Institutional Insights - BofA Client Survey

Institutional Insights - BofA Client Survey

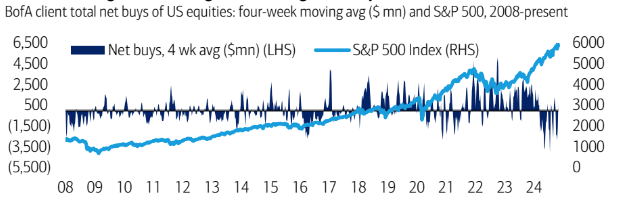

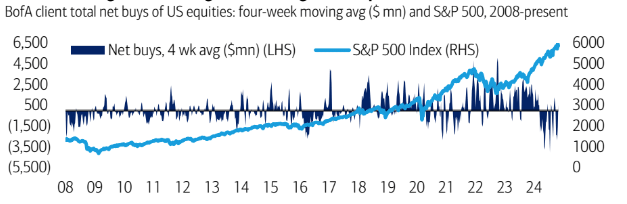

Accelerating equity inflows

• Biggest inflows in 8 weeks: Last week (S&P 500 -2.1%), BofA Securities clients were net buyers of US equities (+$4.9B) for the second straight week (biggest since mid-Sept). Similar to the prior week, clients bought both single stocks and ETFs, with single stock buying again entirely in large caps.

• Institutional and private clients were buyers for the second week and first time in two weeks, respectively, while hedge fund clients were sellers for the first time in four weeks.

• Corp. client buybacks deaccelerated but continue to track above seasonal levels as a % of S&P 500 mkt. cap. YTD, corp. client buybacks as a percent of market cap are on pace for new historical highs. More Tech and Health Care-led inflows

• Clients bought stocks in seven of the 11 sectors, led by Tech (with inflows from all major client groups), Health Care and Comm. Services. All saw inflows the prior week (election week) as well.

• Financials and Energy saw inflows last week after seeing outflows the week of the election (first Financials inflows in six weeks).

• Clients sold Industrials, Materials, Real Estate and Staples. Materials has the longest recent selling streak (last four weeks). Continued broad-based ETF inflows

• Inflows across most sizes/styles: Clients bought ETFs across styles (Blend/Value/Growth) for a second week, and similar to the prior week, bought Large/Mid/Small Cap ETFs (but sold Broad Market ETFs, unlike the week prior).

• Clients bought ETFs in seven of the 11 sectors, led by Cons. Discretionary (biggest inflows since Feb.), Materials and Financials ETFs. Health Care and Real Estate ETFs saw the largest outflows

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!