Institutional Insights: BofA Systematic Flows Monitor 21/7/25

.jpeg)

Further EURUSD declines could trigger large CTA unwinds

Trend Followers Extend NASDAQ-100 Long Positions Amid Elevated Levels

This week, trend followers increased their equity long positions, particularly in the U.S., as the S&P 500 and NASDAQ-100 reached new all-time highs. NASDAQ-100 futures positioning appears to be aligned across short-, medium-, and long-term trend followers, heightening the potential impact of a reversal if CTAs begin to unwind. Our model indicates the closest NASDAQ unwind trigger is approximately 2% below Friday’s close, with selling momentum likely to accelerate if the index drops 5% from its peak. Next week may see continued CTA equity buying, driven by further declines in equity volatility. Outside the U.S., consensus long positions persist in the EURO STOXX 50 and Nikkei 225, with flows next week likely contingent on spot price movements.

CTAs May Begin Covering Overextended USD Shorts

The U.S. Dollar strengthened for the second consecutive week, prompting risk-averse trend-following models to exit stretched GBP long positions. Additional stretched positions could unwind if USD strength continues, with our EUR/USD trigger set at 1.1519 and GBP/USD at 1.3243. The long MXN position remains stretched, but its unwind triggers are further away. Meanwhile, CTAs hold short USD positions against AUD and CAD, while positioning versus JPY remains mixed. Looking ahead, trend followers may increase USD buying against JPY and CAD.

CTAs Maintain CME Copper Buying Despite Divergence with LME

In commodities, CTAs continued purchasing CME copper futures this week, capitalizing on gains initiated by President Trump’s copper tariffs. We expect this buying trend to persist into next week, although LME copper futures may see selling pressure due to divergence with CME futures following tariff-related news. Additionally, trend followers could increase long positions in Aluminum futures, while stretched Soybean Oil longs and Soybean Meal shorts remain unchanged. In bonds, U.S. trend strength declined as 10-year yields rose for the third consecutive week. Our model shows mixed positioning in U.S. 10-year futures, while CTAs maintain a consensus short in 30-year futures. Globally, CTAs remain short Bunds and KTBs, long CGBs, though CGB selling is anticipated next week.

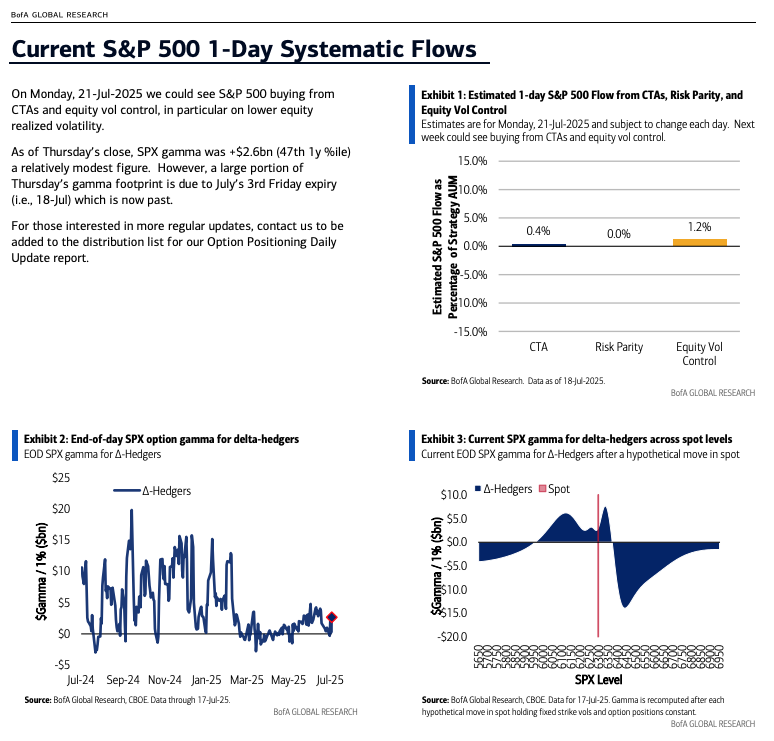

SPX Gamma Suggests Limited Volatility Impact

As of Thursday’s close, SPX gamma stood at +$2.6 billion (47th percentile over the past year), indicating modest levels. A significant portion of Thursday’s gamma footprint was tied to the July 18 options expiry, which has now passed. Following Wednesday’s VIX expiry, VIX gamma reset to lower levels and remains minimal. However, combined VIX option and ETP delta exposure remains historically elevated, reaching its highest level since 2021. This surge is primarily driven by leveraged long VIX ETPs, a phenomenon detailed in our July 15, 2025 GEVI report.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!