Record Moves In Gold As Rally Continues

Gold Rally Accelerating

Gold prices continue their impressive run with the futures markets spending its fifth consecutive day at new record highs. A weaker US Dollar and heightened investor uncertainty is fuelling the current buying spree with the rally looking well supported currently. A weaker JOLTS job openings number yesterday sparked fresh selling in the Dollar, which had already come under pressure amidst a reversal in sentiment linked to Trump’s trade war.

Trade Tensions

Expectations that Trump will strike a deal with China to avoid an escalation of the trade war, as well as Mexico and Canada agreeing to meet Trump’s border requests, saw initial USD strength quickly reversing. Traders are now looking ahead to further incoming jobs data today and Friday with the risk that USD sells off further on any fresh data weakness, allowing gold to keep pushing higher.

Investor Uncertainty

Investor uncertainty is also a key part of this rally. As Trump pushes ahead with more executive orders and more policy adjustments, traders are becoming more unsettled. Recent comments around plans to take over Gaza ha particularly spooked investors with fears of a fresh US conflict in the Middle East if Trump seriously pursued these plans. Additionally, the trade stand-off with China is still a risk and could still escalate further, while the ongoing conflict between Russia and Ukraine remains a key threat also. Against this backdrop, safe haven demand for gold looks likely to continue near-term which, coupled with a weaker Dollar, means the current rally is likely to continue and find good demand on any pullback.

Technical Views

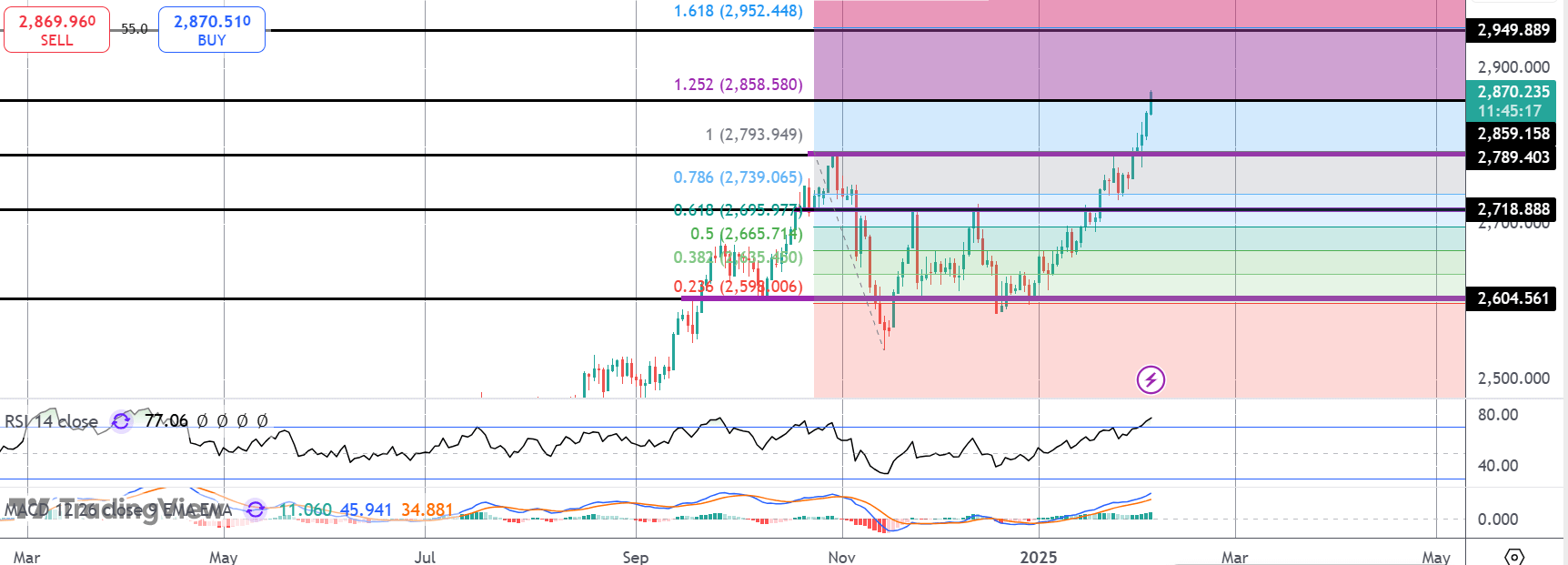

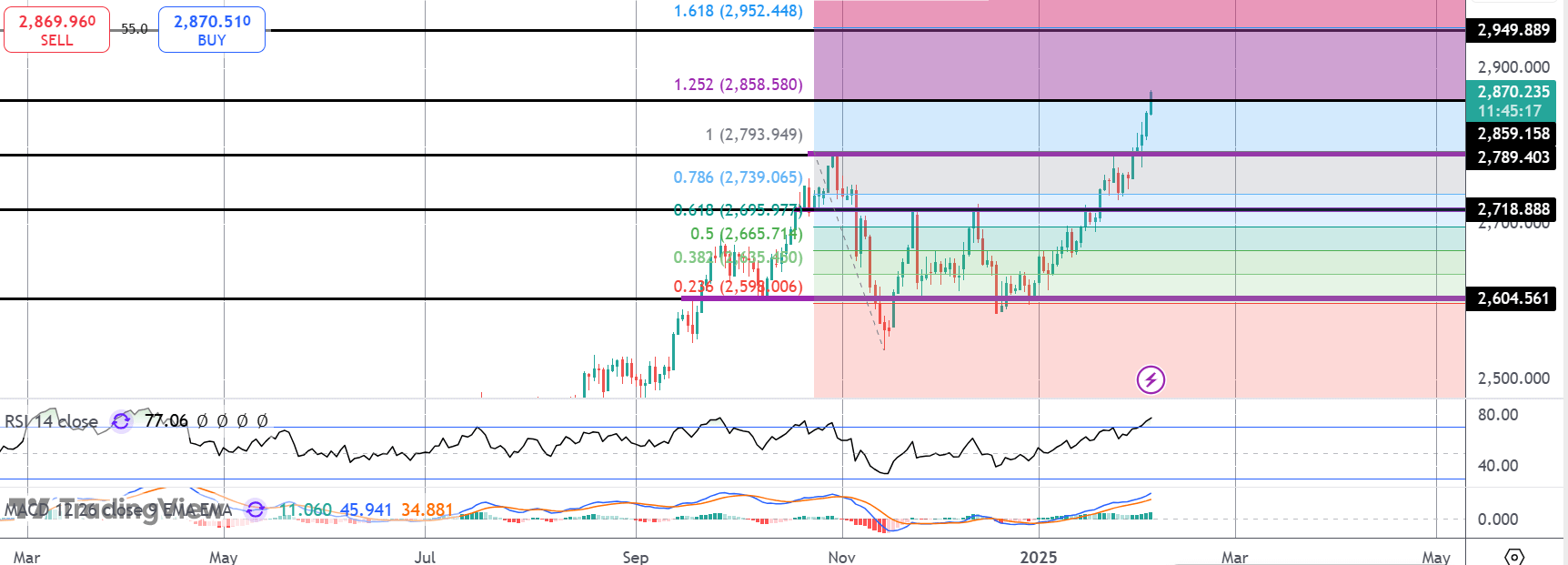

Gold

The rally in gold has seen the market breaking above the prior highs at 2789.40, now testing above the 1.25% fib extension at 2,859.15. While above here, and with momentum studies bullish, the 1.61% fib extension at 2,949.88 is the next bull objective. 2,789.40 remains key support, with the bull view intact while that level holds.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.