Last Signs of Optimism in Chinese Economic Data

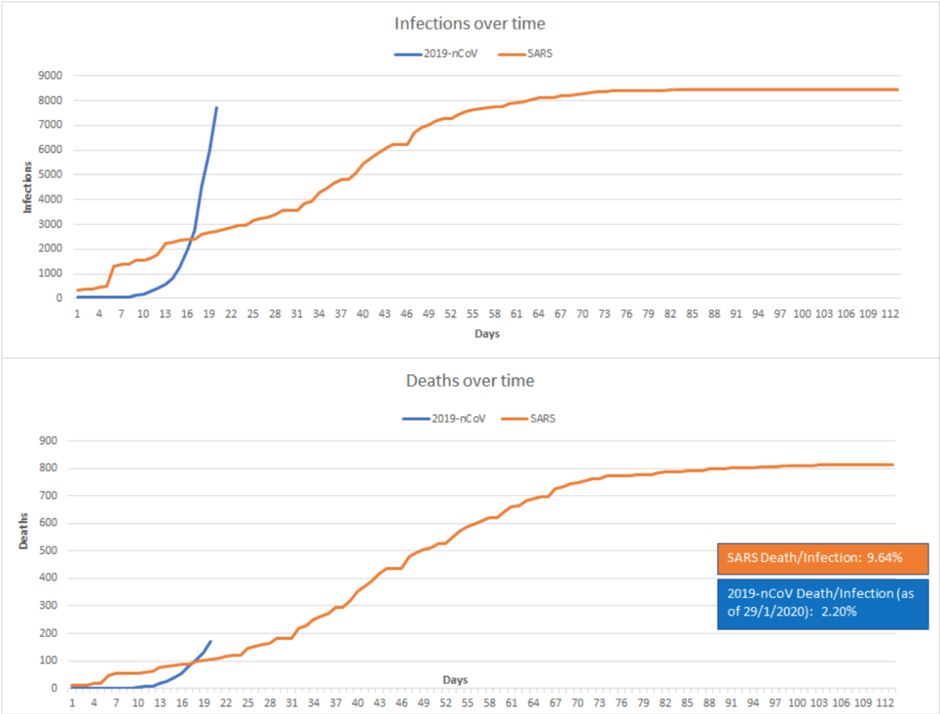

The situation with the spreading virus in China continues to deteriorate despite unprecedented government steps to stifle contamination – some factories are idle, shops and theaters are closed for weeks, complete lockdown of some provinces makes their inhabitants virtually cut off from the rest of the world. But the virus continues to spread at an enviable rate for other pandemics like SARS or Swine flu:

Amid all this, activity in China services sector, surprisingly, grew at faster-than-expected pace in January, official data showed on Friday. The PMI in services sector rose to 54.1 points against the forecast of 53.0. To assume expansion in the services sector, the basic premise is necessary that consumers are not limited in their movement, so that, in fact, there is a physical possibility to consume these services. Where does the positive data come from in the grim picture of the spread of the virus in China?

The explanation, as expected, lies in the time of data collection. Surveys were conducted from January 15 to 20, and not as usual from January 20 to 25, due to the celebration of the Lunar New Year. The PMI report came out with a remark that the effect of coronavirus on economic activity was not fully reflected in the data, therefore, “it is necessary to monitor future trends.”

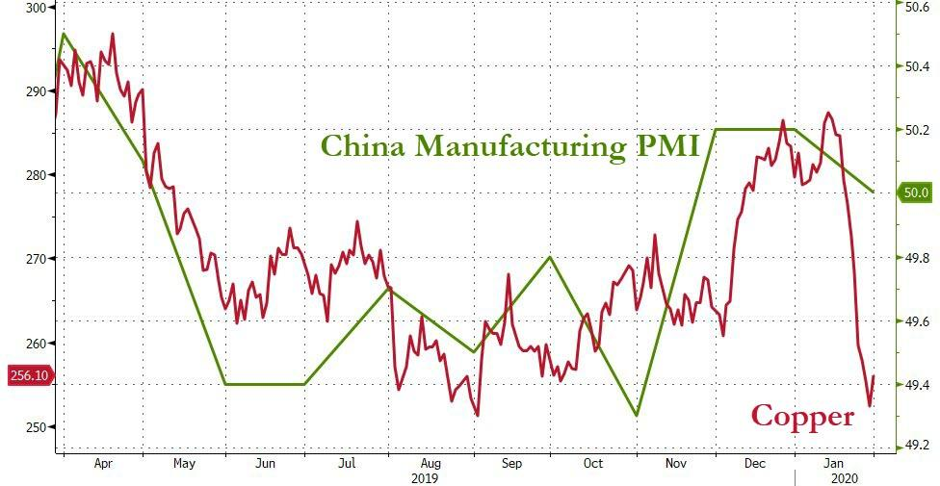

But while in the first half of January a seasonal increase was observed in the services sector, in the manufacturing sector, enterprises felt unwell even before the development of the emergency situation with coronavirus. PMI in the manufacturing sector fell to 50 points in January, but given the sharp drop in copper prices (which has strong correlation with manufacturing PMI), activity in the sector was likely to actually decline:

Source: Zerohedge

China will probably prefer to take up the old and increase monetary support, as well as accelerate the implementation of infrastructure projects, however, the problem may not be a lack of funds, but a lack of projects. Against this background, the decline of the yuan against the dollar seems inevitable, since credit growth is probably the only way to bring the figures closer to the government targets and China will likely take this lifeboat.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.