SP500 LDN TRADING UPDATE 02/04/25

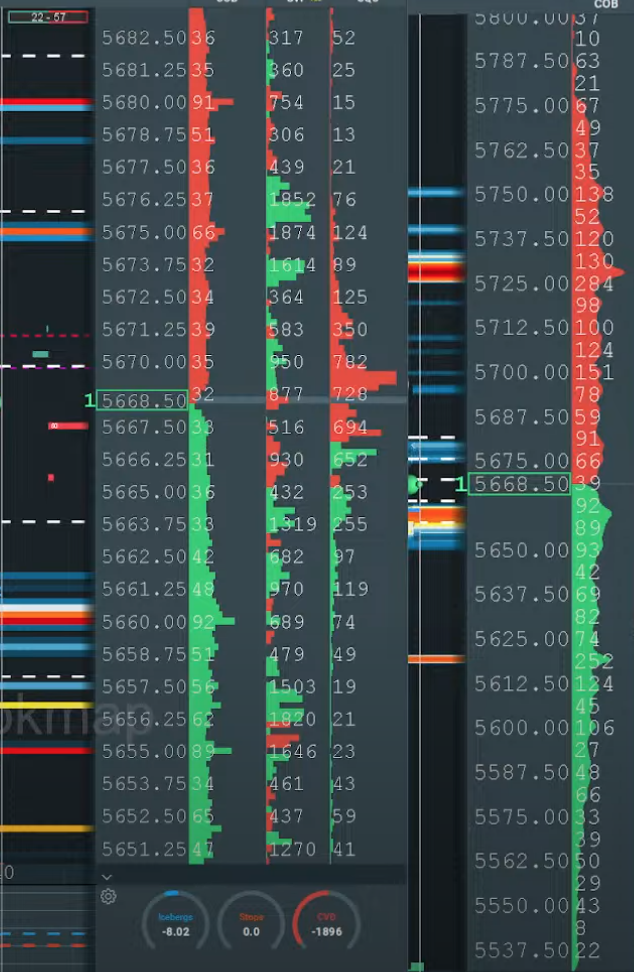

WEEKLY & DAILY LEVELS

WEEKLY BULL BEAR ZONE 5550/60

WEEKLY RANGE RES 5746 SUP 5458

DAILY BULL BEAR ZONE 5610/20

DAILY RANGE RES 5714 SUP 5629

DAILY 2 SIGMA RES 5816 SUP 5528

(QUOTING FRONT MONTH EMINI SP500 FUTURES CONTRACT PRICES, FOR EQUIVALENT US500 LEVELS – -40 POINTS)

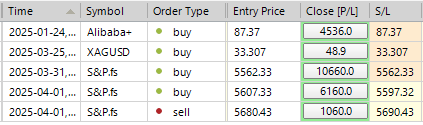

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BB ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: LIBERATION DAY APPROACHES

FICC and Equities | April 1, 2025 |

Market Overview:

- S&P 500: +38bps, closing at 5,633 with $1B MOC to buy.

- NASDAQ 100 (NDX): +82bps, closing at 19,436.

- Russell 2000 (R2K): -13bps, closing at 2,009.

- Dow Jones: -3bps, closing at 41,989.

- Volume: 14.8B shares traded across U.S. equity exchanges vs. YTD daily average of 15.4B.

- VIX: -197bps at 21.84.

- Crude Oil: +39bps at $71.20.

- U.S. 10-Year Yield: -4bps at 4.16%.

- Gold: -16bps at $3,118.

- DXY: +4bps at 104.25.

- Bitcoin: +295bps at $84,855.

Markets continued to chop ahead of tomorrow’s anticipated “Liberation Day,” with remarks from the White House scheduled for 4 PM EST. Retail, Mega-Cap Tech, and High Beta 12M Winners led gains, while Biotech struggled, weighed down by Peter Marks’ departure from the FDA yesterday. SMID Biotech remains a challenging space, with hedge funds hesitant to pick a bottom. Large Biopharma also saw diminished safety bids in the group.

GIR’s Tariff Outlook:

The GIR house view is more bearish than market expectations for tomorrow’s tariff announcement. While a 10pp effective tariff risk may not elicit a significant hawkish reaction, the risk of more aggressive measures—such as reciprocal tariffs or 25% tariffs on key products—could drive the effective tariff rate higher, which GIR believes is underpriced. Assuming clarity on the tariff plan, market focus will shift to macro data, including Friday’s NFP report, amid softer growth data and rising inflation concerns.

Flows:

Floor activity rated a 5/10 in terms of overall levels. Net demand totaled $2.5B, with LOs and HFs leaning net buyers.

- LOs: Bought Tech, sold Macro Expressions.

- HFs: Bought Macro products, slightly sold Tech.

Retail darlings showed strong price action today, with Bitcoin-sensitive names up +617bps, MEMEs +180bps, and NMAX +200%.

Derivatives:

Following yesterday’s session, dealers swung $4B in gamma, now long $1.5B at spot—longer on downside, shorter on topside. Volumes were muted as clients established short-dated downside hedges ahead of tomorrow’s tariff announcement. The desk favors VIX call spreads to capitalize on elevated call wing levels. With VIX > 20, index optionality in short-dated spread format is preferred, with a slight tilt toward NDX over SPX.

President Trump’s speech tomorrow has been rescheduled to 4 PM EST (previously 3 PM). The Wednesday SPX straddle will no longer capture the announcement. The tomorrow SPX straddle is priced at ~0.95% (cash settles vs. 4 PM cash close), while the SPY straddle is ~1.23% (exercise until ~5:30 PM). The desk views SPY options as attractive given this spread.

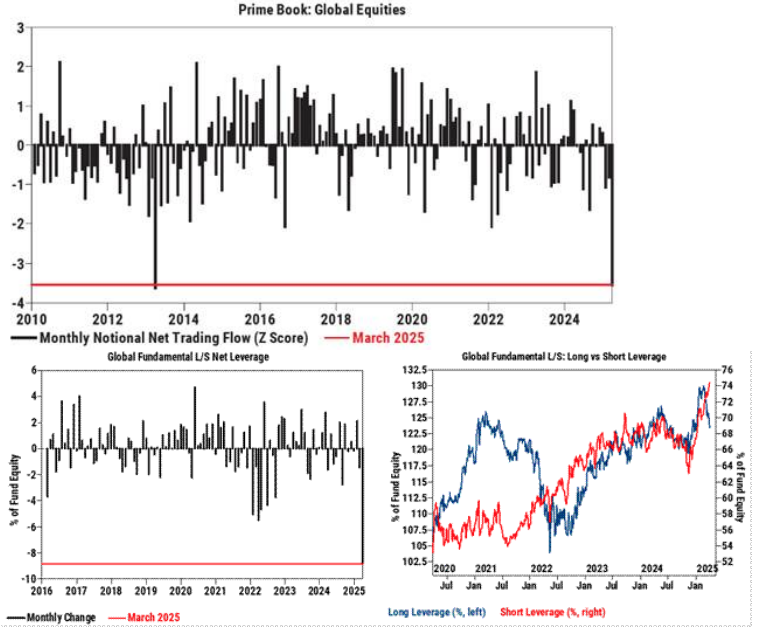

Prime Brokerage Insights (March):

- Fundamental L/S Returns: Fell -2.4% in March due to beta losses from accelerated market selloff. TMT and HC L/S managers experienced their sharpest monthly drawdowns in nearly three years.

- Systematic L/S Funds: Gained +4.4% in March, marking their best quarterly performance on record.

- Trading Flows: Hedge funds net sold global equities at the fastest pace in 12 years, led by single-stock shorting. Single stocks accounted for 94% of global net selling, driven by short sales and, to a lesser extent, long sales (~7 to 1).

- Exposures: Fundamental L/S gross and net leverage ratios fell across all regions in March due to mark-to-market pressures and large net selling. Global Fundamental L/S Net leverage ratio dropped by 9 points—the largest monthly decrease on record.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!