Institutional Insights: Goldman Sachs CPI Preview

.jpeg)

GS: CPI PREVIEW FICC and Equities | 10 December 2024 |

From GS Research: We expect a 0.28% increase in November core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.27% (vs. 3.3% consensus).

• We expect a 0.28% increase in November headline CPI, reflecting 0.25% higher food prices and 0.3% higher energy prices. Our forecast is consistent with a 0.20% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.20% increase in core PCE in November.

• We highlight three key component-level trends we expect to see in this month’s report:

1. We expect used car prices to increase 2.0%, reflecting a rebound in auction prices.

2. We expect another increase in airfares of 1.0%, reflecting strong underlying pricing trends.

3. We expect a rebound in the car insurance category based on continued, albeit decelerating, increases in premiums in our online dataset. • Going forward, we expect monthly CPI inflation of around 0.20- 0.25% over the next few months, though we expect a somewhat higher reading in January reflecting a moderate boost from start of the year price increases.

Thoughts from around GS =>

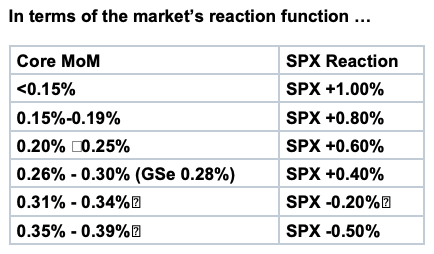

Dom Wilson (Senior Markets Advisor) The December FOMC may well end up determining how equities end up finishing the year. Tomorrow’s CPI is the last major data point ahead that flows into that. Our forecast of 0.28% for core CPI is around the consensus, but if we’re right that the composition of that and PPI maps to a 20bp core PCE release, that’s a little better than what we’ve seen and could be a mild relief. With the market pricing a high chance of a Dec cut, and having put a bit more easing back into 2025, the risks look more two-sided than they did. A properly high print – on the back of two firmer months already would likely see the market worry more about the scope for additional easing, though the bar is high for it to put December in jeopardy. Any meaningful relief probably also creates room for the market to price the prospect of continued easing into 2025. Our core views leave us wanting to have exposure to the resilience of the US growth story, while protecting against major tails and we continue to like having upside exposure to US equities and to the USD as part of that construct. Volatility in the SPX and key European indices continues to look very low both relative to its own history and relative to other asset classes. SPX vols are up from the literal lows last week, but with short-dated call vol firmly below 10, we like using calls or call spreads to carry some of that equity length, particularly over the next few weeks that cover CPI, FOMC and the turn of the year. Put protection is also relatively inexpensive, where those call strategies aren’t viable.

Mike Cahill (Senior FX Strategist) The 20bp move higher in the unemployment rate in the last two months raises the bar for this inflation print to directly influence the policy decision next week, but it should still matter for the overall policy package. Our economists’ inflation forecast is right in line with consensus, but would represent a fourth consecutive warmer print, and we have seen Fed officials respond to three or four prints in a row by adjusting future policy plans - in this case we think that just keeps them on a gradual, cautious path on net. A softer number, especially via a wider CPI-PCE wedge, should see a further relaxation in the 2025 pricing that we’ve already seen rally back a fair bit over the last 2-3 weeks, supporting wider risk sentiment if the market is confident the Fed can deal with tariff and labor market risks without significant inflation concerns. On the other hand, a firmer print coupled with the bounce in sentiment we’ve seen (with the market relatively relaxed about the net impact of possible policy changes) would pack even more Dollar upside if it’s coupled with an unfriendly inflation backdrop. This is especially true if Fed officials decide to wait and see how start of-year inflation readings look after surprises the last couple of years and continue to question whether policy is already not very restrictive.

Joe Clyne (Index Vol Trading) Heading into tomorrow's CPI, equities have settled into a very tight range and vol has collapsed, leaving seemingly little uncertainty about the path of stocks following the inflation print. The one day straddle looks to go out around 45 basis points entering CPI, which (though well off the lows we've seen on nonevent days) is quite low for an event. Vols beyond the one day space are quite low as well, with the 1 month 25 delta call holding a low 9 handle implied vol. The vol crush makes a degree of sense with dealers quite long gamma locally, but the desk likes holding short-dated upside as a hedge that should work in either direction if we can move even somewhat away from the gamma pin. For example, the year end 610 calls in SPY are below a 9 vol and cost less than 3 dollars.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!