It is still too Early to Expect a Major Dovish Fed Shift

Yesterday, the panic in the US market was contained, and the influx of investors into treasury bonds slowed down, which can be seen from the stabilization of Treasury yields across all maturities. Gold, which is quite sensitive to stress in the US banking sector (+5.5% since last Thursday), has retreated by half a percent for now.

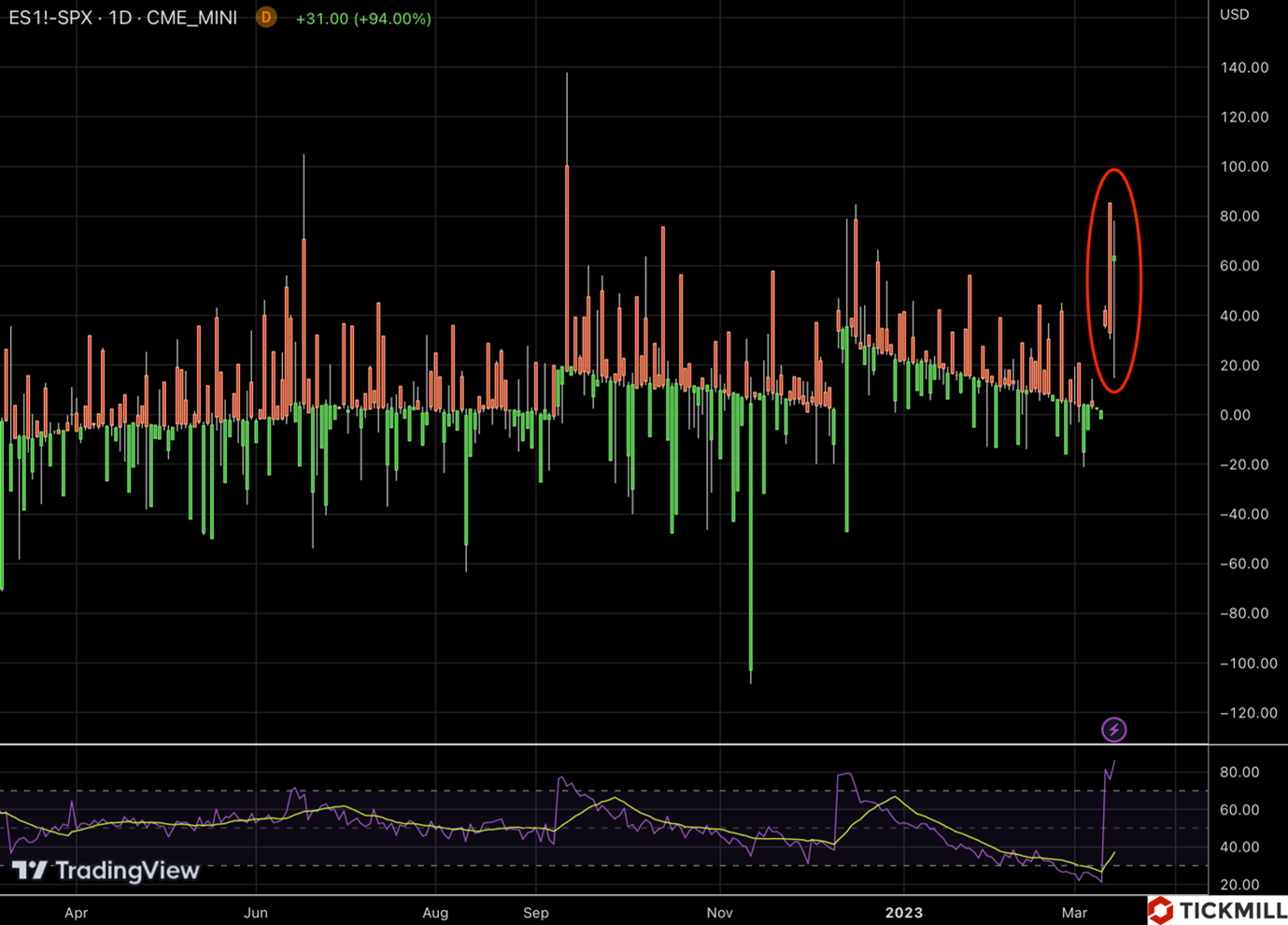

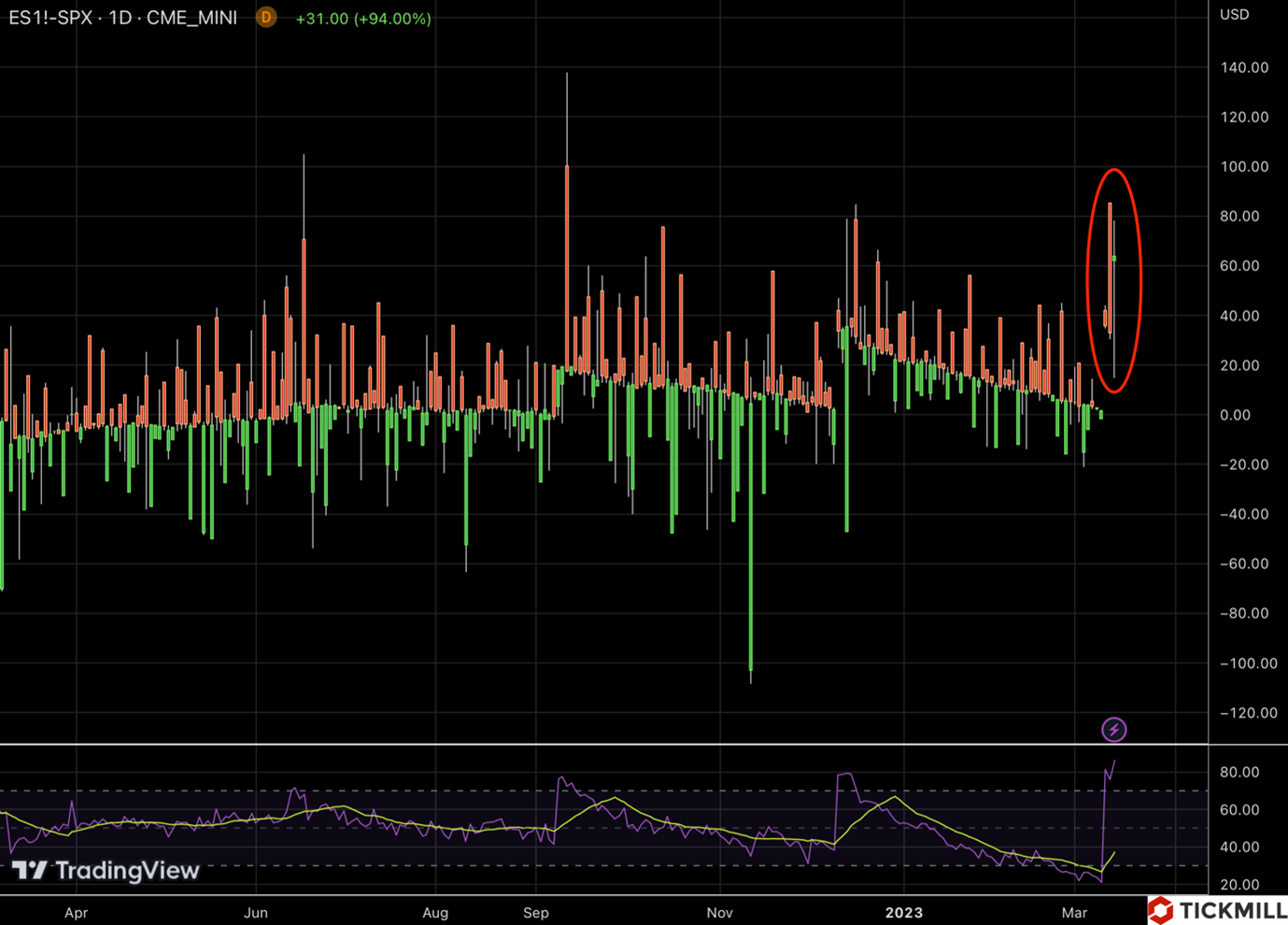

Yesterday's lively rebound of the S&P 500 when it fell to around 3800 points at the beginning of the New York session was a very unusual but important signal. It could have provided significant psychological support to the broader market, and it could also have been a tactical move to nullify option traders who bet on escalation of short-term market panic. It is also worth noting the spread between the March mini S&P 500 contract and the S&P 500 spot price, which, despite the high level of panic, is still in positive territory. Contango usually reflects expectations that the market will continue to rise:

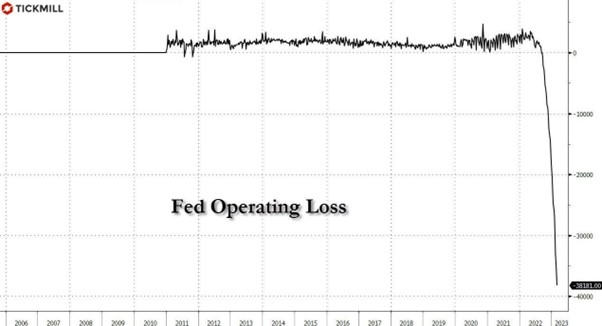

Overall, there are good reasons to expect this. The Federal Reserve has already offered a generous program of exchanging troubled assets for money for affected banks, and in the proposed repurchase (money temporarily secured by bonds) operation, the Fed will value the bonds at face value, meaning that it will bear the entire loss from the bonds that have fallen in price. But this is not a big problem, at least in the market's perception: during the tightening period, the Fed's "income" also suffered because the central bank was also a major holder of long-term treasury bonds, but the market was not particularly concerned about it:

However, the new quasi-QE won't help escape the harsh reality where US inflation is still quite high and even started to accelerate again in February. The Fed has repeatedly stated that reducing inflation is its number one goal, and it's unlikely that stress symptoms in the banking sector are unlikely to throw the Fed off track so easily. Therefore, I think we should be very cautious about the widespread softening of forecasts regarding the rate trajectory. If today's CPI report again indicates an acceleration of inflation or at least corresponds to the forecasts, the market is likely to start re-evaluating the pace of tightening in favor of more aggressive ones. In this case, the market will take into account a higher risk of new defaults in the US banking system, which will put pressure on the broad market of risky assets.

Also, the cryptocurrency market is likely to be significantly corrected - the situation on it resembles a classic short squeeze, where liquidation of large short positions made in February did not leave serious obstacles for buyers for some time, which is why we saw a parabolic growth (almost +30% in a few days).

In my opinion, there is also significant potential for correction in gold: as 2022 showed, the Fed's tightening coupled with inflation easing weighed on the yellow metal's quotes. The return to this combination of factors after the "dust settles" will undoubtedly be a bearish factor for the asset.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.