China's AI disruptor?

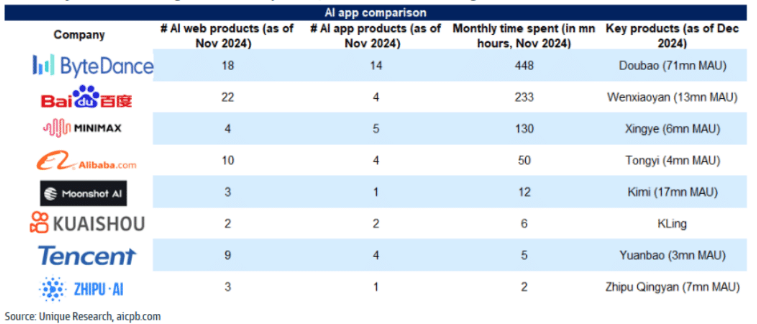

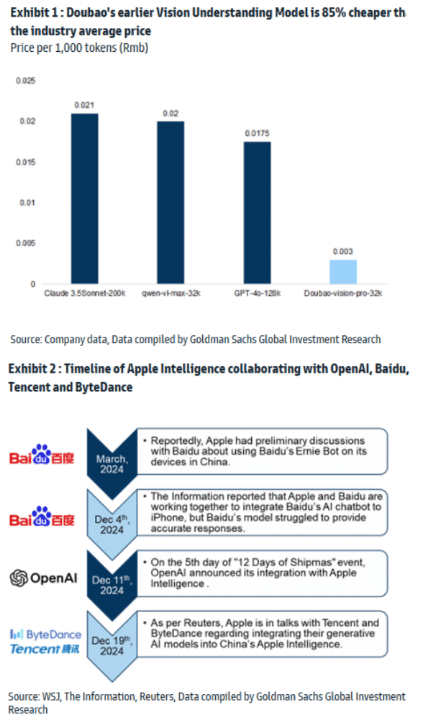

Deepseek is causing the Asian AI ecosystem to enter a phase of profit-taking (GS Japan AI - 3.08%, GS Asia Power Grid - 3.3%) and is significantly impacting Nasdaq in pre-market trading. GIR points out that recent enhancements in models and cost efficiencies are likely due to a combination of expert architectures, a greater focus on post-training, cost optimisation, and reinforcement learning aspects of models. Ronald Keung emphasises that open-source Chinese models like DeepSeek R1/V3 and Alibaba’s Qwen have attracted considerable developer interest since their launch, thanks to their transparency and much lower pricing per token compared to global models. In a chip-constrained environment in China, many players have optimised their model outputs. This trend is not limited to Deepseek; numerous established companies have a wide array of AI products.

Key Implications:

- The primary focus remains on Softbank's Stargate returns on investments and capex efficiency, thereby impacting beneficiaries in the supply chain and energy sector.

- Potential competition may arise between well-capitalized internet giants and startups due to decreased barriers to entry.

- Shifting from training towards more inference tasks that require lower computational resources raises questions, especially regarding GS Asia Power Grid's recent performance.

- Chinese players have potential for global expansion, with geopolitical considerations serving as a notable caveat.

- Looking ahead to 2025, Chinese cloud and data center players are expected to prioritize chip availability and the capability of cloud service providers to enhance revenue through AI-driven cloud growth. There is a focus beyond infrastructure and GPU renting, exploring how AI workloads and related services can contribute to overall growth and margins.

- Among beneficiaries, Tencent is well-positioned to lead in introducing To-C AI agent applications within its ecosystem. Internet giants with cloud businesses, such as Alibaba, and data centers like GDS and VNET, are likely to benefit from increasing demand for public cloud services and AI computing driven by heightened AI adoption trends.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!

.jpeg)