Revised ECB Inflation Concept Could Disappoint Euro Bulls Tomorrow

European markets posted their biggest decline in almost three weeks on Wednesday, the day before the ECB meeting, at which officials are expected to discuss reduction of monetary stimulus.

Until recently, the markets did not seriously consider the possibility of the ECB moving towards normalizing monetary policy. The reason was that the ECB at its meetings tried in every possible way to make it clear that it was not going to cut asset purchases soon. However, last week the situation began to change rapidly. Two ECB officials, among them the head of the Danish Central Bank Knott, said that current dynamics and forecast of inflation are favorable for PEPP tapering.

This week, another official of the ECB's governing council, Austrian Central Bank Governor Holzmann, said the ECB could begin tightening monetary policy sooner than most market experts expect. The official believes that the factors of increased inflation have turned out to be more stable than previously assumed, moreover, increased inflation may begin to take root in inflationary expectations, which will make it more difficult and costly to control inflation.

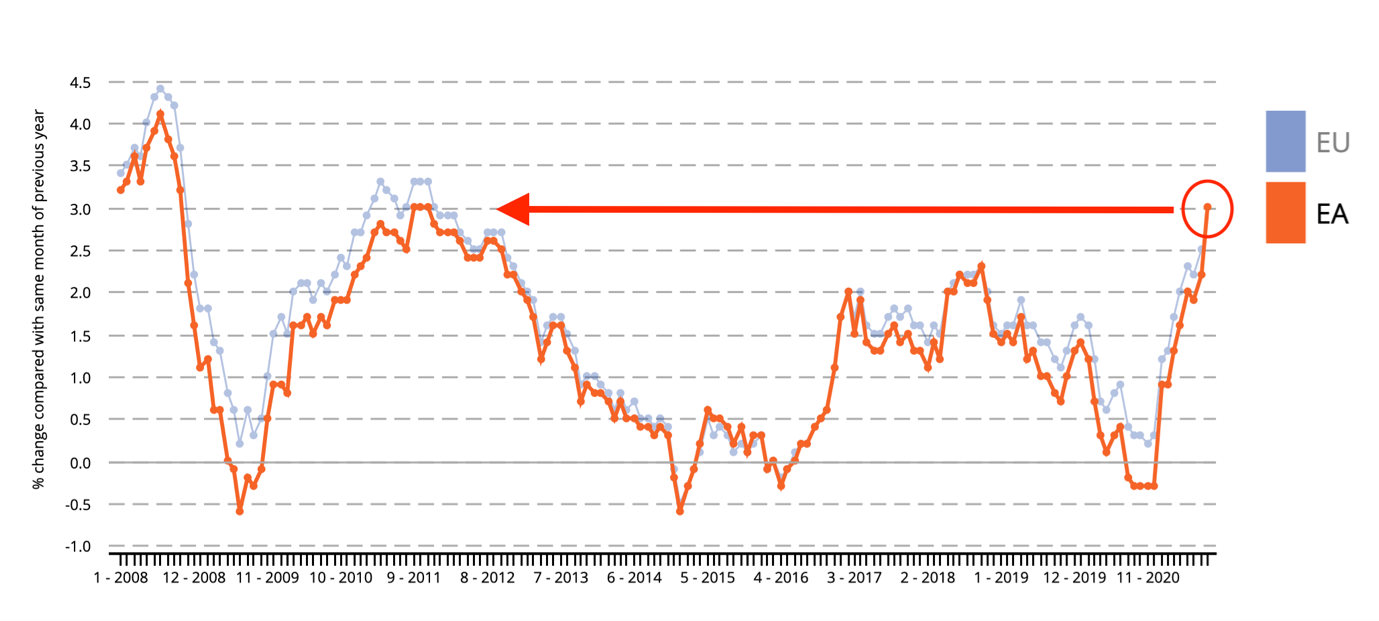

The ECB really has something to worry about - the growth of prices in the Eurozone in August in annual terms amounted to 3.0% - this is the maximum in 10 years:

However, it is worth remembering that the ECB updated its monetary policy strategy in the summer. According to the new concept, low inflation is more difficult to fix than high inflation, which makes the ECB more tolerant of inflation overshoot than undershoot. From this it follows that most likely there will be no big changes at tomorrow's meeting and the euro may even decline due to unjustified hopes.

European equity markets are under pressure on Wednesday; however, losses are gradually decreasing. In the second half of the London session, there was a demand for emerging market currencies, USDRUB was able to stop its growth and went into decline, in addition, the cryptocurrency market is also trying to recover.

The calendar of events today is not very busy, the focus of the markets may be the Fed's Beige Book, as well as the speeches of Williams and Kaplan, who will participate in the FOMC vote. The assessment of the August NFP report may trigger a market reaction, as the chances of aggressive roll-off of QE have diminished since release of the report, so it is now important for the markets to know what the Fed thinks about the weak August NFP report.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.