Preview of the ECB Meeting: The Farewell of Mario Draghi

“The wave of righteous anger” of Draghi fellows is likely to be a difficult test for his farewell meeting on Wednesday. The head of the ECB will have to explain why the irreconcilable stance of some of his peers and even resignation of one of them does not jeopardize the smooth implementation of credit softening or why it is safe to ignore the growing discord inside the ECB.

After the announcement of a new wave of stimulus in September including deposit rate cut further into negative territory and new monthly asset purchases the ECB will need to move on to technical details. The questions during press conference is likely to boil down to the adequacy of “ammunition” and, of course, efficiency. It makes no sense to inflate the balance sheet and lower the rate if their goal is to spur exclusively market inflation expectations (that is, inflation expectations priced in bonds). This only works in the mode of delivering constant “surprises”, that is, it is necessary to constantly exceed policy expectations in order to achieve their necessary adjustment. If the program is unable to spur real credit expansion, then it has to be perceived as a temporary measure before moving on to the paradigm of "dominant fiscal stimulus." That is, what directly affects demand, and not indirectly, through the interest rate channel.

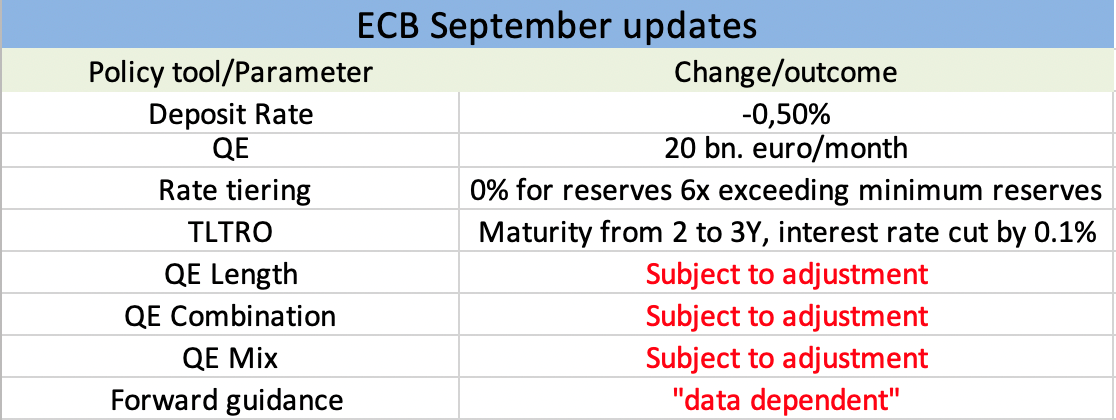

Here is the rundown of ECB meeting in September:

Those policy tools that require clarification are marked in red and the comments related to them can potentially affect both bonds and the Euro. But well, it is unlikely that Draghi will take responsibility to speak for Lagarde, i.e. comment clearly even medium-term policy outlook.

More specifically about the QE parameters, they are interesting insofar as the supply of debt (i.e. government bonds) is limited by the current market supply + the rate of issue (in fact, fiscal discipline). The statement about the open end of QE contradicts (more precisely, it needs to be clarified), since according to some estimates, ECB purchases will drain the supply of German bonds already in 9 months. How, in this case, the ECB will continue to execute the program is unknown. The market needs clarifications.

Moreover, the revealed contradictions “narrow down” the space for clarifications to speaking about deadlines, limits etc. This type of rhetoric is of course bullish for the Euro.

As for rate tiering, it is worth mentioning an interesting counter-effect that arose in the market: by lowering the interest rate and at the same time exempting banks’ reserves from the negative interest rate (those reserves that exceed 6 times the regulatory minimum), the ECB unexpectedly got an increase in the market borrowing costs. Some banks, expecting the exemption of funds from the extra costs, withdrew funds from the market and move them to the ECB reserves. If the problem persists rate tiering may have to be tightened.

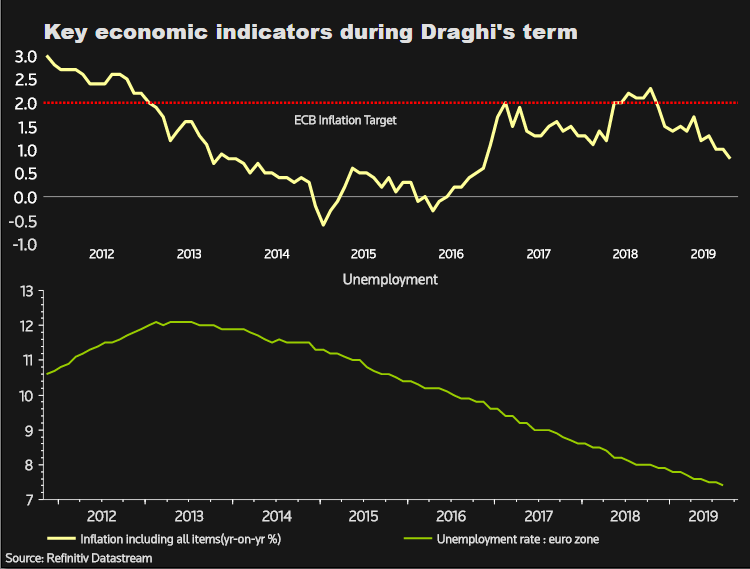

And finally, the results of the presidency of Mario Draghi in one chart:

Goodbye Super Mario, we will miss you ...

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.