MicroStrategy Makes Record Bitcoin Purchase

BTC Holding Near Highs

Following a strong rally over the start of November, Bitcoin prices have settled into consolidation mode over the last week with BTC futures trading in a tight range just under the all-time highs. Despite this, BTC has found strong demand into any dips with price still hovering around $90k mark. Indeed, broader sentiment remains bullish with many crypto watchers calling for +$100k by year end.

MicroStrategy Buys Bigger

Michael Saylor’s MicroStrategy fund has been leading the charge on the Bitcoin front. Following two hefty BTC purchases in Sep/Oct and Oct/Nov, the fund bought its largest stake yet of $4.6 billion BTC last week. Saylor now owns around $30 billion in BTC, making it the largest institutional holder of BTC, and is positioning for a bull run over early 2025 as Trump takes office.

Bull View Remains

While BTC prices have lost upside momentum in recent days, the prevailing view remains firmly bullish. Traders are eyeing fresh upside through year end as the market braces for pro-crypto policy under Trump, including the potential for a US strategic Bitcoin reserve. As Trump’s plans for the crypto community become clearer prices look poised for a further rally into next year.

Technical Views

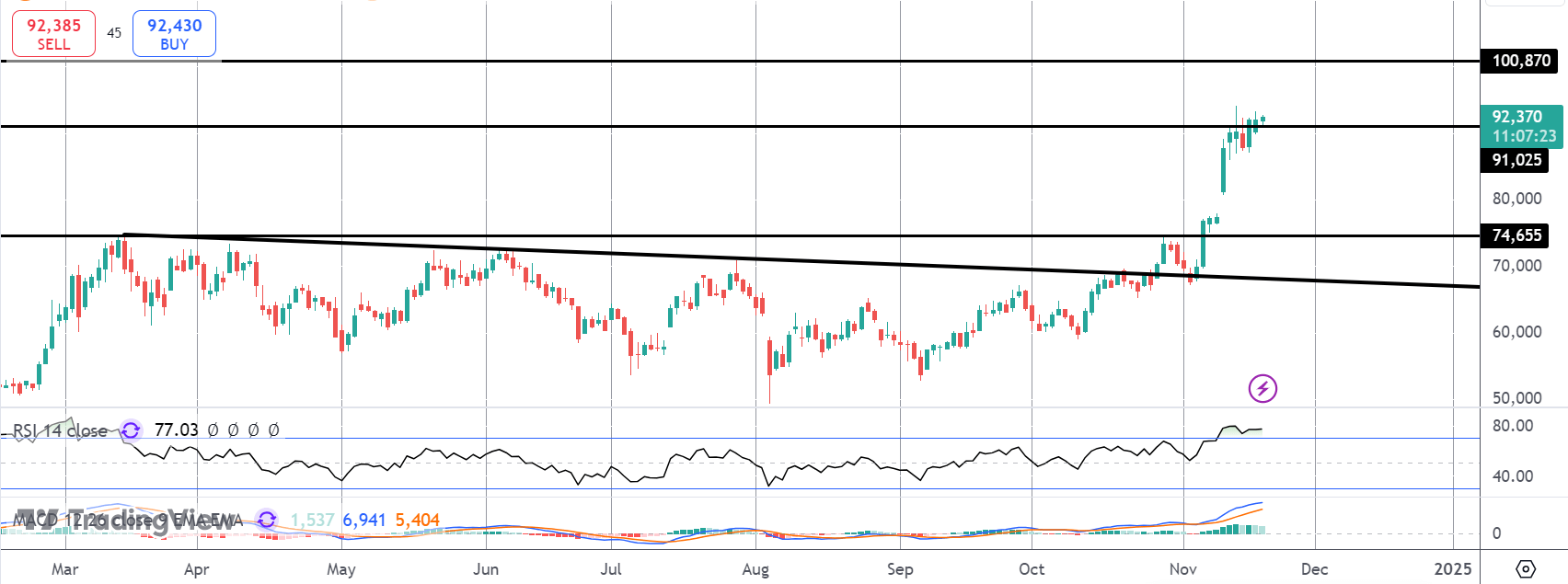

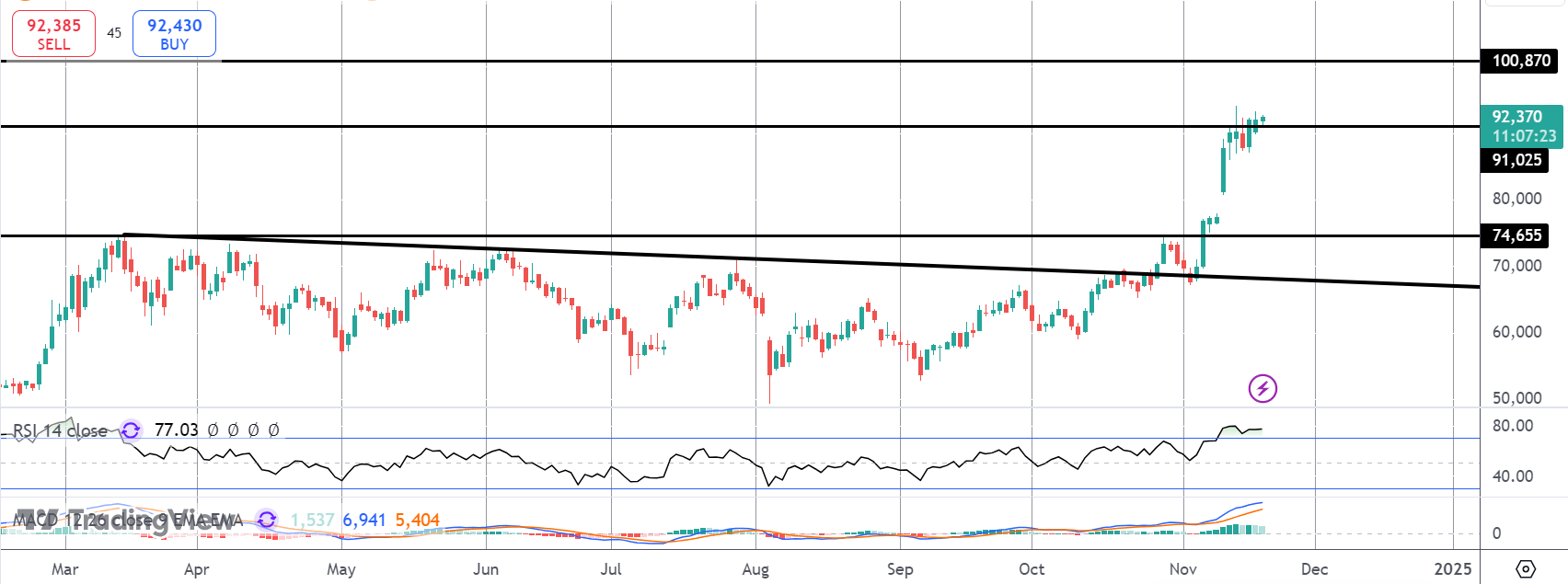

BTC

The market is now on its 5th inside candle within the range set on November 13th. While the outlook remains bullish, near-term a correction could still be seen, potentially a gap close against the Nov 8th level. While price holds above 74,65 however, focus remains on a continued push higher with 100,870 the next resistance to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.