Inflation Report Boosts Dollar, Fed's Pause Looms: Market Insights

The inflation report gave the dollar a little boost, causing it to gain almost half a percent against the euro and Swiss franc on Thursday. Commodity currencies took a hit alongside the commodity market, with the Australian dollar dropping by 0.7% and the New Zealand dollar by 0.4%. Despite an overall decrease in consumer inflation in the US during April, core inflation remained steady at 5.5%. The dollar gains ground without the help from equity market corrections and with the solid likelihood of the Fed taking a break in June (chances are now almost 100%), suggesting that the factors driving its performance lie in worsening growth prospects outside the US.

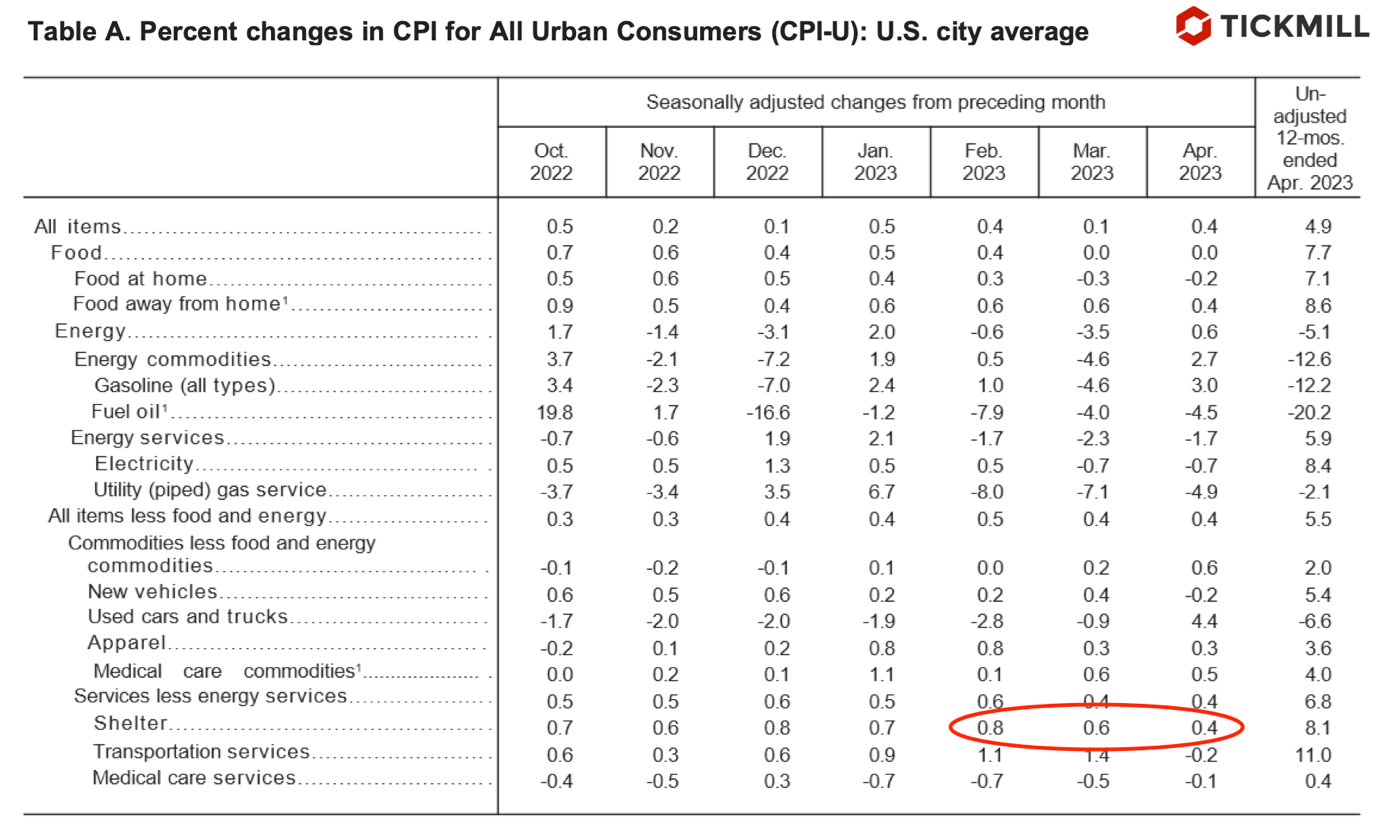

Yesterday's inflation report showed a drop in consumer inflation overall, but core inflation remained stable. However, a significant sign of decreasing inflation in the upcoming months was the consistent weakening of shelter inflation:

This component carries significant weight in the Consumer Price Index (CPI) and is one of the most influential factors (as rental prices follow housing prices, and contract terms lead to price stickiness). Additionally, it affects future inflation through inflation expectations. This isn't surprising considering that a considerable portion of consumer spending goes toward rent and housing maintenance.

Treasury yields slip reflecting the market's growing confidence that the Fed will announce a pause in June:

The Producer Price Index (PPI) didn't meet expectations, with a monthly price increase of 0.2% compared to a forecast of 0.3%. This further indicates a weakening consumer inflation since businesses will have fewer incentives to raise prices.

Today, the Bank of England raised interest rates by 25 basis points and stated that further increases are possible if inflation doesn't respond to policy changes. The central bank revised its economic growth forecast to higher values, and the "boost in optimism" is the strongest since 1997. Market participants suspect that the central bank won't stop and will raise rates up to 5%. Looking at the technical chart for GBPUSD, the price has approached a crucial bearish line. If it breaks through and consolidates above this line successfully, it could easily gain bullish momentum. The presence of a hawkish central bank, as revealed in today's meeting, serves as a foundation for a bullish Pound outlook:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.