NFP Reports Surprises on the Downside but all Eyes are on the Wage Growth

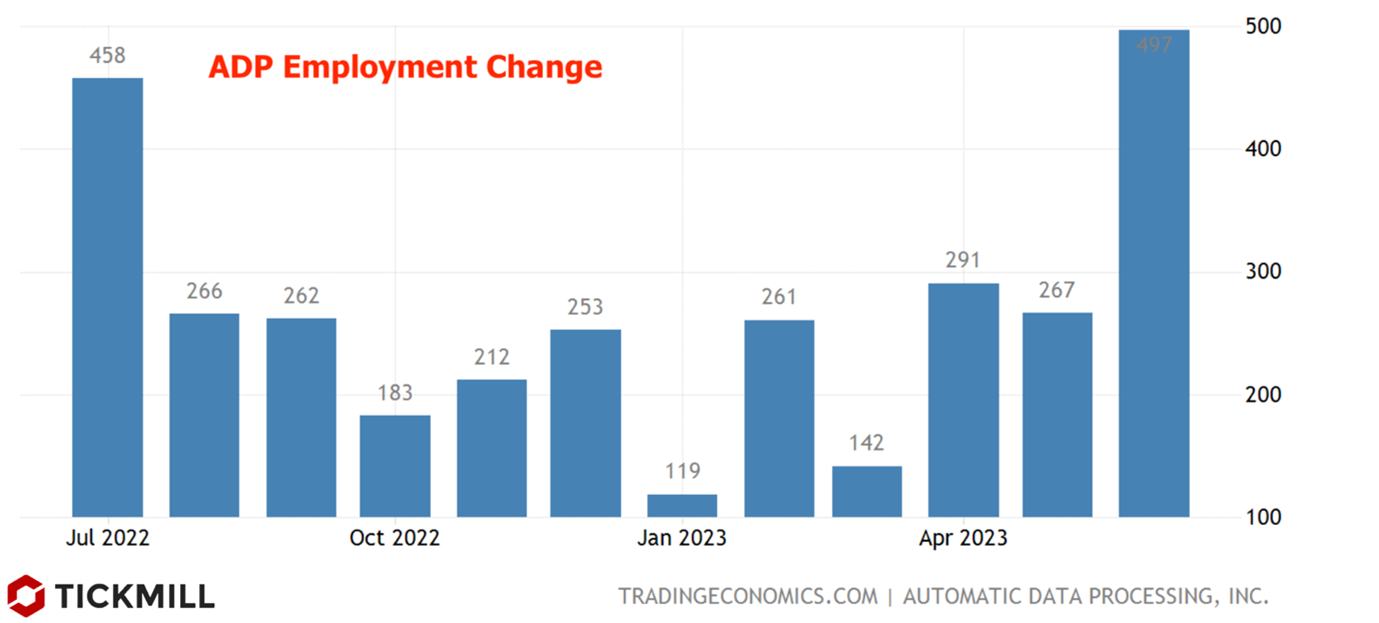

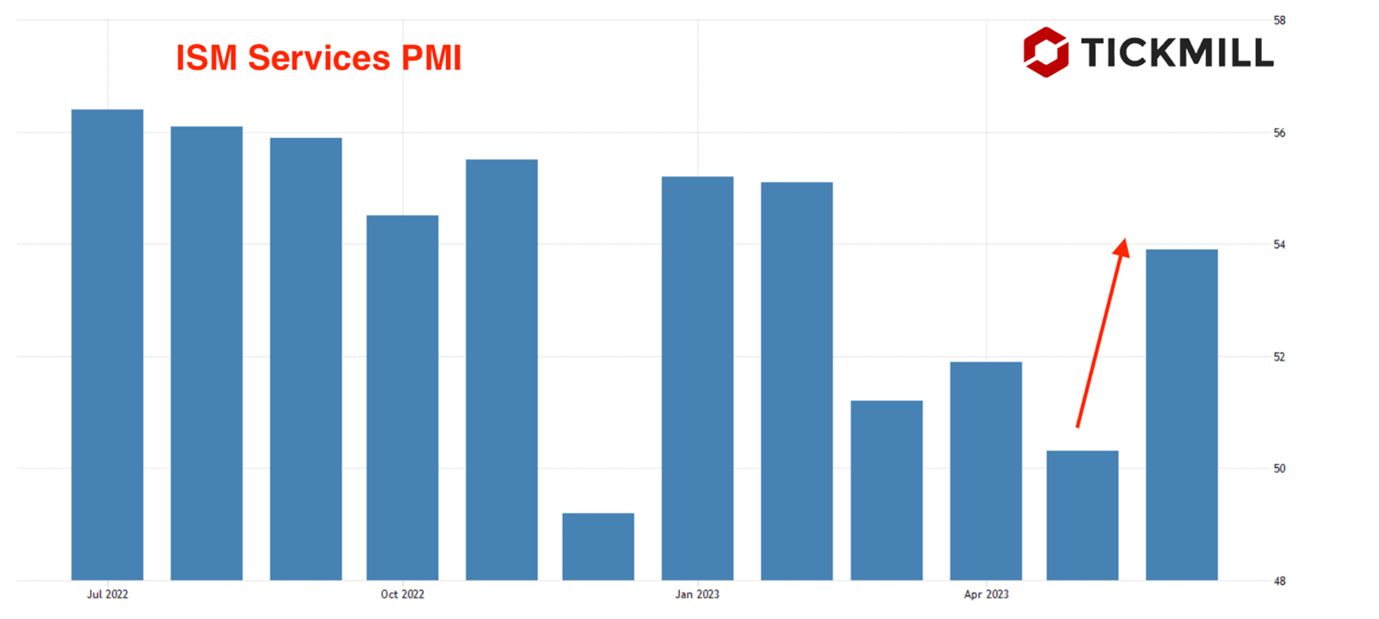

The US fixed income market remains under pressure as Treasury bond yields break key resistance levels on US data surprises. On Thursday, the data from ADP and ISM surprised on the upside, once again underscoring resilience of the US economy against high borrowing costs. According to ADP, employment grew by an impressive 497K jobs, while the services activity index rose from 50.3 to 53.9 points.

The hiring subindex in June increased from a negative 49.2 to 53.1 points, further reducing the chances of the Federal Reserve (Fed) backing down or adjusting its hawkish stance (with two rate hikes expected this year). Price pressures in the sector increased slightly higher than expected, with the corresponding index reaching 54.1 points against a forecast of 53.3 points. In post-industrial economies, the share of services in total output is usually quite high, and the US is no exception (over 70%). Therefore, the state of the services sector can provide insights into the overall state of the economy.

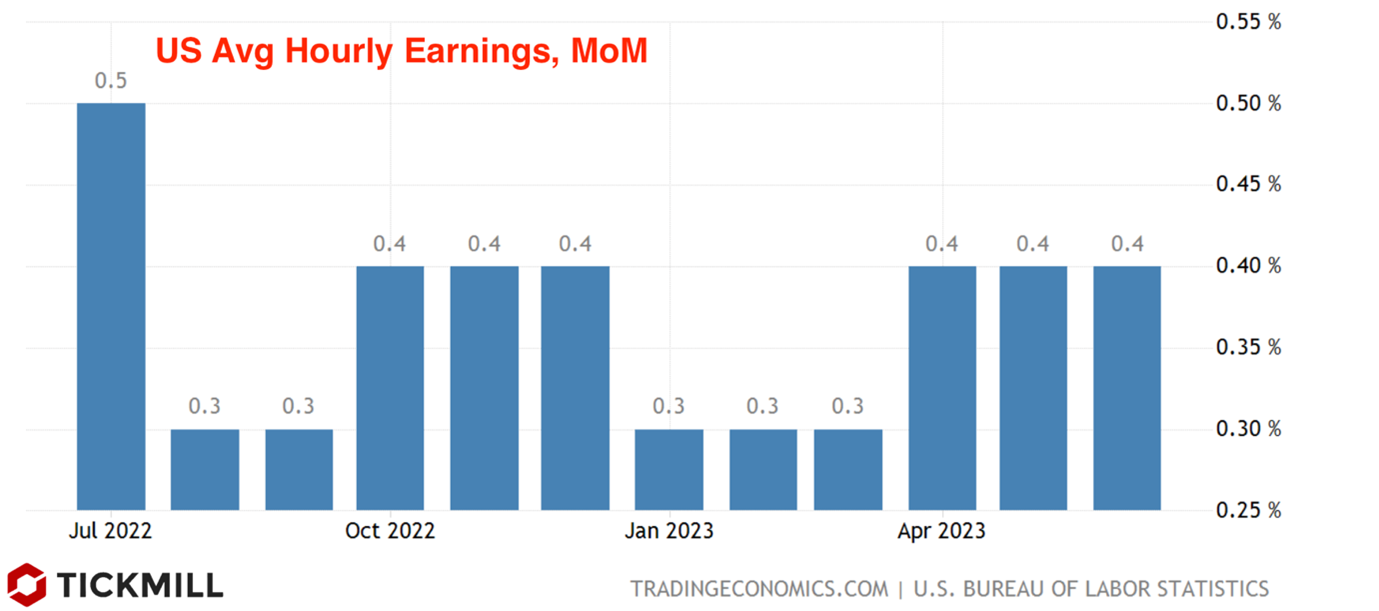

Yesterday, unemployment benefit claims rose to 248K, compared to a forecast of 245K, with the previous week's print at 236K. The report from the Non-Farm Payrolls (NFP), released today, helped slow down the sell-off in the Treasury market. Job growth came slightly below expectations (209K vs. 225K exp.). Considering the ADP report from yesterday, expectations for today's report were heavily biased towards a positive surprise. As a result, the job growth nearly in line with the forecast led to retracement movements in the Treasury market, causing yields to retreat from local peaks and the dollar to undergo a moderate correction. However, it is worth noting that the inflation component did not contradict the Fed's plans: wages rose by 0.4% in a month and by 4.4% on an annual basis, exceeding the forecast of 4.2%. Unemployment, as expected, fell to 3.6%.

In my opinion, betting on extended dollar correction from this point is definitely premature. Next week, on Wednesday, the June CPI will be released, and considering the very clear hints from the Fed that the tightening is not over yet, and the market has not fully priced in two more rate hikes, selling the dollar is very risky. There are potential catalysts for a strong wave of dollar buying. Furthermore, as mentioned earlier, there are currently no signs of weakening inflation, as demonstrated by the NFP report. Wage growth has been strong for the third consecutive month, and consumer spending, which is a primary source of consumer inflation in the absence of supply-side shocks, should follow suit.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.