Shifting BOE Expectations Drag FTSE Down

FTSE Falling Further

The FTSE remains under pressure today with the index now down more than 3% from the YTD highs. Following a strong rally over late Feb – mid May, the index is now retreating as traders scale back their near-term BOE rate-cut expectations. Much of the preceding rally had been built on the expectation that the BOE was moving towards a rate cut as early as June, in line with falling inflation data and a weaker economic outlook. However, a recent strengthening of UK data, including upside GDP surprises, has seen traders reversing calls for an early summer cut.

Inflation Still Key

While inflation was seen falling further last month, at 2.3% headline CPI was above the 2.1% the market was looking for. Many traders feel that the BOE will now wait for once further push lower in inflation (back down to or below target) before actioning a rate cut. Indeed, with the UK PM having called a snap election for early July, a rate cut in June looks less likely now.

Bearish Risks

GBP has been trading on a much firmer footing following last week’s data, adding further bearish pressure. While this narrative holds (no June rate cut), FTSE looks likely to remain tilted lower with the index currently on course for its longest losing streak since August 2023.

Technical Views

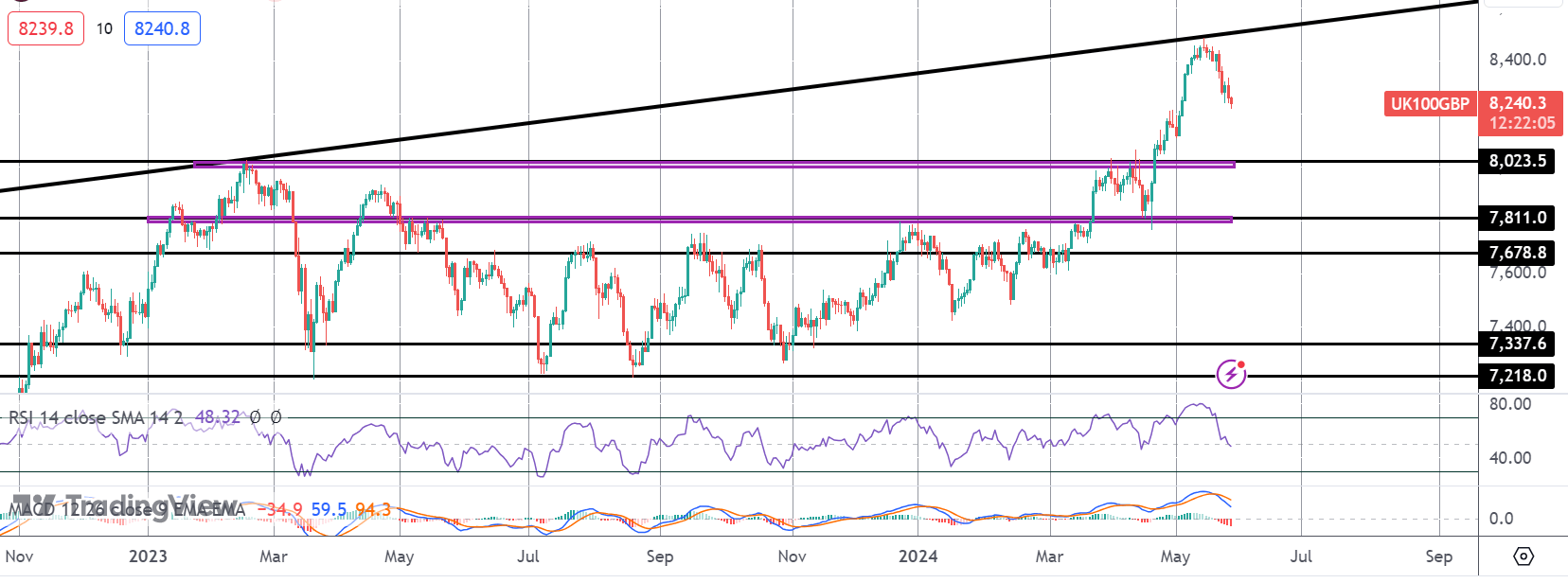

FTSE

The pullback in the FTSE is gathering pace and with little in the way of technical support until a retest of the broken 8023.5 highs, this looks to be the clear target for bears. Bulls will need to defend this area to maintain the broader bullish outlook or risk a test of deeper support at 7811 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.