Is Gold Headed For A Fresh Breakout?

Gold Still Within Range

Despite recent macro and geo-political developments, gold prices continue to trade within the range which has framed price action over the last six months. The futures market has turned higher through recent sessions but has yet to break the high watermark set in March. A dovish shift in the traders’ Fed expectations looks favourable for gold bulls, however, with gold prices seen pushing higher on the back of Friday’s NFP shock. Given that the US jobs market is now in a worse place than previously thought, there is room for gold prices to advance as we head towards the September FOMC with the rates market now pricing in a cut at the meeting with one further cut ahead of year end.

Trade War & Safe-Haven Demand

Alongside the dovish shift in Fed pricing, gold prices are also being supported via increased safe-haven demand amidst an uptick in trade uncertainty. The return of sweeping US tariffs last week, and the risk of more tariffs to come, could prove to be the catalyst needed for a fresh upside break in gold. The yellow metal had been firmly higher earlier in the year as tariff uncertainty gripped markets, falling back as a series of suspensions and tariff reversals cooled market fears. With tariffs back in place and Trump, as recently as yesterday, threatening to take firmer action on Chia, gold prices could return to the bullish action we saw earlier in the year.

Technical Views

Gold

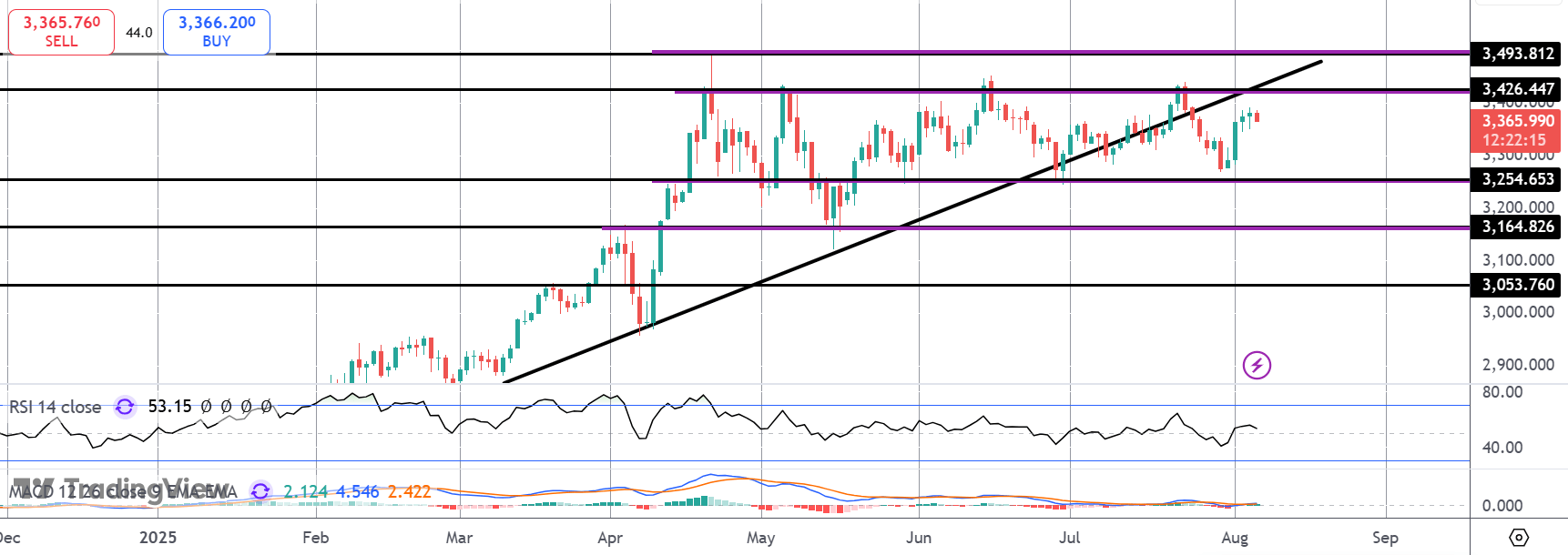

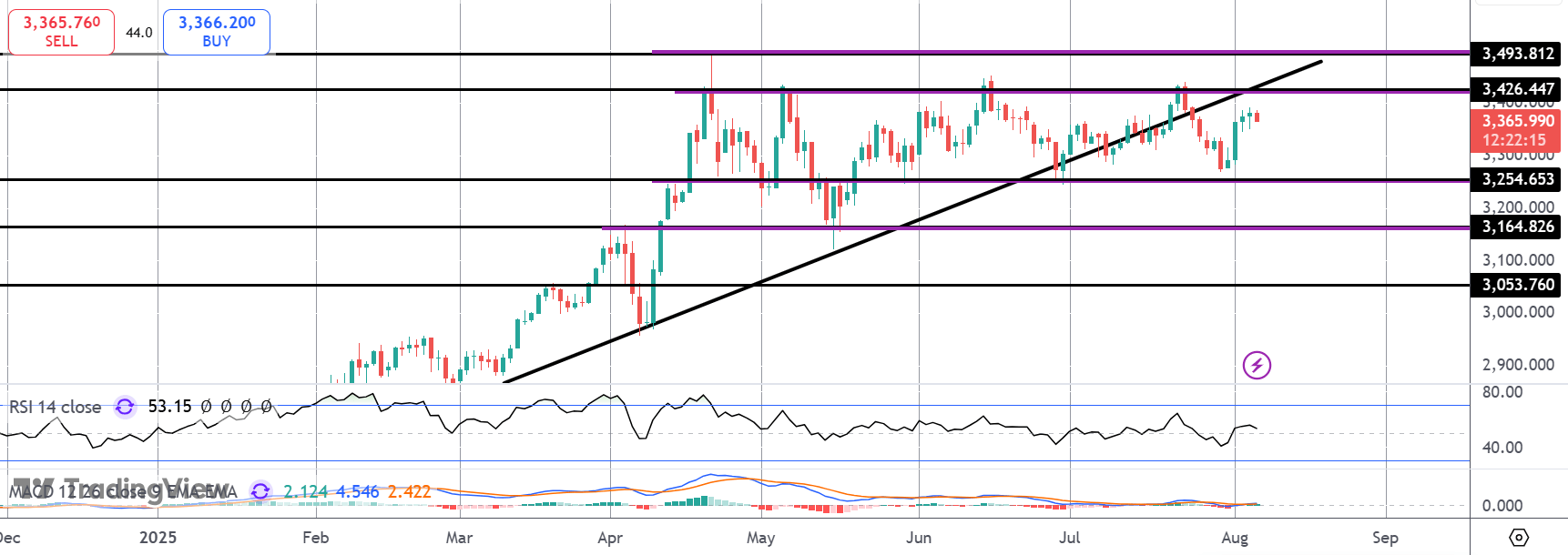

The rally in gold off the 3,254.65 range-lows has stalled for now ahead of the retest of the broken bull trendline and the 3,426.44-resistance level. This area is a key pivot for the market with a break higher seen opening the path for the next bull phase into new highs. Focus is on a fresh breakout while price holds above the range lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.