NZD Tanks As RBNZ Signals End of Tightening Campaign

RBNZ Hiking Finished

The New Zealand Dollar is falling sharply today on the back of the latest RBNZ meeting overnight. Despite the central bank hiking rates by a further .25%, the sell-off emerged as governor Orr signalled no further hikes were likely near-term. Notably, some policy makers had been in favour of holding rates unchanged this time around, marking the first time there has been dissent within an RBNZ vote.

With the OCR now at the target level issued by the bank when it began tightening, the RBNZ is essentially declaring job done for now. In terms of market expectations, pricing now suggests rate cuts will come from Q3 onwards.

Lagged Policy Impact

Explaining the decision, the RBNZ noted that it was confident that its recent 525 basis points worth of tightening would continue to feed through into the economy going forward, bringing CPI down to target. In terms of forecasts, it now projects CPI to be back in its target band by Q3 next year. In terms of growth, the RBNZ is now forecasting a milder slow down than it was projecting previously, now forecasting a dip of just -0.2% from -0.5% prior.

Technical Views

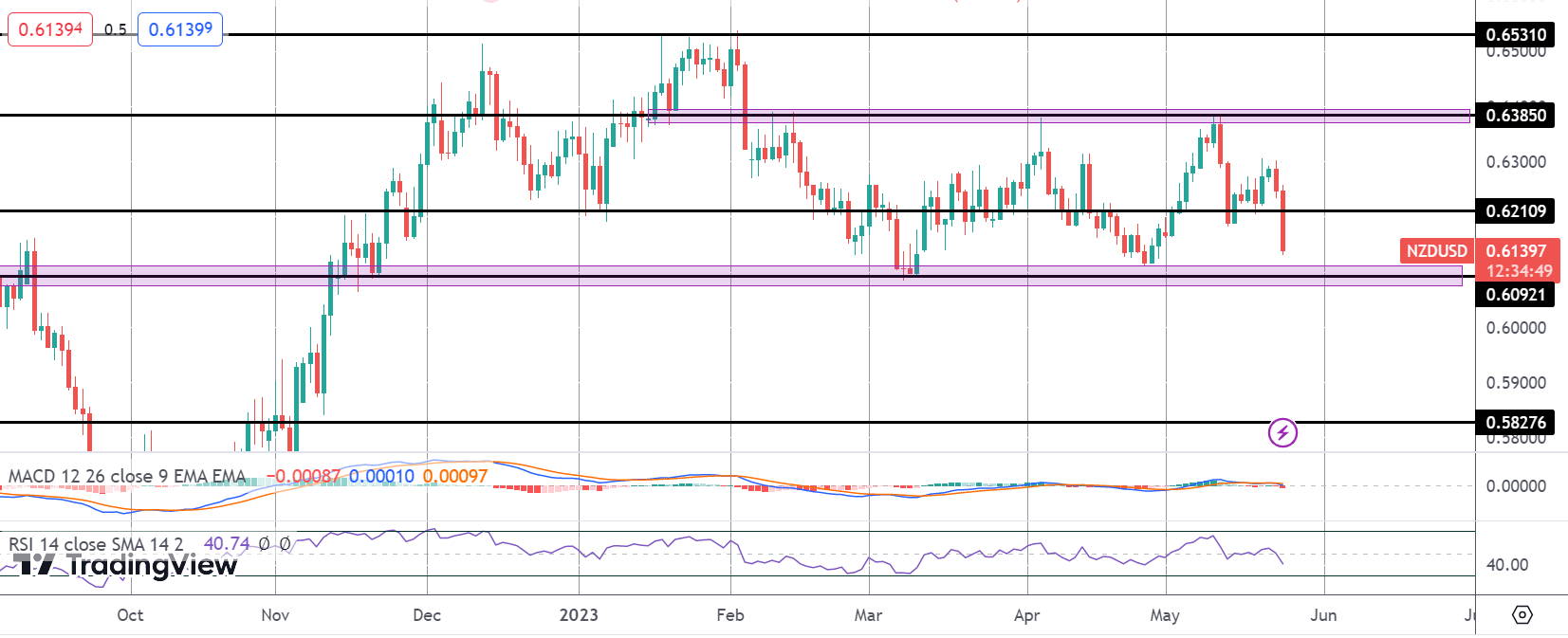

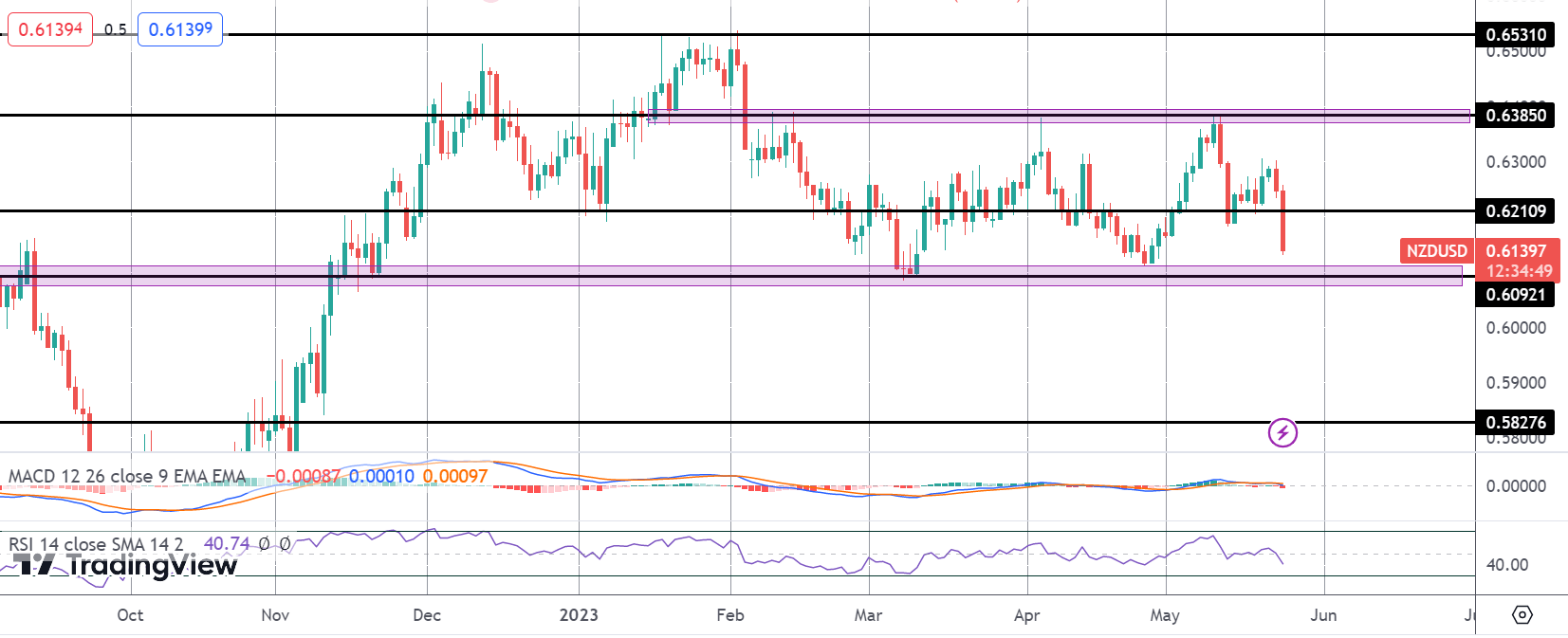

NZDUSD

The sell off in NZDUSD has seen the pair breaking down sharply through .6210 as the reversal lower from .6385 gathers pace. Price is now fast approaching a test of the .6092 region. This is a key support level and if broken, there is room for a much deeper drop towards the .5827 level below.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.