Record Slide in USD Ahead of NFPs Today

Dollar Slide Deepens

The US Dollar is down heavily today ahead of the keenly awaited February jobs report with the Dollar Index on course to print its largest losing week since the first week of November, 2022. A shift in outlook on the Fed, as well as a fluctuating response to Trump’s trade war, have been the key drivers behind the move. Near-term Fed easing expectations have risen higher recently in response to some key data misses. Traders are now waiting for the all important NFP release later today and, on the back of a heavily weaker-than-forecast ADP print earlier in the week, traders are clearly bracing for further data weakness.

Forecasts & Trading Implications

On the numbers front, the market is looking for the headline NFP print to come in at 159k from 143k prior, with wages to cool to 0.3% from 0.5% prior and the unemployment rate to hold at 4%. If confirmed at these levels, USD is likely to remain pressured. However, if we see an undershooting of these forecasts, selling should accelerate into the weekend with Fed easing expectations moving higher again. On the other hand, any surprise upside today should see selling pause for now though it would likely take a significant upside surprise to fuel a USD recovery at this point. As such, risks remain skewed to the downside into the release today.

Technical Views

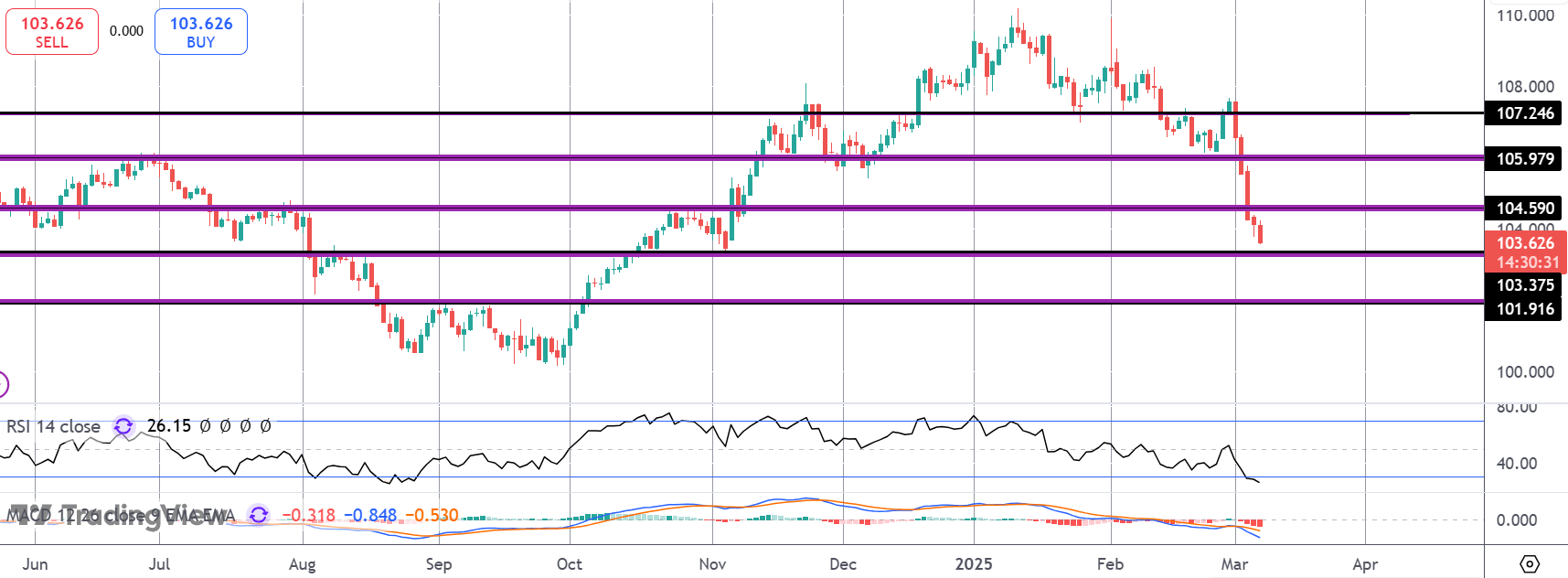

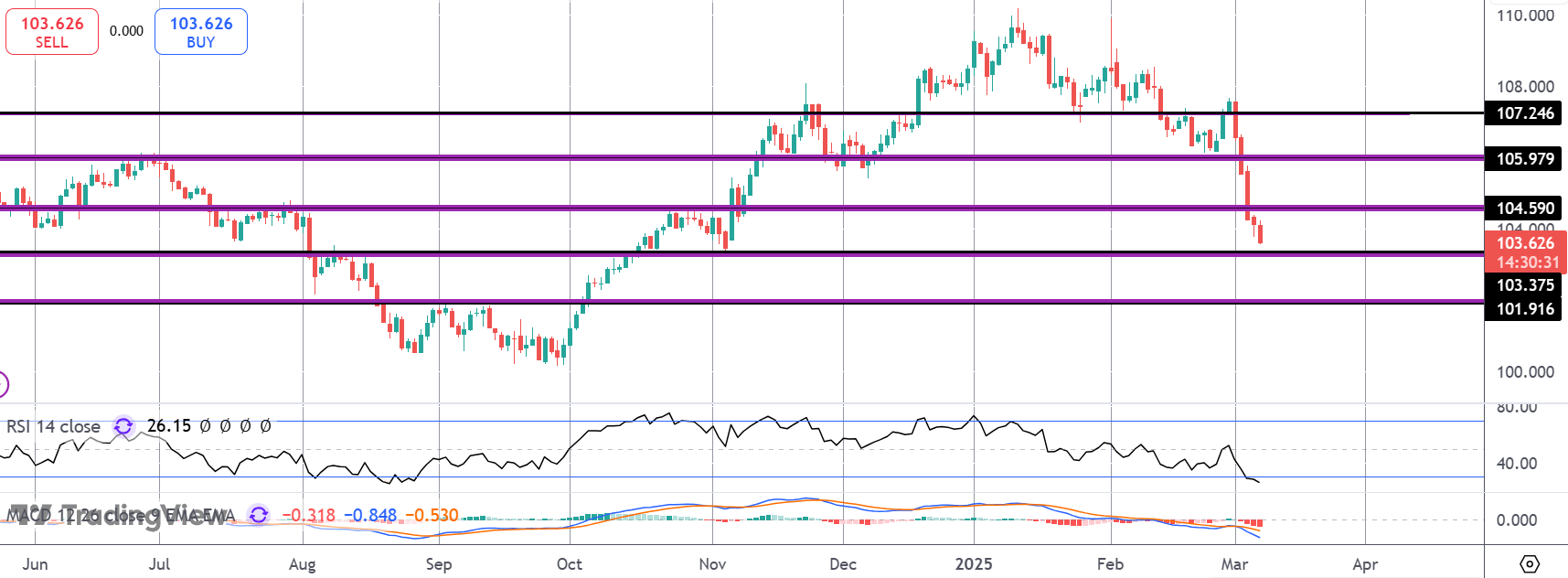

DXY

The sell off in the index has seen price breaking down through several key levels recently. Price is now below the 104.59 level and fast approaching a test of the 103.37 level. With momentum studies bearish, focus is on a continuation lower with 101.91 the deeper level to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.