Institutional Insights:Goldman Sachs Tactical Flow of Funds - February Outlook

.jpeg)

Goldman Sachs Tactical Flow of Funds: February Outlook

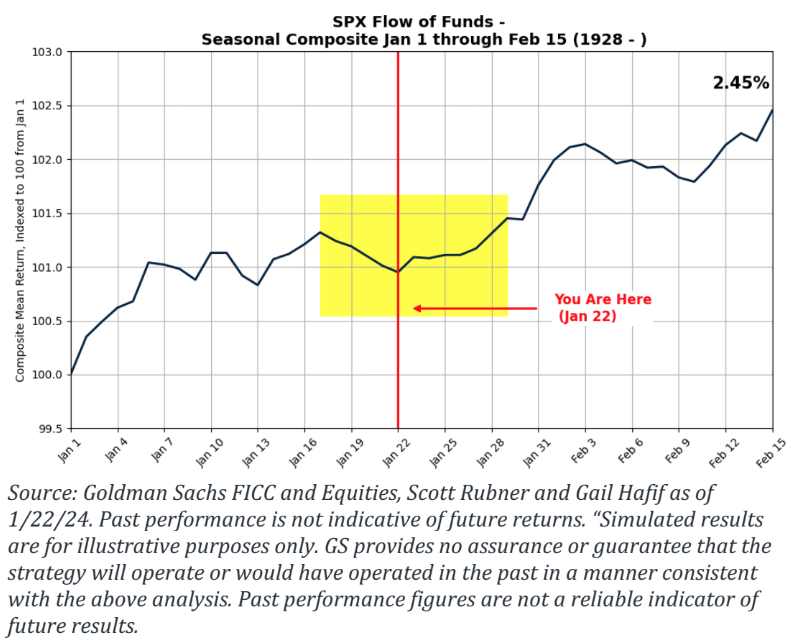

Flow Of Funds Checklist: Market technicals are recovering rapidly, and current exposure does not align with the present spot (SPX 6110). The technical overhang from late December (first week of January) has dissipated, and we have entered the typical #January Effect.

a. Significant current equity short base: record gross overall exposure (dominated by shorts) with reduced net exposure

b. High systematic fixed income short nearing critical levels

c. Long (buffer) equity index gamma (indicating recovery)

d. Consequently, liquidity has significantly improved (Jan 1st = $3.50M vs. Today = $15.70M), a 4.5x increase

e. Re-leveraging from volatility-control strategies due to the reset in volatility (VIX = 14.64)

f. Corporate blackout period concludes on Friday 1/24. This is the peak closed repurchase window. The full-year corporate repurchase estimate remains at $1 Trillion.

g. Decrease in sentiment and leverage

h. Favorable seasonal trends for the second half of January – today marks the local January low

i. January Effect inflows: the largest month of the year for equity allocations, including 401k, 529, etc.

Bottom Line: Current positioning does not reflect the ongoing rally in risk assets and may trigger some FOMU (fear of materially underperforming) against benchmarks. We have a favourable technical window for the upcoming month.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!