New Highs For Bitcoin on Record Options Demand

BTC Grinds Higher

Bitcoin prices remain well bid today as bull sentiment remains intact. BTC futures briefly broke out to fresh all-time highs around the $94k mark yesterday before softening back. Bullish momentum has waned over the last week with prices showing a much shallower and more laboured grind higher. Price action suggests that correction risks are growing and its likely that we see an order book clear-out of all the late long traders soon, before making a fresh push higher.

Record Options Demand

Looking ahead, there was further good news for the crypto market this week. The launch of BTC ETF options trading on the Nasdaq marks a further opening up of the crypto market to institutional investors. Indeed, BlackRock recorded record demand for options trading on its BTC ETF with $1.9 billion on the first day. Notably, the put/call skew on the IBIT contract was roughly 82% bullish spread among roughly 350k contracts.

Trump Trade

The broad expectation in the market is that BTC is poised for heavy gains next year as Trump takes office. Trump’s support for the crypto community had been a key theme of his presidential campaign and a big driver of the gains we saw in BTC, even ahead of the election results. Looking ahead, near-term volatility is to be expected but the medium-term view over the next three months is firmly bullish.

Technical Views

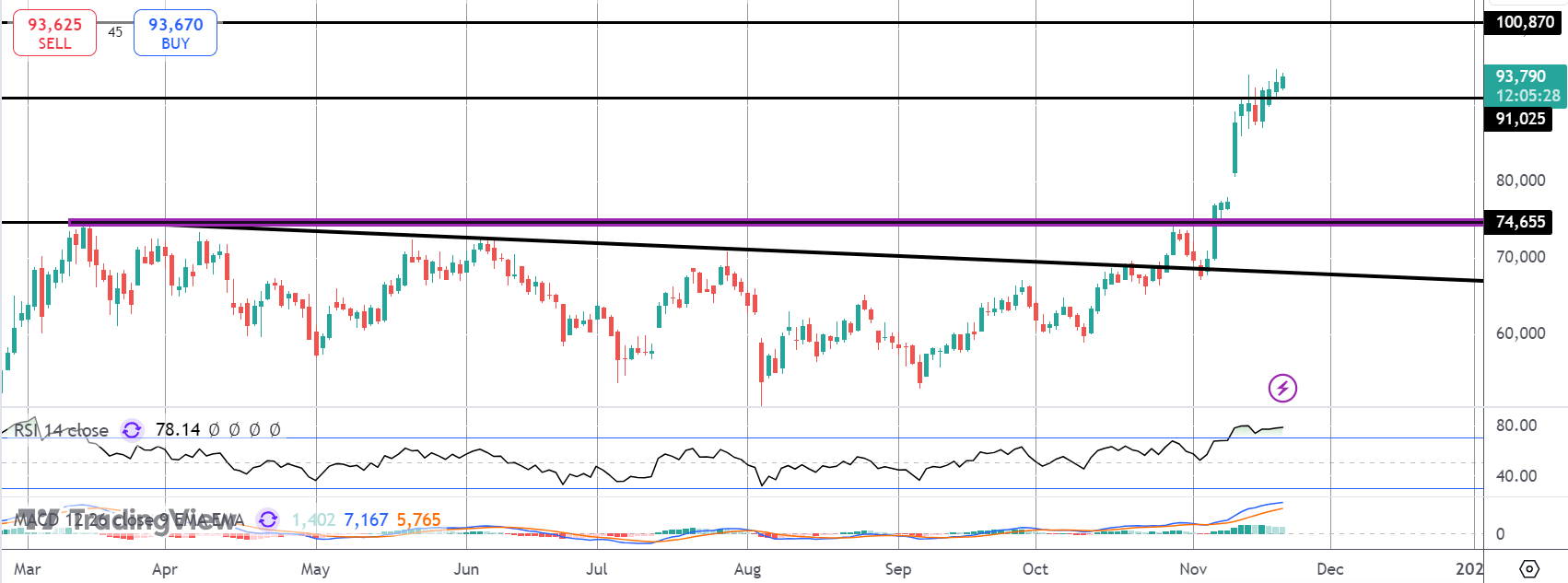

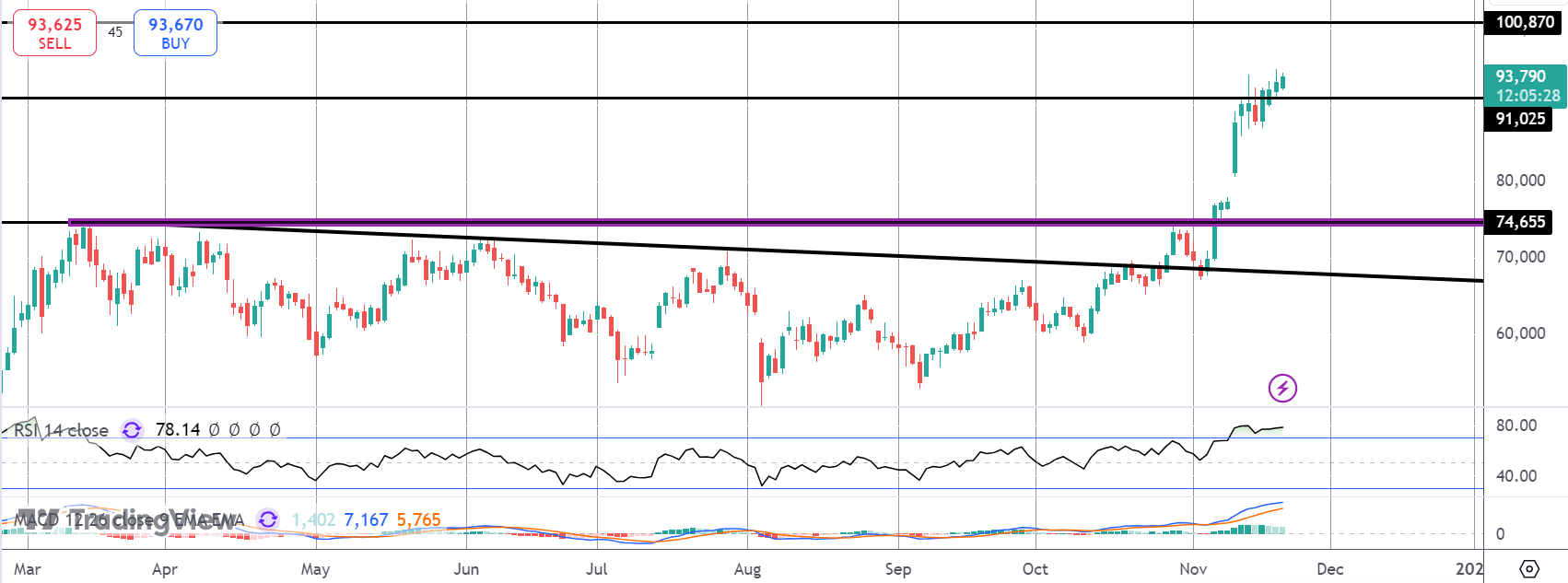

BTC

The rally in BTC has lost momentum in recent days though prices continue to grind higher. The market is now trading above the 91,025 level which is the 1.61% Fib extension of the main correction over 2024. While above here, focus is on the 2% extension next at the $100k mark. To the downside, 74,65 remains the key support to note with the bull outlook intact while price holds above that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.