Gold Futures: Profit Taking

After enduring several days of broader weaknesses in commodities, Gold experienced a pullback on February 25th. A significant amount of profit taking appeared to take place through futures, continuing the overall trend noted in the latest Commitment of Traders reports. Specifically, the total open interest in Gold decreased by approximately $5 billion, which is three times greater than the typical daily fluctuation. Demand from ETFs also declined. Importantly, momentum has maintained a sensible buffer, easing worries about an immediate flush by CTAs. However, it is noteworthy that the options market is becoming increasingly apprehensive about further consolidation. After managing to withstand several days of weakness across the commodities sector, Gold saw a retracement on February 25th. From February 20th to 24th, Gold increased by 0.2% even as the BCOM index fell by 1.7%. Yet, on February 25th, both Gold (down 1.5%) and the index (down 0.7%) faced losses.

Significant profit taking seemed to occur through futures, in line with the pattern seen in recent Commitment of Traders reports. Gold's total open interest dropped by around $5 billion, indicating a change three times the normal daily amount. The expiration of options may have exacerbated this decline. Nonetheless, it was clear that liquidation took place. The last two Commitment of Traders reports displayed similar trends. Between February 4th and 18th, Managed Money, Other, and Non-Reportable categories collectively sold $9.9 billion, primarily due to the termination of long positions ($8.2 billion). Managed Money was the predominant contributor to this. Interestingly, these bearish movements coincided with rising prices, defying typical market correlations.

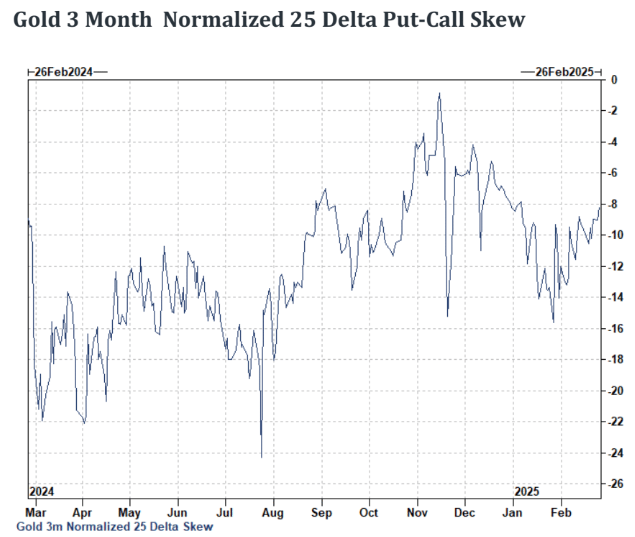

Furthermore, ETF demand decreased. The total known ETF holdings fell slightly, ending a notable six-day accumulation. Consequently, purchases in other products did not sufficiently counteract the unwinding of futures. Crucially, momentum has continued to maintain a solid buffer. As of February 24th, Gold's short-term momentum indicator was showing a positive figure of 4.5% according to GS Futures Strategists' methodology. Therefore, the net length of CTAs is expected to remain stable. But keep in mind that the options market is increasingly worried about additional consolidation. Gold's three-month normalized 25 delta put-call skew has increased to an 82% rank over the past year.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)