Key Factors to Watch in AUD Crosses

We’ve had some important developments in the fundamental backdrop for AUD recently that are worth discussing. These developments are particularly evident in the price action of AUDNZD and AUDJPY.

Rate Movements Driving AUDNZD

So, looking at AUDNZD we’ve seen a large move higher recently in the wake of the RBNZ unexpectedly cutting rate by .5% at their last meeting. The move, which came only days after the RBA kept rates on hold, was above the expected .25% cut and caused a sharp jump in AUDNZD, which the market is still digesting.

Though the RBA chief later that week said that the RBA will likely have to cut rates again this year, for now, AUDNZD is still trading higher with NZD weakened by the rate cut. The market is currently pricing in another RBA rate cut by November though, with global sentiment deteriorating rapidly, this could come sooner. Recent cuts suggest that simply cutting rates by the expected amount is not effective in weakening the AUD and as such, the risk of a larger than expected cut is growing.

Trade Wars Driving AUDJPY

The AUDJPY then has been a clear reflection of the deterioration in risk sentiment recently. Following the unexpected announcement of a fresh set of trade tariffs due to hit Chinese goods starting September 1st, along with subsequent heavy devaluing of the Chinese Yuan, risk markets have recoiled. The uptick in trade tensions has weighed heavily on AUD while JPY has been supported by an increase in safe haven inflows as equities come off.

Indeed, although we saw a brief recovery in equities this week as the US announced that some of the goods due to fall under the new tariffs will be exempt until a later date, the move was short lived and equities have come under pressure once again, sending JPY higher. For now, the market awaits a fresh update regarding the next set of trade talks due to take place in September. However, with the situation remaining highly volatile, there is the potential for talks to break down at a moments notice, which should be heavily bearish for AUDJPY.

Technical Perspective

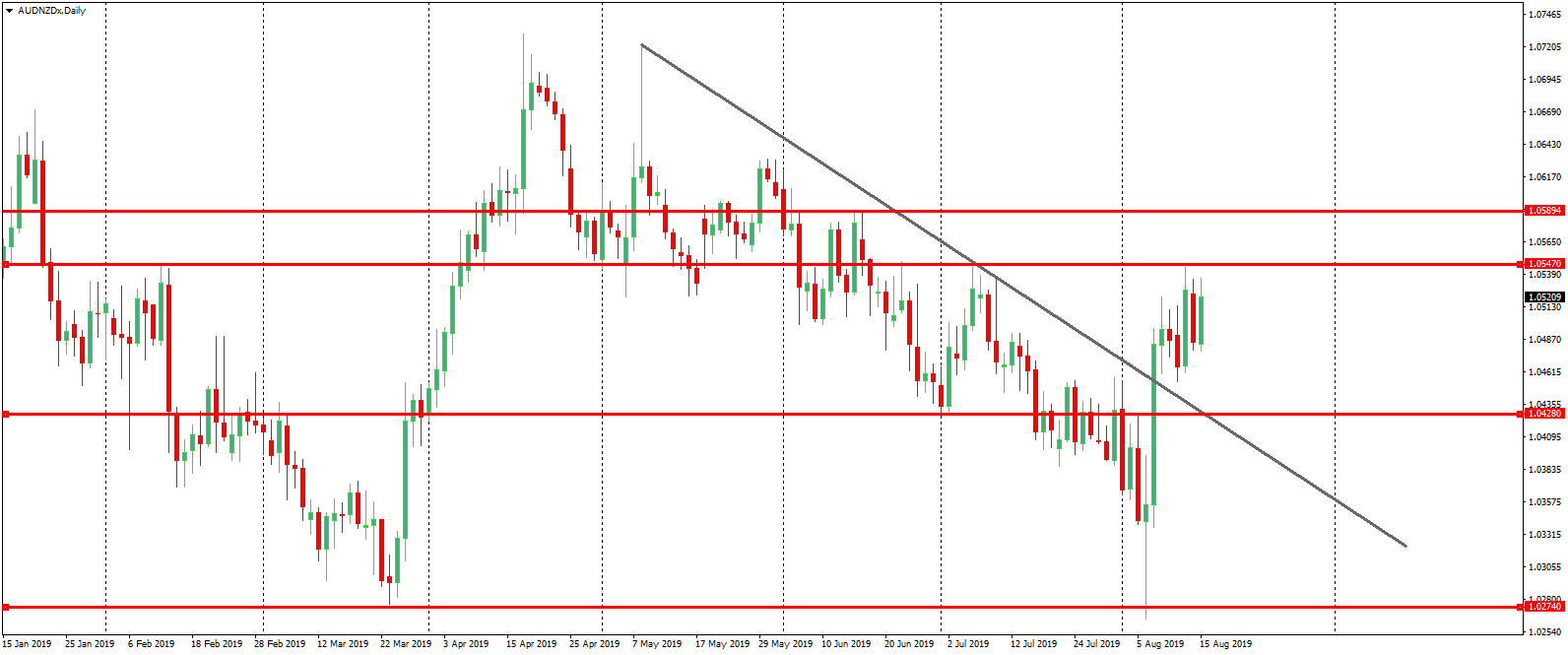

Looking at AUDNZD on the daily, you can see clearly the scale of that knee jerk move, which we saw in reaction to last week’s RBNZ rate cut. AUDNZD has reversed sharply off the recent 1.0274 lows and catapulted back above the bearish trend line from May highs. However, for now, the 1.0547 level has capped the rally with AUDNZD coming off a bit since testing it. While we remain above the broken trend line and above the 1.0428 support though, focus remains on further upside.

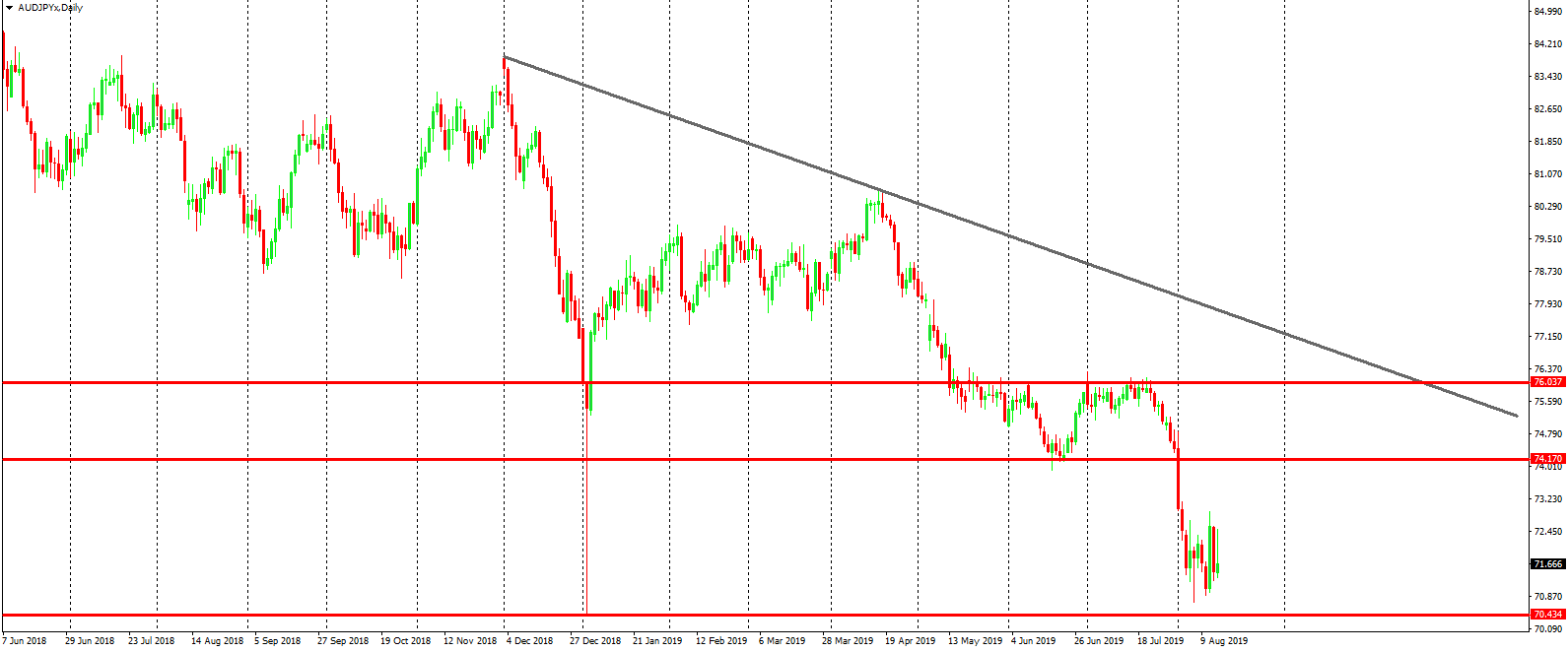

Moving over to the AUDJPY then and starting on the daily and you can see how heavy the declines have been over the year so far, and particularly over the last week. Price breaks down below the 74.17 level trading all the way down to just shy of the 2019 lows at 70.43. Indeed, despite some upside mid week, price is remaining hemmed in near these lows, keeping the outlook very bearish in the near term. Bulls will need to see a break back above the 74.17 level to take the pressure off.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.