Market Spotlight: USD GDP & Fed's Powell In Focus

Busy Day For USD

Looking ahead today we have plenty to keep an eye on with the US ADP and JOLTS jobs data to be closely watched ahead of Friday’s headline NFP data. Alongside those readings today, we also have an advanced look at Q3 GDP along with Fed’s Powell speaking at the Brookings institute later today.

Will US Economy Bounce Back?

First up, GDP. The market is expecting the economy to have bounced back to 2.8% last quarter, up from 2.6% in Q2. Such a reading will confirm that the US is out of technical recession and potentially put a larger December hike back on the table. With doves arguing that Fed rate hikes are harming the economy, any data to the contrary will no doubt be welcomed by hawks and USD bulls. In this scenario, US stocks are likely to fall with tech stocks likely to suffer most. However, any surprise downside in today’s data will be seen as strengthening the chances of a smaller hike in December.

Traders Looking to Powell for December Clues

Later today focus will then shift to Fed chairman Powell. Powell will be speaking on the economic outlook in the US and the employment environment, with traders looking for solid clues today as to whether the Fed is likely to opt for a smaller .5% hike in December, or push ahead with a further, larger hike. Again, the impact is likely to be magnified in tech stocks which have suffered the most from USD bullishness this year.

Technical Views

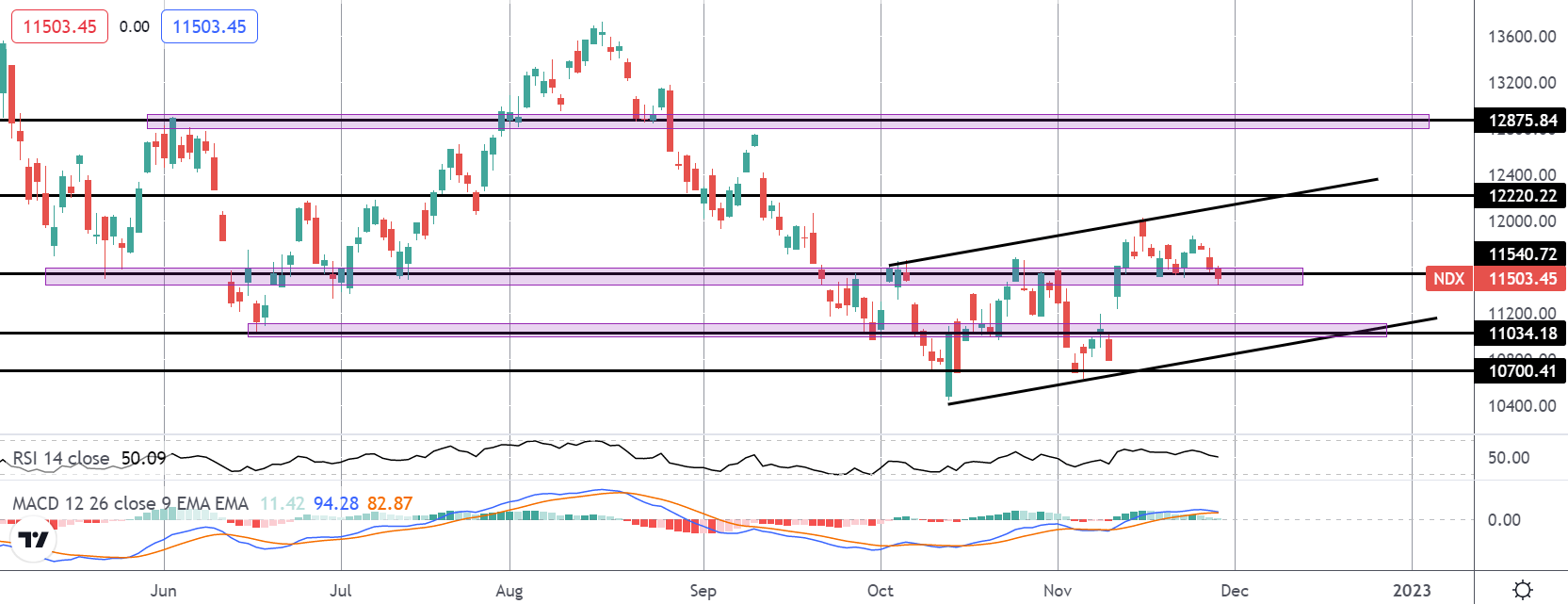

NASDAQ

The index has been correcting higher over recent months within a broad bullish channel. Price recently stalled into a test of the channel top and is now sitting back on support at the 11540.72 level. Should we see any fresh USD upside today, a test of the 11034.18 level and bull channel lows will be the next focus. However, while 11540.72 holds, focus is on a further push towards the 12220.22 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.