Institutional Insights: Goldman Sachs Tactical Flow-of-Funds: Retail Traders

.jpeg)

GS Tactical Flow-of-Funds: Retail Traders

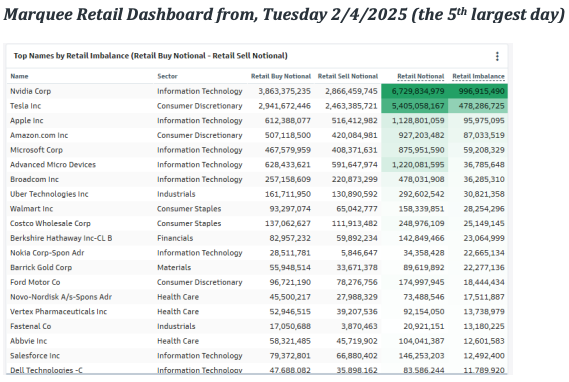

Goldman Sachs' Tactical Flow-of-Funds analysis highlights a surge in retail trading activity, with unprecedented buying behaviour dominating equity markets. Record-setting buying imbalances among retail traders have emerged, marking a new trend that outpaces institutional flows. On January 17, 2025, retail investors recorded the largest buy imbalance in Goldman Sachs' dataset, totalling $5.03 billion, surpassing even the frenzied activity seen during the pandemic. This was followed by the second-largest imbalance of $4.89 billion on February 3, 2025, and the fifth-largest of $4.23 billion on February 4, 2025. Remarkably, four out of the top five retail buy imbalances in the dataset occurred over the past two weeks, reflecting aggressive dip-buying. The report suggests growing competition for dip opportunities and notes that retail investors, often driven by "YOLO" or animal spirits, are effectively challenging institutional positioning in equity markets.

Retail buying behaviour in specific single names is proving critical for index construction, as these purchases heavily influence market movements. Notably, the report mentions active monitoring of platforms like r/wallstreetbets, a popular subreddit with 17.6 million accounts, where retail sentiment and strategies are frequently shared. This highlights the growing impact of retail investors in shaping market dynamics through concentrated buying activity.

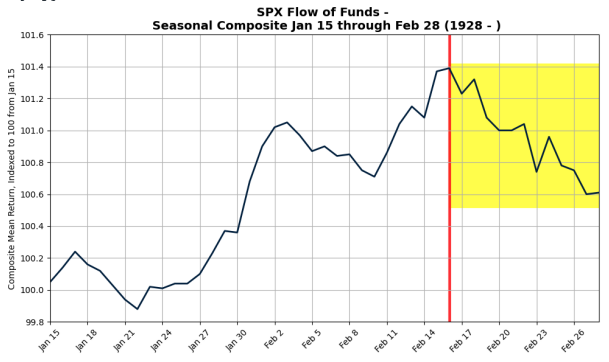

Goldman Sachs highlights strong tailwinds for the U.S. equity market driven by robust retail and corporate demand. Beginning Friday, February 7, an estimated 60% of S&P 500 companies will have open repurchase windows, signaling a significant shift in demand dynamics. Goldman’s corporate trading team projects record share buyback executions in 2025, estimated at ~$1.16 trillion across the S&P 500 and Russell 3000 indices.

This equates to an average of $4.64 billion in corporate buybacks per trading day, which increases to ~$7 billion during open repurchase windows and drops to ~$3 billion during closed windows. The repurchase window closes on March 16 but, combined with aggressive retail buying, this demand presents a powerful driver for equity market strength in the near term.

In the coming week, market flows will be highly sensitive to price movement. For a flat tape, buyers are expected to contribute $1.84 billion globally, with $1.46 billion flowing out of the U.S. An upward market would prompt buying of $1.03 billion globally but $1.70 billion flowing out of the U.S. Conversely, a down market would see significant selling, with $27.02 billion globally and $14.04 billion exiting the U.S.

For the next month, in a flat market, selling will dominate with $1.47 billion globally and $1.46 billion leaving the U.S. However, an upward trend would spark substantial inflows, with $33.66 billion globally and $9.28 billion into the U.S. In a down market, selling pressure is projected to intensify significantly, with $188.54 billion globally and $63.60 billion out of the U.S.

Key pivot levels for the S&P 500 (SPX) are as follows: short-term at 6005, medium-term at 5842, and long-term at 5374. These levels will likely serve as critical markers for market sentiment and positioning in the near term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!