Market Spotlight: NZDCHF Downside Opportunities

NZD Weaker Ahead of RBNZ

NZDCHF has come under heavy selling pressure over recent sessions as traders brace for the upcoming RBNZ meeting this week. Despite firmly hawkish guidance issued at the November meeting, which suggested a further .75% hike to come, the recent severe flooding and cyclone damage in New Zealand has prompted expectations of a much smaller hike, likely .25%, with outside chances of the RBNA holding off from hiking altogether. Coming at a time when the country is still grappling with excessive inflation and the impact of recent RBNZ tightening, the recent weather emergency is casting further shadows over the economic outlook there.

Bullish CHF Views

CHF on the other hand has been one of the best performing currencies of late. The market’s shifting ECB view alongside an uptick in Swiss inflation has seen a flood of demand for the safe-haven. Additionally, the recent uncertainty regarding the changing hands of the BOJ governorship has lead safe haven flows away from JPY and into CHF, helping lift the currency further. Looking ahead, the current dynamic looks likely to continue this week with the risk that the RBNZ meeting drives NZD lower near-term, creating further opportunities for NZDCHF bears.

Technical Views

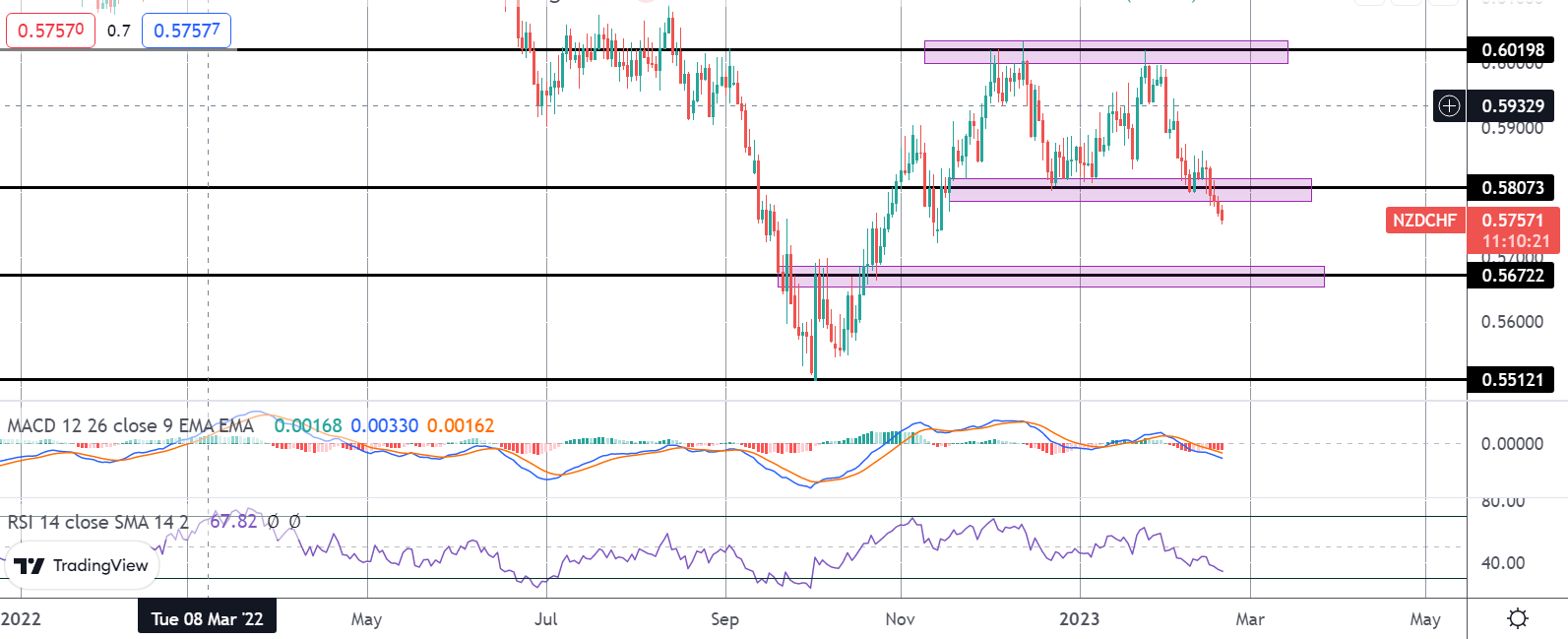

NZDCHF

The recent failure at the .6019 level looks to have carved out a double top formation with the break of support at .5807 opening the way for a deeper move towards the .5672 level, In line with bearish momentum studies readings. With the retail market almost 90% long the pair, there is plenty of room for a deeper decline near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.