Huge Sell Orders Noted in Bitcoin

BTC Remains Weak

Bitcoin prices continue to tread water today, still sitting at the foot of Tuesday’s decline. The market has settled into a tight range here and last night’s FOMC minutes failed to deliver any meaningful directional cues. As such, focus is firmly on Powell’s speech tomorrow with price action likely to remain muted ahead of that event.

Big Bitcoin Sales

Given the difference in how Bitcoin operates versus other assets, namely the blockchain function, one of the interesting things about the market is the amount of analytical data offered up. On chain analytics can be thought of as similar to order flow analysis and this week there have bene some noteworthy developments. One such item is the news that a major Bitcoin whales has closed out their roughly $60 million long position after 6 years and instead gone long ETH.

Whale Moves

Major moves from whales can have a big impact on the market and can also give some indication into directional sentiment as typically this money is positioned for the long term. As such, the decision to close out such a position suggests a loss of confidence in further gains, at least near-term. In the last 24hrs the Bitcoin market has seen a further $100 million worth of long liquidations suggesting rising caution ahead of tomorrow’s Jackson Hole symposium.

Bullish Risks

However, should Powell come through tomorrow and deliver a firm easing signal for September, risk markets (including BTC) are likely to rally sharply into next week, attracting a fresh surge in institutional demand which could pave the way for the next leg higher in BTC.

Technical Views

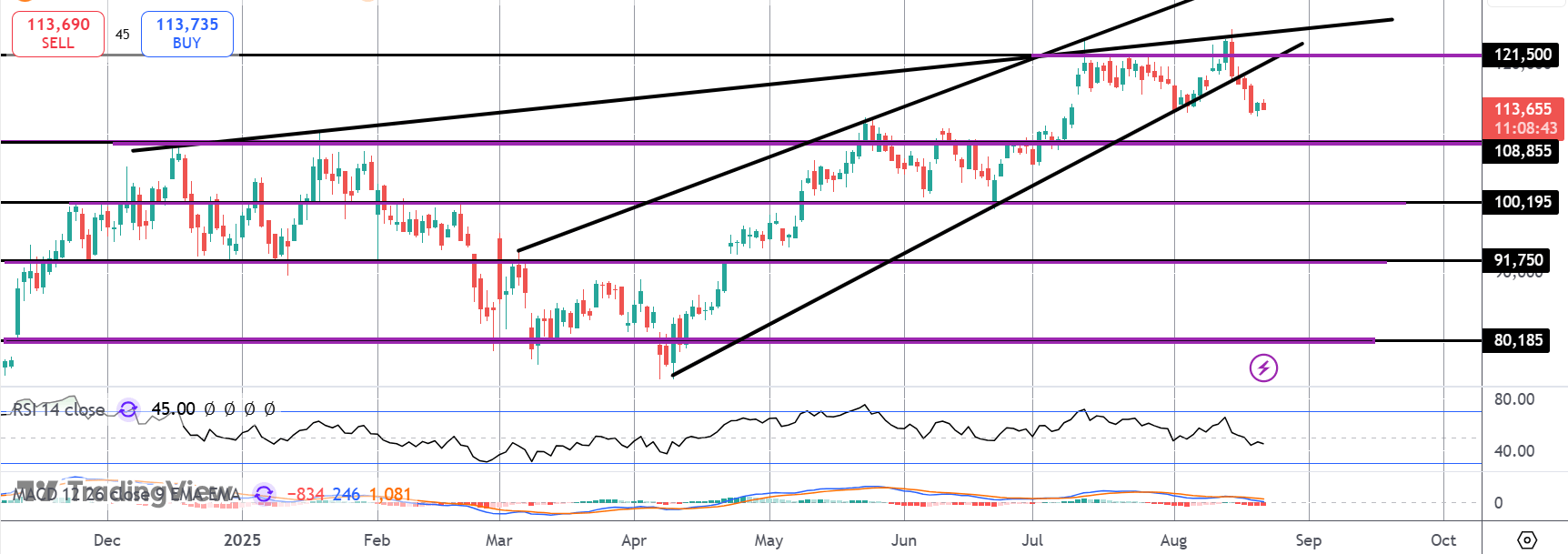

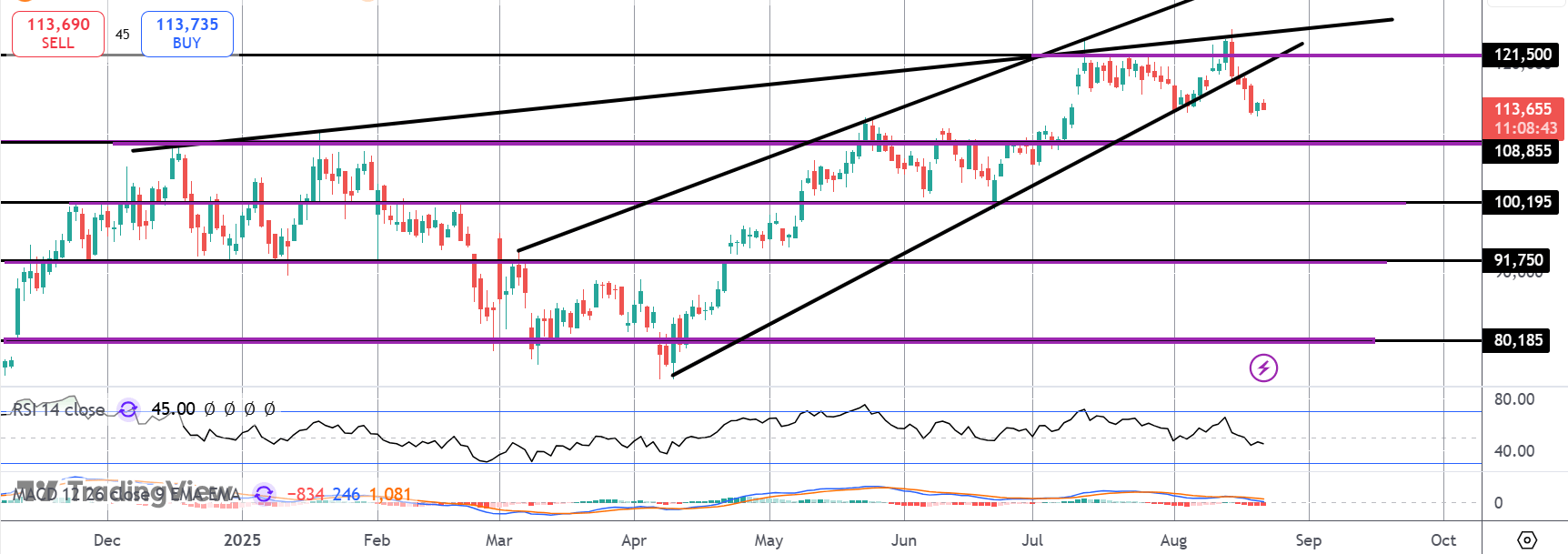

BTC

The sell off in BTC has stalled for now around the 113-level August lows. Momentum studies remain weak and risks of a further push lower remain high. $108,855 will be the key level to watch with bulls needing to defend this zone to prevent a deeper drop towards the $100k mark.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.