Preview of the Fed Meeting: What to Expect From Dollar After the Third Rate cut in a row?

With each new interest rate cut, it is becoming increasingly difficult for the Fed to maintain a straight face, commenting on the decision as a neutral “mid-cycle adjustment”. The signs that the economy is in the “middle of the cycle” are diminishing fast, and even vice versa, the isolated weakness of certain aspects of activity (for example, the slack manufacturing) is becoming widespread.

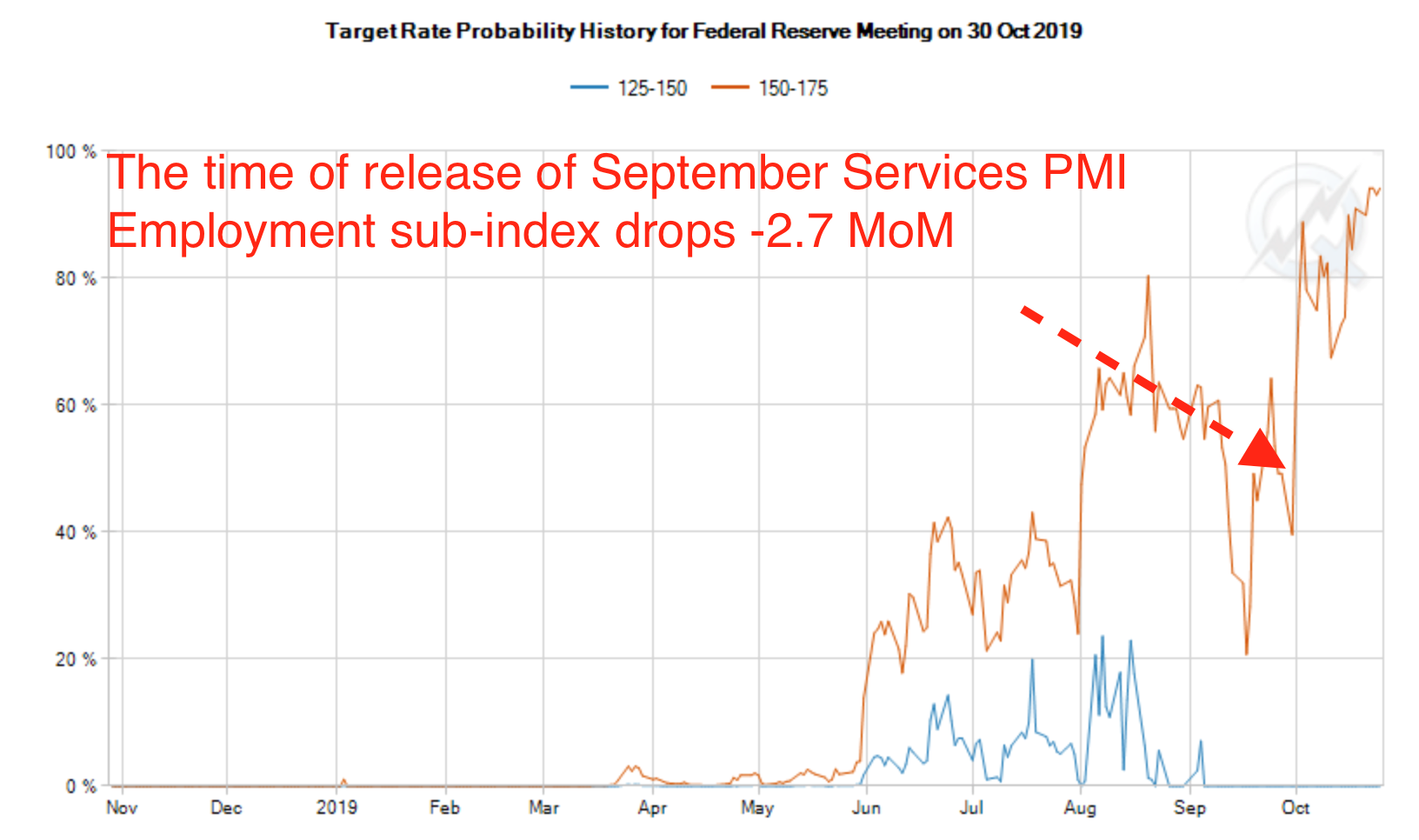

The most alarming sign so far was the change in employment with a sharp decline of the corresponding component in PMI indices of the manufacturing/services sectors. If few market players were concerned about manufacturing employment, the employment sub-index in services sector PMI (where 80% of the population is employed) was of particular attention. It was after the release of this piece of crucial economic data that the chances of rate cut, according to futures markets soared twice, almost to 100%:

Therefore, at the October meeting, where the interest rate is likely to be decreased for the third time in a row, Powell will need to show a remarkable ability to look optimistic and explain how such a policy can be still combined with optimism. Otherwise, the calm in stock market will be in jeopardy even despite easing commitments.

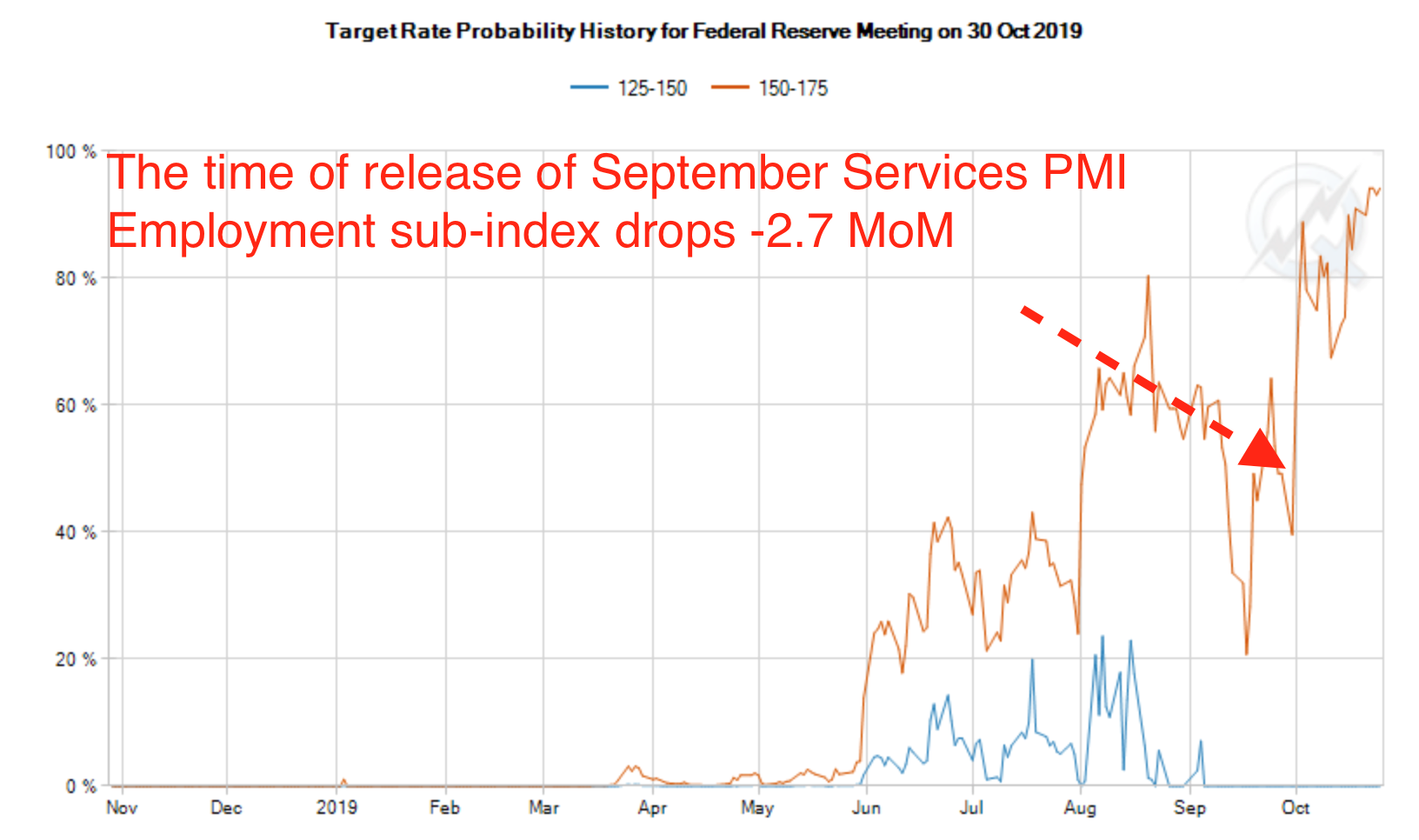

A shortage of liquidity in the short-term financing market since mid-September and massive injections of money through repos speak more about a specific feature of the crisis – the growing lack of trust (or counterparty risk). In one of my previous articles I wrote that large US banks from the Top 4 are basically sitting on reserves, but they prefer not to lend them in the open market, and instead agree for small but guaranteed interest on reserves paid by the Fed. Only partially such a policy is explained by the regulatory norms such as the ratio of cash to assets, to HQLA, etc. To avoid panic, bank officials write off what is happening on the costs of regulations:

The Fed’s efforts to fill the market with liquidity through repos are complicated by the fact that, with expectations of lower interest rates (higher bond prices), investors may be reluctant to part with bonds due to decent yield prospects. Therefore, initially considered as emergency measures, repos “have become the norm” and Powell will have to explain at the meeting what was meant by “organic balance growth” if it was not blatant QE, standing repo facility, etc. From a practical point of view, this is one of the key points of the meeting, which is worth paying attention to. And the balance of risks for the dollar is shifted down because of “new QE” risk.

Positive expectations of the meeting are associated with a relative lull on the front of the trade war with China in October and a decrease in the risk of "disorderly" Brexit. The parties came close to signing the first phase of the agreement, which would oblige China to increase purchases of agricultural products, and the United States, in return, to postpone the introduction of planned tariffs in December. Britain’s risks of leaving the EU without a deal were reduced thanks to the agreement between conservative leader Boris Johnson and the EU.

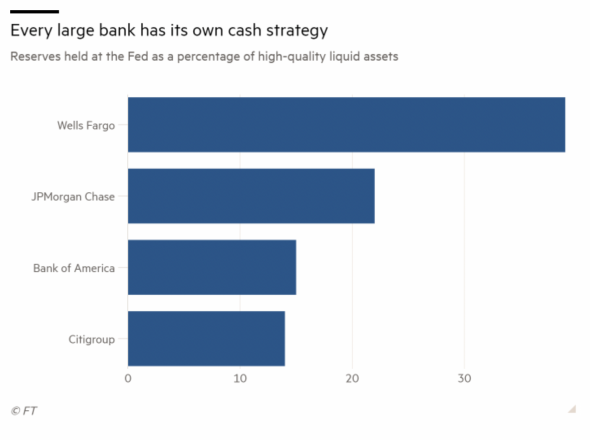

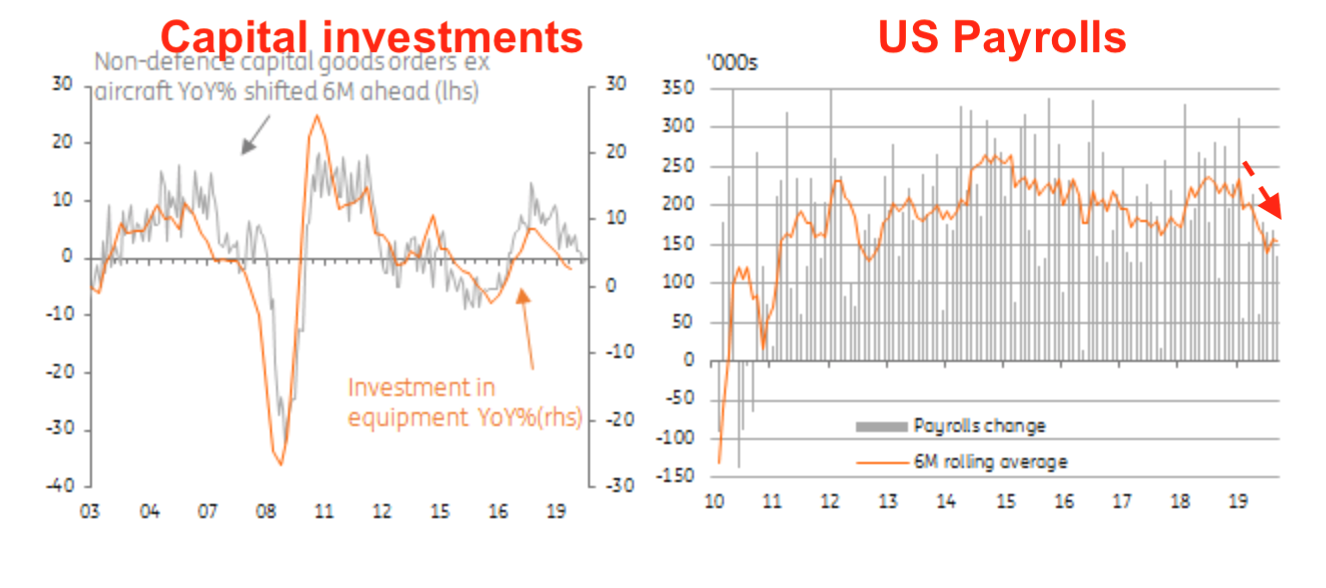

One of the key US consumer markets - real estate - is still in a relatively good shape given low mortgage rates and unemployment. However, the forecast for employment and investment is becoming increasingly negative if we look at six-month moving average and assume inertia in the trend:

Summing up: I am inclined to believe that the Fed will finally retreat from classifying the rate cut as “mid-cycle adjustment” and will acknowledge signs of broader slowdown in economic activity and reiterate its readiness to “act as appropriate”. Expectations of a “new QE, but with a different name” will also likely lead to a sell-off signal for the dollar.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.