Non-Farm Payrolls Report Likely to Beat Expectations Thanks to Strong ISM Report

The strengthening of the dollar on Friday ahead of the Non-Farm Payrolls report clearly shows that the market is dominated by expectations of a strong update, allowing the Fed to move more confidently to tighten policy. ADP and ISM reports in the non-manufacturing sector showed conflicting dynamics, which slightly increased the uncertainty ahead of Friday's release. The ADP indicated weaker job growth in July (330K vs. 695K forecast), however, ISM's report in the non-manufacturing sector exceeded expectations. Significantly, the hiring component has shifted from depression to expansion (49.3 in June, 53.6 in July), and the sub-price index rose less than expected. This indicates that negative pressure on sector margins is gradually beginning to ease, which should stimulate the sector's recovery in the coming months. Initial claims for unemployment benefits were broadly in line with the forecast, with long-term claims exceeding expectations, declining more than expected in the reporting week.

The Bank of England spoke at today's meeting with more hawkish rhetoric, so the decline in the pound against the dollar is less than the decline in the euro. It is clear that the race of large central banks to reduce monetary support for the economy is now the main catalyst for strong movements and trends in the foreign exchange market. Today's Non-Farm Payrolls report is expected to clarify the Fed's possible stance at the August Jackson Hole conference, at which it often announces sweeping policy changes. Last year it was an average inflation targeting announcement (it is still unclear what that means), this year it is expected to be a QE-related announcement.

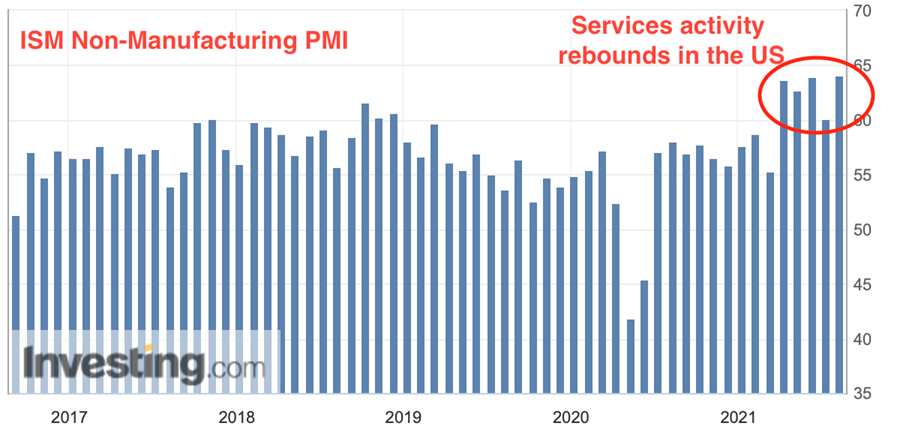

The positive ISM service sector report boosted the chances of a strong NFP report as the service sector employs over 70% of the US population and the report is the leading employment indicator. The key indicator rose from 60.1 to 64.5 points, and the level of business activity rose in July to a maximum in several years (67.5 points):

Richard Clarida said on Wednesday that the state of the US economy is likely to allow for the first rate hike at the end of 2022. If the NFP report justifies expectations, the demand for the dollar is likely to continue to rise primarily due to favorable dynamics of bond yields on expectations associated with the Fed, which will also attract foreign investors, boosting investment USD demand.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.