Calmer Crude Markets

Following heavy volatility at the start of the week, crude oil prices action has calmed down sharply through the week. Crude futures are now hovering around the level of last week’s closing price, reversing the initial gains seen on Monday as traders reacted to news of Saudi Arabia unveiling a fresh set of voluntary production cuts. The new 1 million barrel per day cut failed to produce any bullish follow through in crude as traders instead focused on the rest of OPEC+ keeping their current production levels intact.

EIA Forecasts Production Increase

The latest update from the Energy Information Administration this week showed US crude inventories falling by 0.5 million barrels last week. This was less than the 1.2 million barrel deficit expected. However, with the EIA forecasting oil production to rise sharply over the remainder of the year, prices have gained little support from the release. Indeed, the EIA forecasts oil prices to remain lower despite the latest Saudi production cut given that global production as a whole is now set to rise above earlier projections. Looking ahead, oil prices look vulnerable to further downside near-term particularly if we see a hawkish surprise from the Fed next week.

Technical Views

Crude

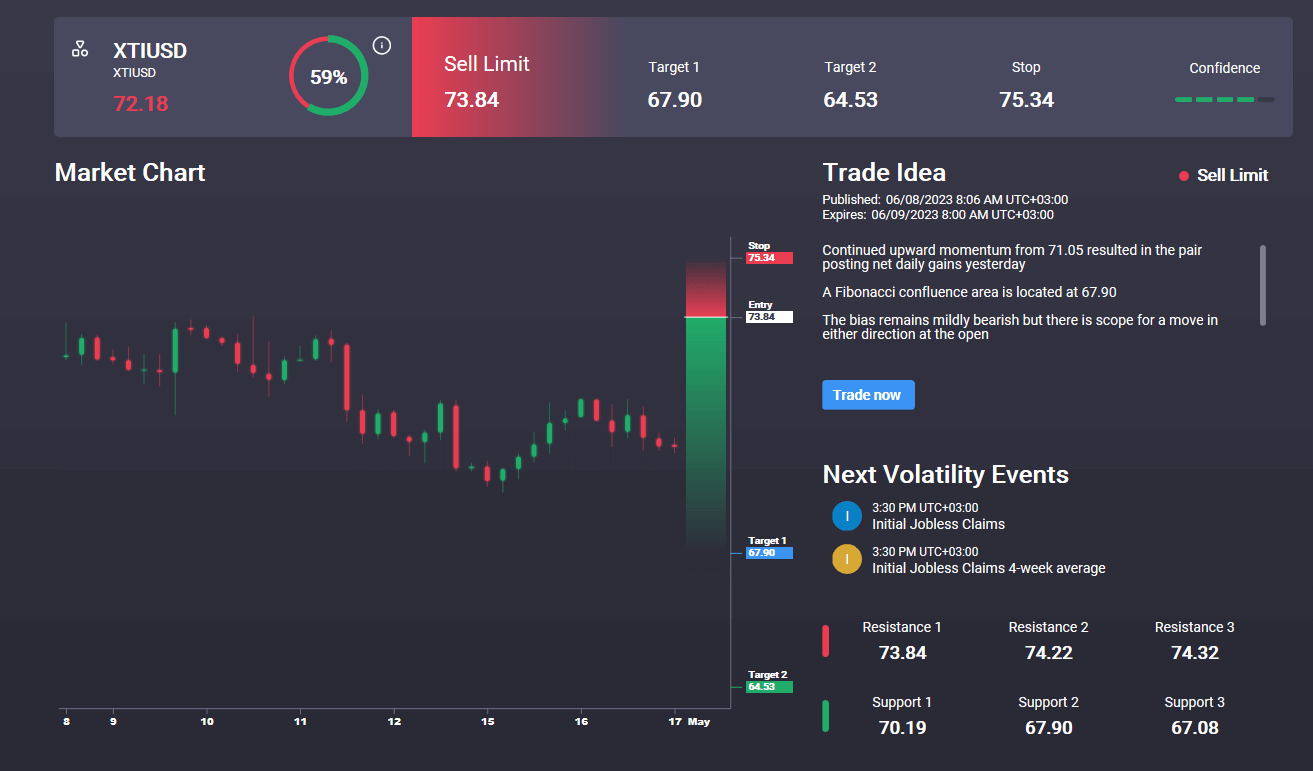

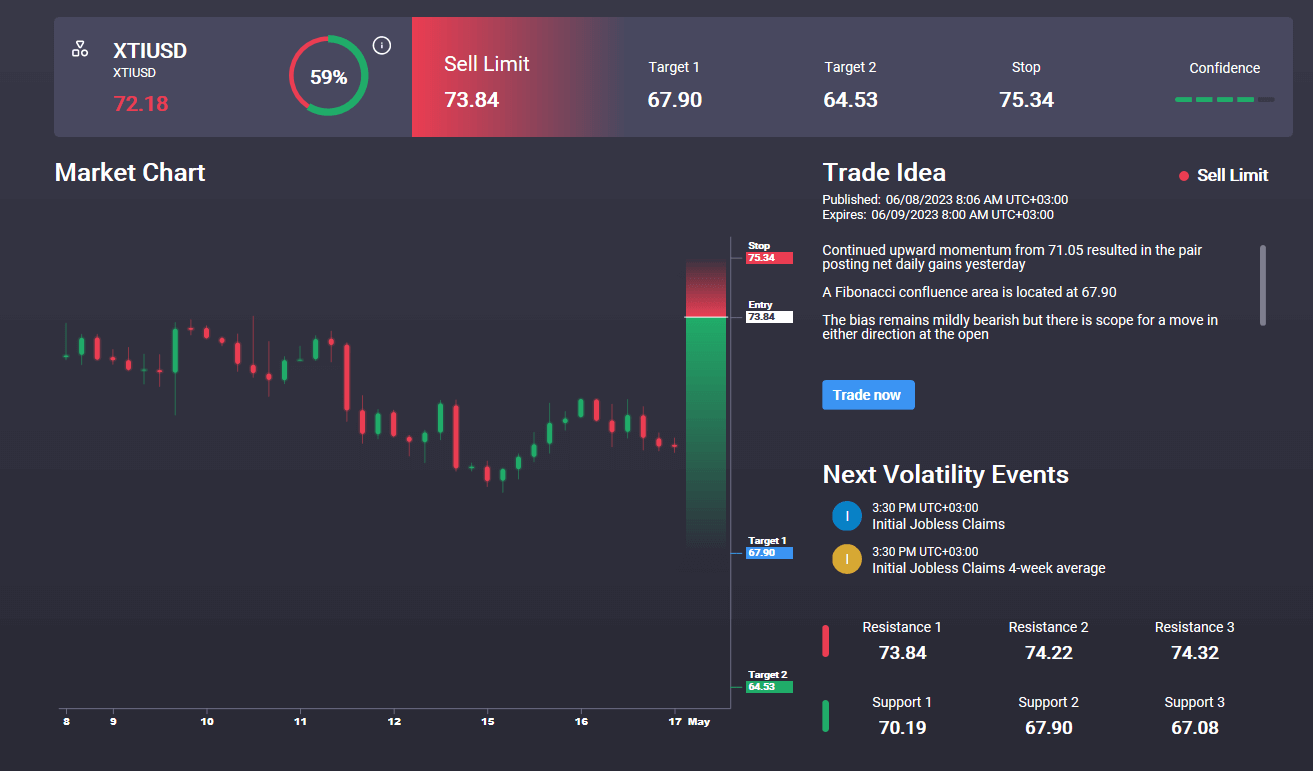

Prices continue to hover around the 72.61 level currently. To the downside, 65.34 has underpinned the market since Q1, providing a base. However, bulls have failed to develop any upside momentum and with price still holding within a large bearish channel, focus remains on further downside unless we see a break of 82.59. Interestingly, we also have an active sell signal in the Signal Centre today set a little above market at 73.84 suggesting selling interest on any pop higher from here.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.