Oil Prices Rising Ahead of Year-End

Red Sea Disruption Supporting Oil

Oil prices are rising for a third straight session today as concerns over Red Sea shipping routes fuel a spike in prices. Many major companies including those transporting oil have paused shipping routes through the Red Sea on the back of recent attacks from Yemen’s Houthi forces. With no indication yet as to when the shipping routes will reopen, for now the disruption is keeping oil prices underpinned.

Weaker USD Helping Oil

A weaker Dollar backdrop is also helping support oil prices here. With the Fed now widely expected to begin cutting rates as early as Q2 next year, the US Dollar has weakened materially in recent weeks and looks vulnerable to further losses. Any incoming data weakness, particularly in inflation and inflation-linked readings, should amplify USD selling, further supporting oil prices near-term.

EIA Inventories Due

Looking ahead today, traders will be focusing on the latest EIA inventories report. The release is expected to confirm a further drawdown of more than 2 million barrels, which should add further support to the current rally in oil prices if seen, on the back of the prior week’s 4-million-barrel surplus. Oversupply concerns have been a key issue for crude this year and as we head towards 2024 traders will be keeping an eye on US production levels to see if there has been any easing of output which would also be bullish if seen.

Technical Views

Crude

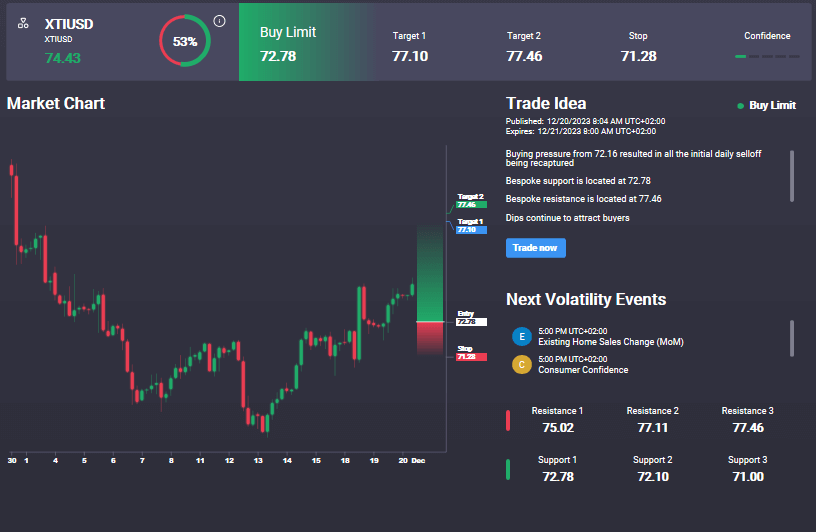

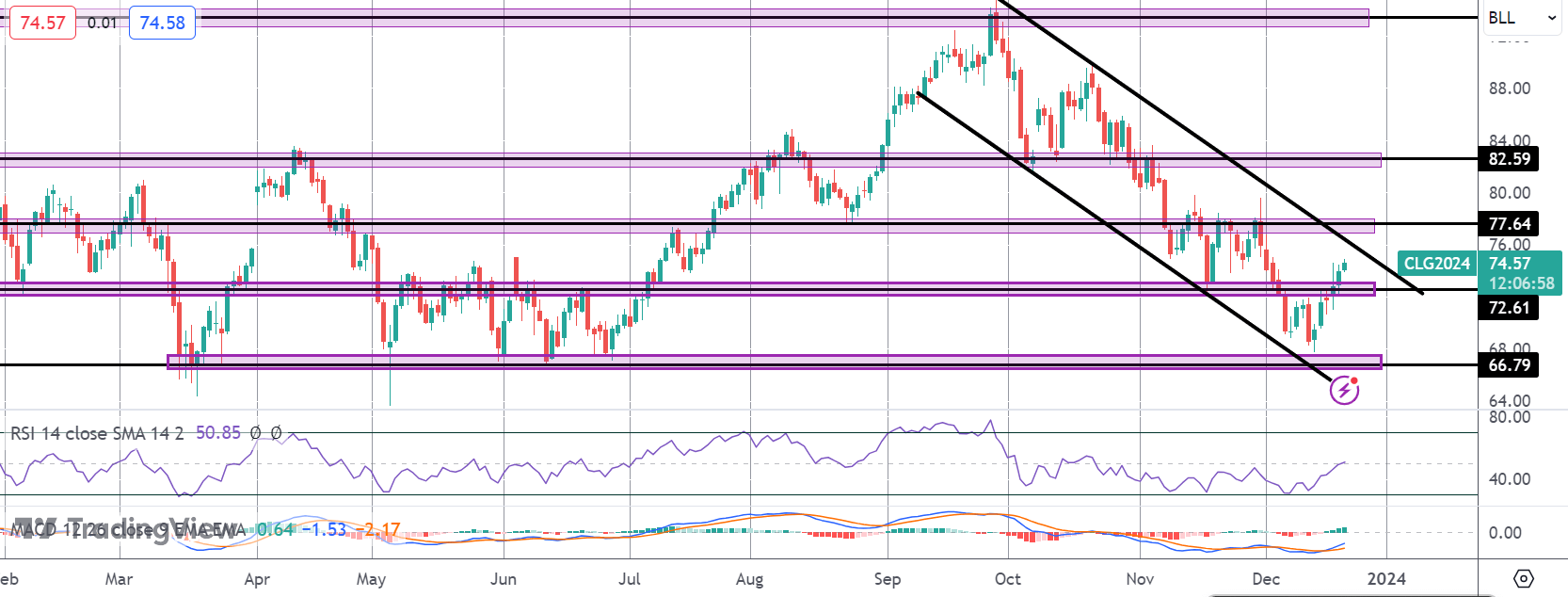

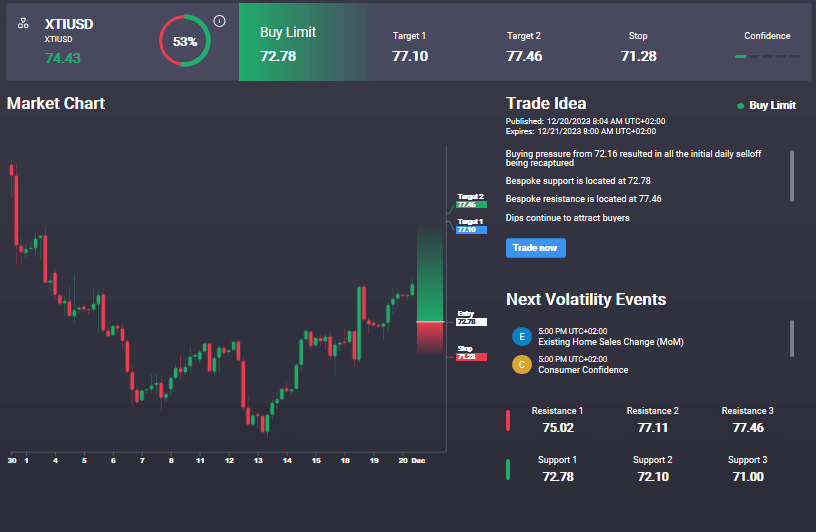

The rally in crude has seen the market breaking out above the 72.61 level with price now fast approaching a test of the 77.64 level and the bear channel highs. This will be a key test for the market with a break above potentially opening the way for a much fuller reversal up towards 82.59. Indeed, we have an active buy signal in the Signal Centre today set at 72.78, suggesting a preference to buy any dips from current levels, targeting a move back up through highs.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.