USDJPY Reversal Deepens

USDJPY has fallen back under 140 for the first time since September as the correction lower in USD threatens to spill over into a proper reversal. Yesterday’s US CPI release has seen market pricing for the December FOMC swinging in favour of a smaller .5% hike, fuelling an unwinding of USD longs. Added to this, attempts by the BOJ to stabilise the Yen in recent weeks have helped undeprin the currency with traders now anticipating further action should any fresh weakness materialise. With these two themes providing the backdrop, sentiment has shifted now and USDJPY looks prone to further weakness in the near-future.

UoM Sentiment Data Up Next

Looking ahead today, the latest UoM consumer sentiment data looks set to further weigh on the Dollar. The market is forecasting a drop to 59.5 from 59.9 prior which should keep USD pressured into next week. Additionally, if any surprise weakness is seen, the USD sell off will likely accelerate near-term ahead of next week’s retail sales data.

Technical Views

USDJPY

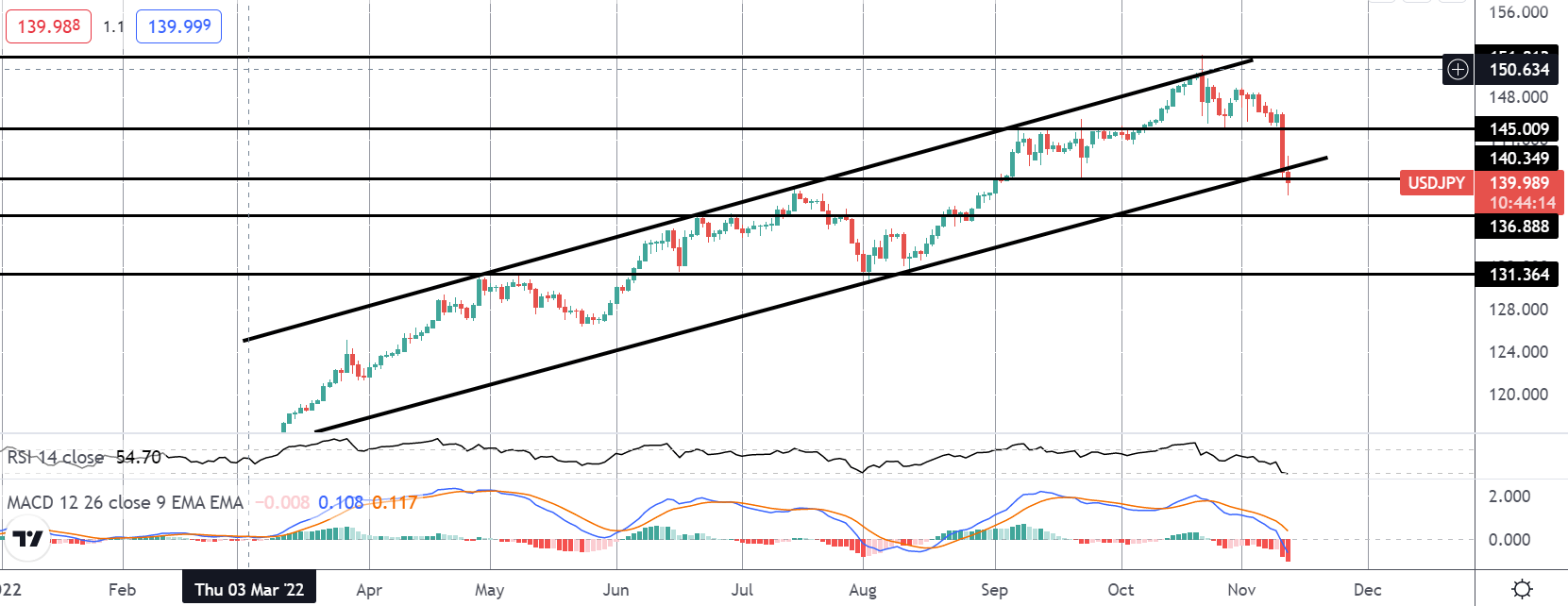

The reversal in USDJPY from 151.81 has seen the market breaking below key support at the 145.00 level and below the rising channel from YTD lows. With both MACD and RSI having turned bearish here, the focus is on a continued push lower while price remains below the 145.00 level. Currently, support at 140.34 is holding, so today’s close will be key. Below here, the next supports to monitor are 136.88 and 131.36.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.