Institutional Insights: Ciit June 20th OPEX Strategy

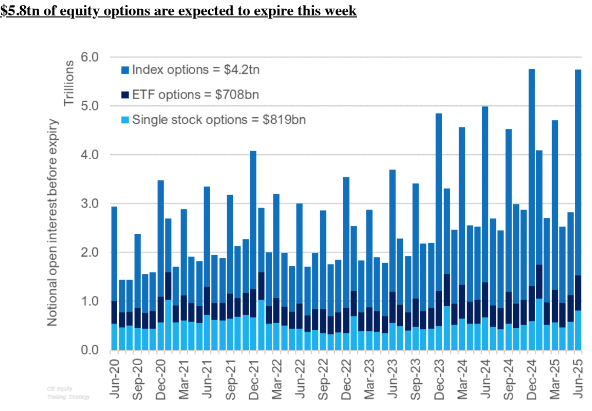

We project that $5.8 trillion in notional open interest related to equities will expire on June 20. This total encompasses $4.2 trillion in indices, $708 billion in ETFs, and $819 billion in single stock options. When looking forward to the expiration date, major companies that may experience significant volatility include BIIB, NTRS, and COIN. Check inside for the complete list. $5.8 trillion in equity options are anticipated to expire this week.

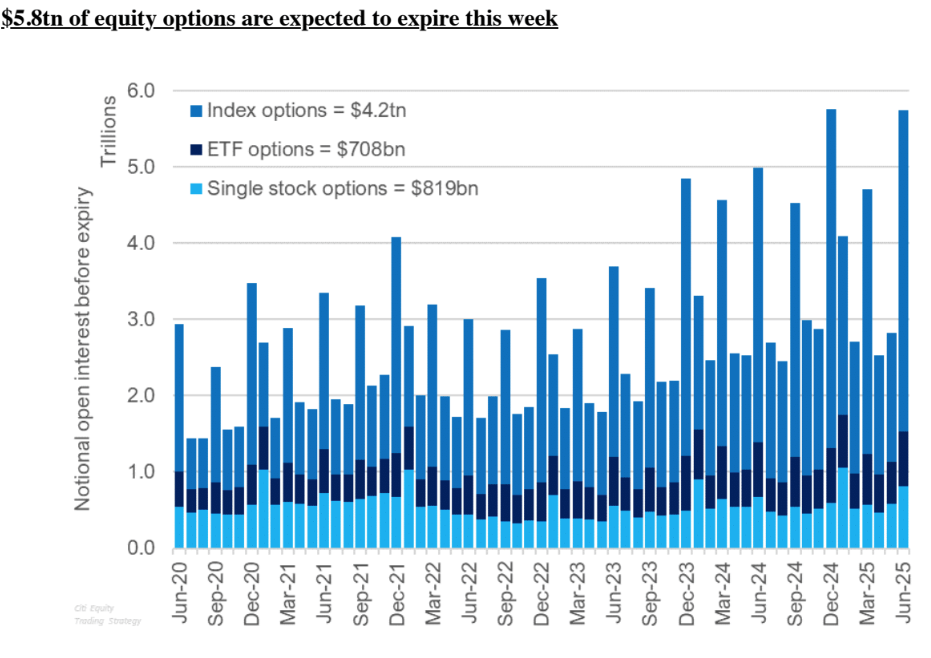

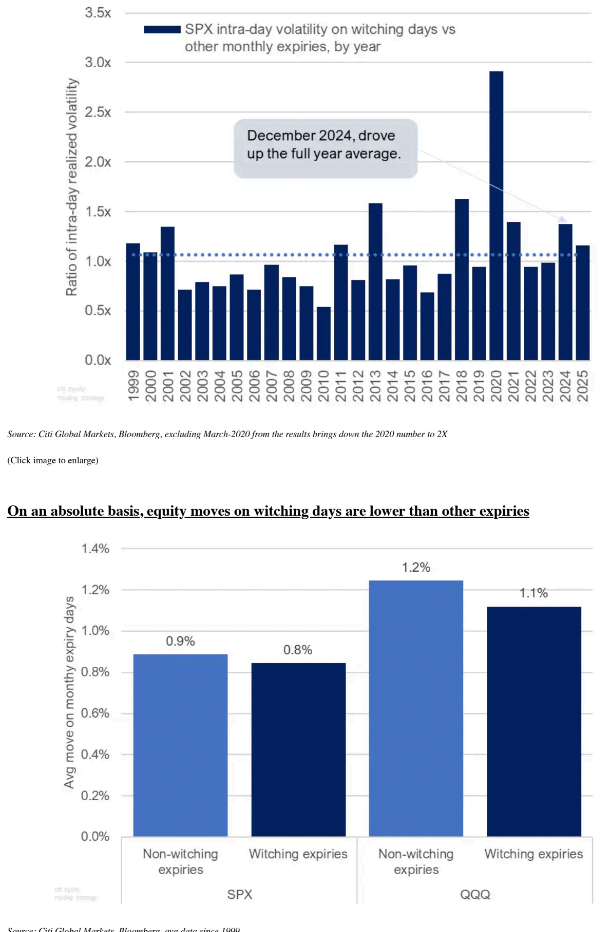

Are triple-witching days more volatile than other monthly expirations? The options expiry on Friday is significant as it aligns with index futures expiry, which may lead to larger-than-usual flows compared to other months. We frequently receive queries from investors regarding equity market volatility on these occasions. A brief review of volatility and equity movements on expiry days indicates that historically, these days tend to reduce volatility. While witching days during the pandemic experienced more volatility than the average monthly expiry, except for those instances and a few other years, the intra-day volatility (measured by the day's open, close, high, and low prices) on witching days has generally been lower than on other monthly expirations. Additionally, end-of-day fluctuations for SPX and QQQ on witching days have also been less pronounced (see charts below).

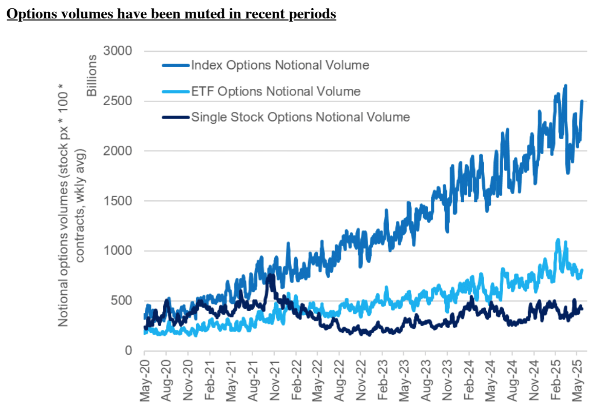

Options activity slows across ETFs; index and single-stock volumes increase Overall, options trading activity has declined in ETFs but has rebounded in index and single stocks. Retail trading appears to have significantly contributed to the rise in single-stock volumes, while heightened geopolitical risks have driven increased index flows, particularly on the put side. Recently, extremely short-term options trading (0DTE) has been predominantly skewed toward puts.

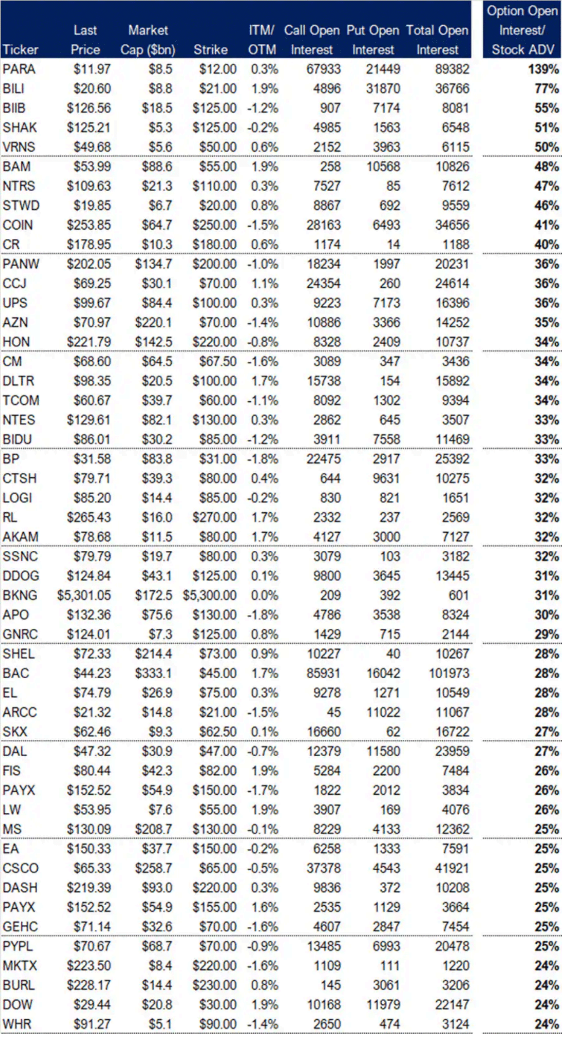

Stocks in Focus Today

Stocks with significant open interest near the current price have the potential to experience unusually high or low volatility around expiration days. This behavior is often influenced by delta-hedging activities performed by options traders. When traders who are net long at-the-money options engage in hedging, it can suppress volatility, potentially 'pinning' the stock price. Conversely, hedging by traders who are net short can amplify volatility.

The table below highlights 50 options chains where the strike price is within +/-2% of the current stock price, and the open interest represents a substantial percentage of the stock's average daily trading volume. These stocks may exhibit unusual volatility around their expiry dates.

Methodology:

We identify strikes within +/-2% of the stock price, with at least 500 open interest contracts and a market capitalization of at least $5 billion. The ratio of open interest multiplied by 100 to the average 20-day trading volume is then calculated, and the options chains are ranked based on this metric. The table below displays the top 50 options chains identified through this methodology.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!