Institutional Insights : BofA Flow Show

Institutional Insights : BofA Flow Show

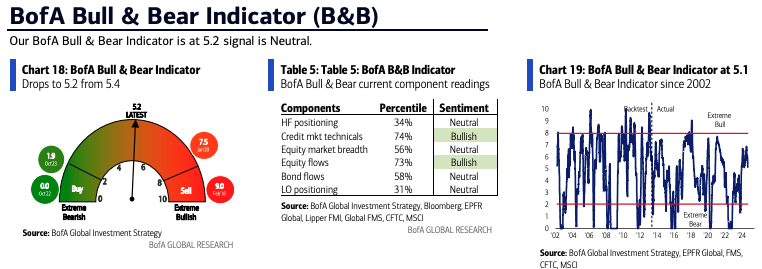

According to analysis by Bank of America flows in the market are as follows:

"Scores on the Doors: gold 25.0%, crypto 17.3%, stocks 17.3%, HY bonds 8.3%, IG bonds 5.4%, cash 3.9%, commodities 2.6%, govt bonds 2.1%, oil 0.5%, US$ -0.7% YTD.

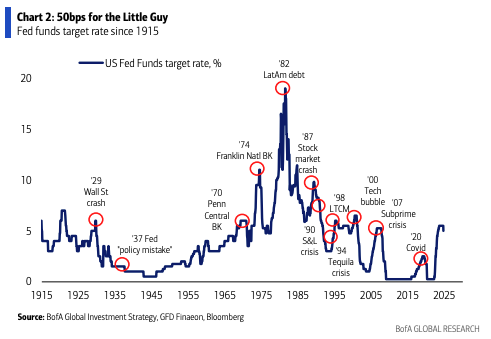

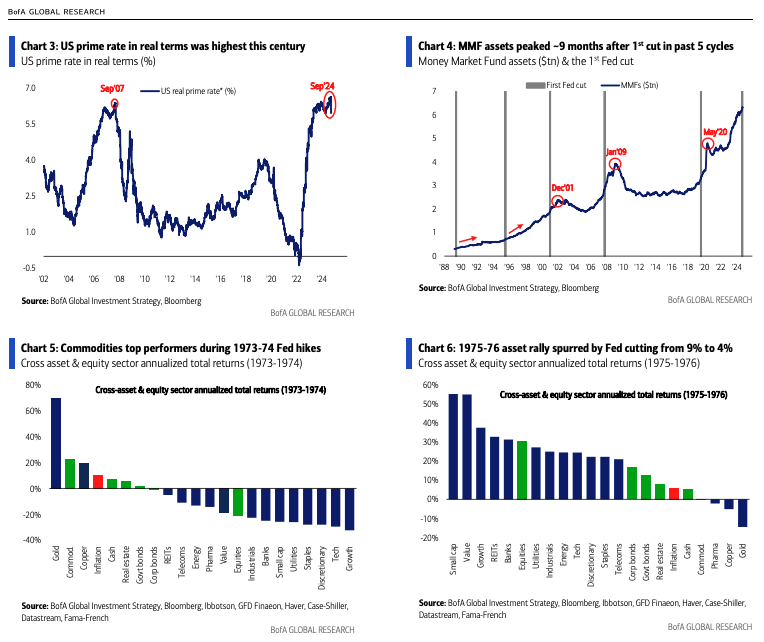

The Biggest Picture: Wall St loves “panic cuts” when no panic (Chart 2); 50bps as Fed wants to slash real rates to prevent recessionary small biz sector cutting jobs (Chart 3);

Wall St chase says Fed “ahead of curve” and 250bps cuts = 15-20% EPS growth in ‘25; best “soft landing” plays = international stocks & commodities; we use rip to buy dips in Bonds & Bullion to hedge recession & inflation “tails”.

The Price is Right: soft landing tell = private equity ETF (PSP) >$70 (the ‘21 high when Fed funds 0.25%...says big rate cuts bullish macro); no landing tell = GNR>$60, KRE>$60, EEM>$45…says Wall St inflation will mutate to Main St; hard landing tell = 30-year UST rallies < 3¾% despite debt, deficits, politics, inflationary Fed.

Tale of the Tape: last time Fed eased 50bps with credit spreads this low was Jan’81, with stocks at all-time highs was Apr’86 (Table 1); historic norm is inflows to money market funds continue after 1st Fed cut for 9 months (Chart 4); but aggressive Fed ease ’09 & ’20 caused sharp drop in MMFA, and this source of blowoff top risk…note big IG bond & stock inflows this week"

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!