Institutional Insights: Goldman Sachs Bullish On UBER

.jpeg)

Goldman Sachs Uber (UBER, Buy, PT $96)

Solid NT earnings with attractive entry point due to overdone AVs concerns

Our bullish view on UBER is driven by

1) overdone investor concerns over autonomous driving,

2) growth from increased on-demand grocery penetration and

3) a well-positioned product portfolio near term.

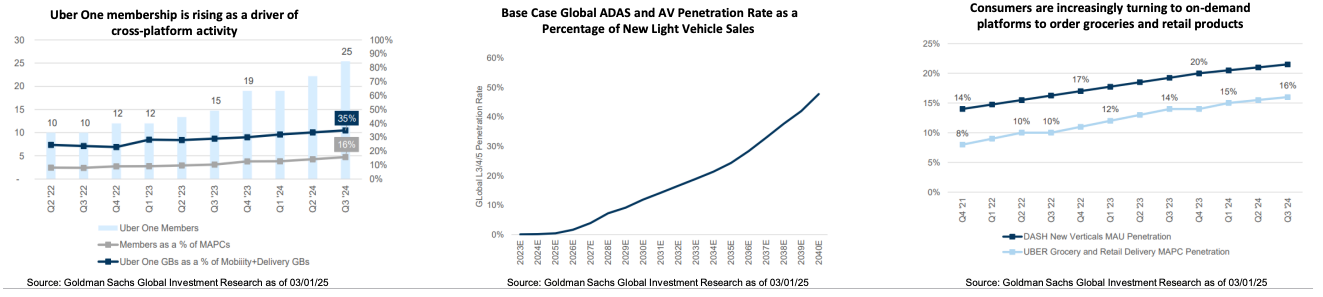

▪ Overdone investor concerns: Short-term debates (pricing inflation and competition impact on mobility growth) and medium/long term industry concerns (the impact of autonomous vehicles) has led UBER to underperform with shares down ~20% since 3Q24. Eric sees this performance as unjustified as Uber has developed deep relationships across the AV ecosystem with 14 partners including Aurora, Wayve and Waymo. As the adoption of AVs will likely play out over an extended duration of at least several years; he has confidence UBER can continue to deliver on its February 2024 Investor Day commitments despite the rise of autonomous vehicles and he models GBs/Adj. EBITDA growing at a +16%/+39% ‘23-’26 CAGR. Sheridan is +7% above the Street on 2026 GAAP EPS, with capacity for additional buybacks beyond his modelling. ▪ On-demand groceries demand underpins growth: Demand for new verticals at UBER continues to outpace core restaurant food delivery. In Q3'24, over 16% of UBER's Delivery users ordered from Grocery and Retail, up over +200bps YoY. Over >1/3 of UBER’s MAPCs (Monthly Active Platform Consumers) are now multi-product users in markets where both Mobility and Delivery are available and multi-product users spend >3x more than single-product users on average. Uber One, the company’s cross-platform subscription product, is an important driver of cross-platform utilization and grew to 25mm+ global members in Q3’24. ▪ Underappreciated advertising business: UBER's advertising business grew nearly +80% YoY in Q3 and Delivery advertising exceeds a $1bn run-rate which highly margin accretive. GIR estimate advertising contributing 8% of Delivery revenue in 2025 (and 30% of EBITDA, which implies ex-advertising incremental margins of 6%) and 1% of Mobility revenue in 2025 (or 2% of Adj. EBITDA at 75% margin). ▪ Valuation: GIR’s 12-month price target of $96 is based on an equal blend of (1) 20x EV/GAAP EBITDA applied to our NTM + 1 year estimates and (2) 20.5x a modified DCF using an EV/FCF-SBC multiple applied to our NTM + 4 years estimates discounted back 3 years. Shares currently trade on 2.6x EV/Sales 2025E which screens as attractive vs peer DASH on 6.2x.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!