CPI The Key

Yesterday’s US CPI report might well prove to be a pivotal moment for the Dollar. Over recent weeks, an increasing number of players have been looking to call a top in USD linked to expectations of a slowing of Fed tightening. With headline CPI having dropped half a percentage point last month, falling to 7.7% annually from 8.2% prior, there is now a strong case for the Fed to reduce tightening to just .5% in December. Price action in USD certainly reflects this perspective with DXY breaking through key support and trading down to its lowest level since August.

USD Longs Unwind

With one further inflation reading to go before the December FOMC, the Dollar has room to come off further if consumer prices are seen falling again. With this in mind, short USD plays look to be the way to go now with late longs being squeezed out and longer-term players likely squaring profits ahead of year end in anticipation of a shift from the Fed.

Technical Views

DXY

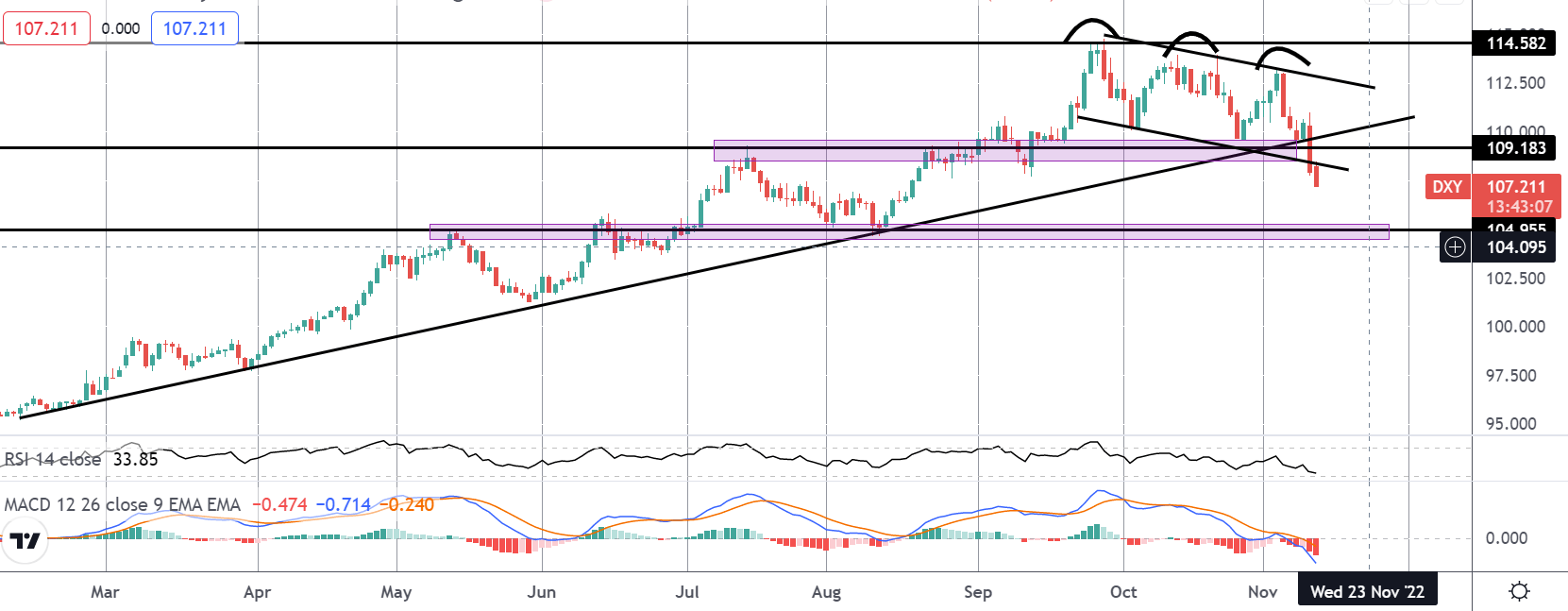

The correction from the 114.58 highs has gathered pace on the break below the 109.18 level and below the rising trend line. The move below this key support is a warning sign of a deeper reversal starting to form. With both MACD and RSI bearish, the focus is on a further move lower with 104.95 the next big support to note. For now, the outlook Is bearish while price holds below the 109.18 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.