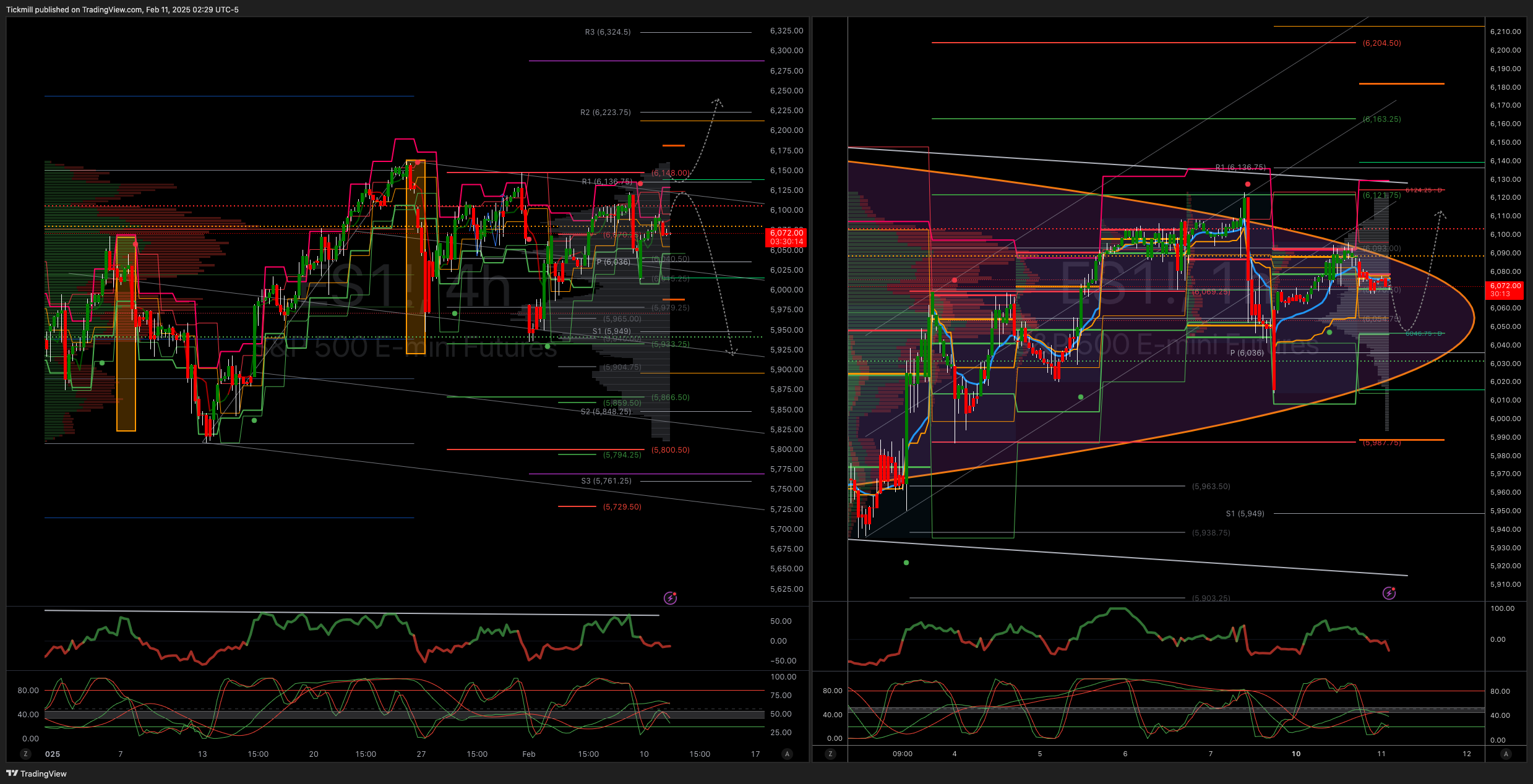

WEEKLY BULL BEAR ZONE 6114/24

WEEKLY RANGE RES 6114 SUP 5918

DAILY BULL BEAR ZONE 6053/43

DAILY RANGE RES 6129 SUP 6046

TODAY'S TRADE LEVELS & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET WEEKLY/DAILY RANGE RES

SHORT ON TEST/REJECT OF WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES SUMMARY: UNWINDING ACTIVITY

FICC and Equities

10 February 2025

S&P rose by 67bps, closing at 6066 with a Market On Close (MOC) sell order of $300mm. NDX increased by 124bps to 21756, R2K up 35bps at 2287, and Dow climbed 38bps to 44470. A total of 15.99 billion shares were exchanged across all U.S. equity markets compared to the year-to-date average of 16 billion shares. The VIX was up 447bps to 15.80, Crude rose by 206bps to 72.46, the U.S. 10-year yield remained unchanged at 4.49, gold increased by 159bps to 2906, the DXY was up 26bps to 108.32, and bitcoin increased by 218bps to 97316.

The week started slowly with equities generally rising, prompted by relatively muted news coverage except for the weekend revelation of Trump imposing a 25% tariff on steel and aluminum imports. Price movements were hesitant in sectors like energy (shorts up 416bps) and industrials (shorts up 249bps), largely driven by the resilience in steel stocks, notably ROK which surged by 13% (as it was a consensus short), following impressive earnings. The major inflows were observed amid weakness in airlines, and the 2% rise in crude oil didn’t provide support, while the UofM Friday/tariff discussions contributed to a climate of uncertainty and cautiousness.

In the tech sector, UBER saw a 5% increase today, continuing its momentum from the Ackman disclosure last Friday, with our indicators displaying cover demand...We believe that positioning plays a significant role in this sharp rebound from post-earnings lows...In consumer, there was slight recovery in retail/discretionary stocks after pressure on Friday, with MCD climbing 4% after surpassing lower expectations.

Our floor rated activity levels at a 5 on a scale of 1 to 10. Overall traded flow concluded at +265bps compared to a 30-day average of +83bps. Skews remained subdued. LOs ended as net buyers with +$280mm while HFs ended balanced. LOs were net buyers of discretionary and macro products while selling utilities and tech. HFs were net buyers of tech and financials while selling discretionary and healthcare.

DERIVATIVES:

It was a quiet overall session as the SPX intraday range was only 44bps, marking the second smallest of the year. Following our prime brokerage data indicated HF interest in Chinese equities last week, we witnessed continued activity today in FXI upside. There’s persistent interest in BABA, and we favor a 1x2 call spread there due to the high wing. Despite moving lower compared to last week, the SPX term structure remains inverted at the front-end as the market anticipates the CPI release on Wednesday morning. The implied move for SPX on Wednesday is just 0.88%, while the IWM implied move is approximately 1.5%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!