Market discounts retail sales data focusing on the Fed comments as July meeting looms

Greenback posted surprisingly muted response to strong US retail sales on Tuesday, despite of actual figures printing almost twice higher than the estimates. Some traders went on vacation, the rest opted to focus on the Fed’s comments, so the mix of lowered trading volumes and weakened importance of the “hard data” only helped Dollar to sustain gains slightly above 97 level during the trading session on Wednesday.

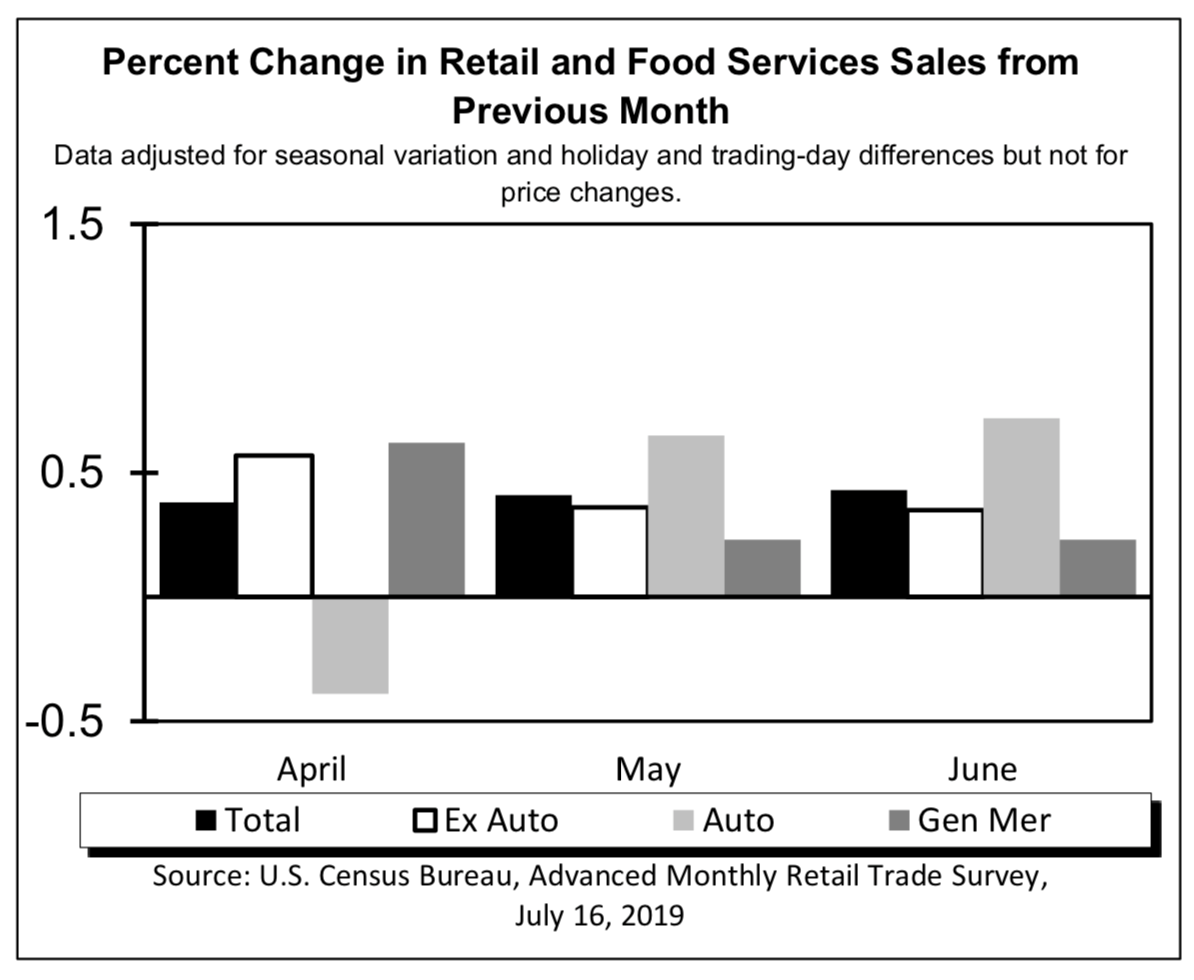

Retail sales in the control group grew by 0.7%, more than twice as high as expectations (0.3%), retail sales metrics including/not including goods with volatile prices indicated a steady rise of consumer spending in June. Car sales for the second month in a row make a positive contribution to sales, probably due to a seasonal increase in summer trips.

Powell, speaking in Paris, attempted to refine his subtle guidance to July meeting, keeping market focus on the risks of decline in inflation expectations and their “deanchoring”, fall in market-based compensation for inflation, which require more policy accommodation. At the same time, the Fed opts to discount traditional fundamental data, showing its concern the expectations. Powell’s comments boosted the odds of 50 bp rate cut to 31%.

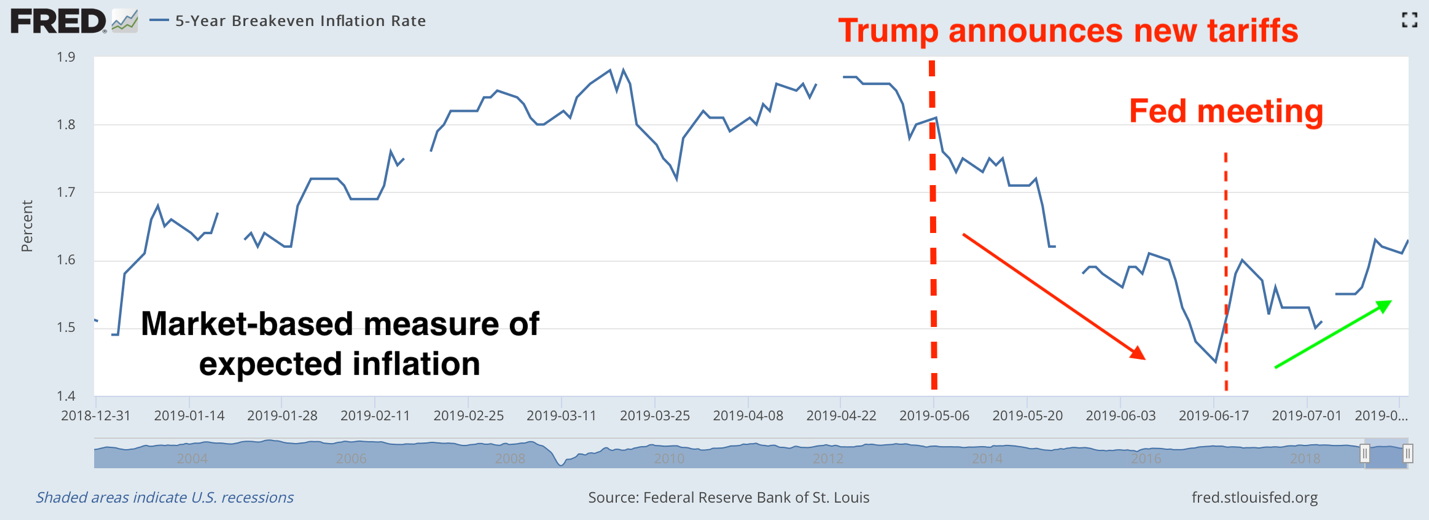

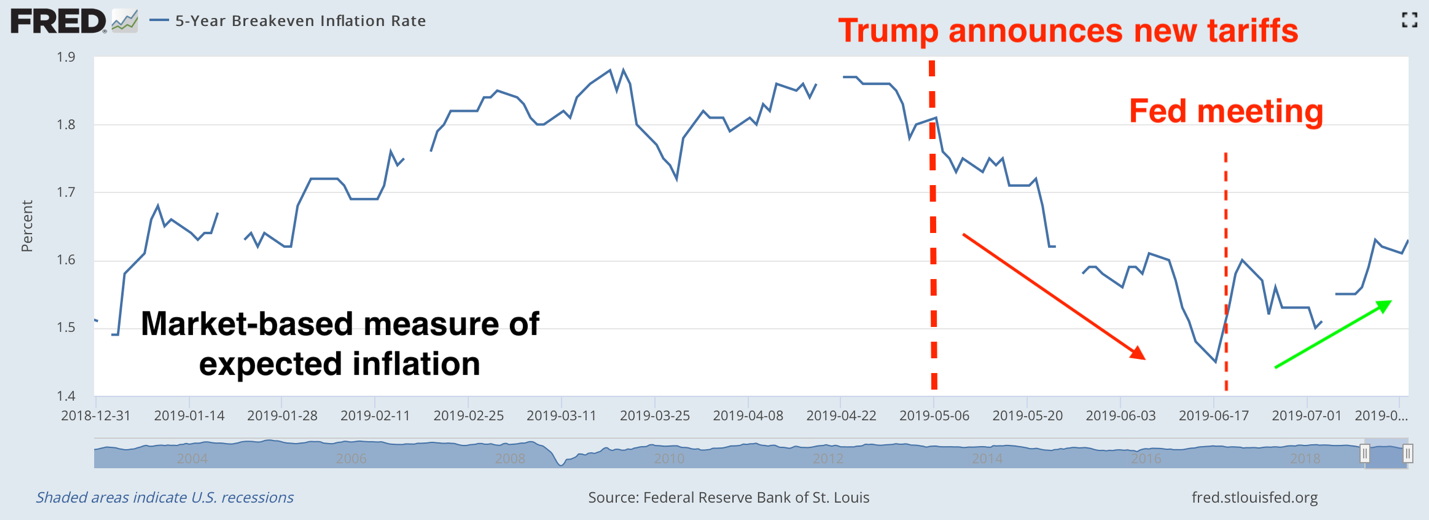

At the same time, Powell managed to convince the market that the Fed will be able to support inflation. Market-based metrics of inflation expectations have turned into growth from the end of June:

It can be seen from the chart that the main risks are currently perceived to stem from US bilateral trade relations as the inflation expectations tumbled exactly after the announcement of new tariffs on China goods in May. This was also repeatedly stated by Powell. On the other hand, the decline inflation expectations in May could be a market foresight of the new round of credit easing in response to exacerbation of tariff tensions, in which case the Fed turns out to be led, reacting to short-term market whim, instead of spotting genuine trend in the economy.

However, for the late phase of expansion, which the US economy is supposedly in, the “hard” data tends to lag (since crises start with a sharp change in expectations in response to a shock), therefore, the Fed needs to “diversify” the sources of information in order to stick to the proclaimed “data dependency” policy in early 2019.

In my opinion, the rate cut by 50 bp is difficult to consider a commensurate “precautionary measure” in response to economic changes, where retail sales and the labour market are growing at a fairly steady pace. A strong stimulus signal from the ECB next week will reduce the risks of a further “slowdown in growth abroad” (one of the reasons for the Fed’s concerns, along with the trade war), and US GDP data on Friday may contain a positive surprise as shown by NFP and retail sales. All this may limit dollar sales.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.