EURUSD Breaks Out

EURUSD bulls remain firmly in the driving seat today with the pair seen extending gains on the back of yesterday’s rally. EURUSD broke out above the 1.1126 level yesterday which has been a major resistance level over the last year. Heavy bearishness in USD has fed nicely into fresh support for EUR. With the Fed now widely expected to shift into neutral after a final hike this month, traders are turning their attention back to hawkish ECB expectations.

Further Hikes Seen

The release of the latest ECB meeting minutes yesterday highlighted how firmly bullish the central bank is. With inflation forecasts revised higher alongside a fresh rate hike, the June meeting also saw the bank essentially pre-announcing a further hike this month. However, a further hike in July was described as a “minimum” requirement for bringing inflation down, keeping expectations geared towards further possible hikes which should keep EUR well supported near-term.

Technical Views

EURUSD

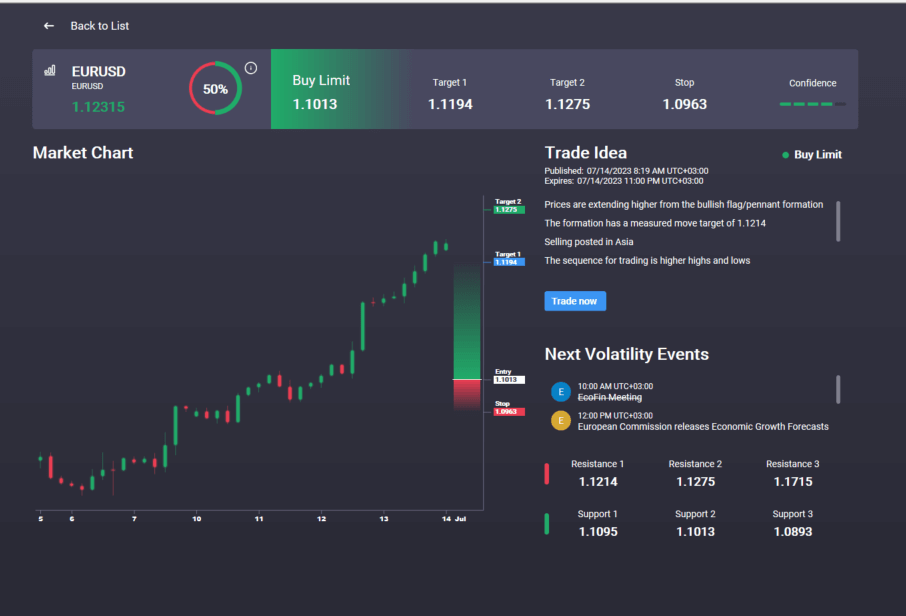

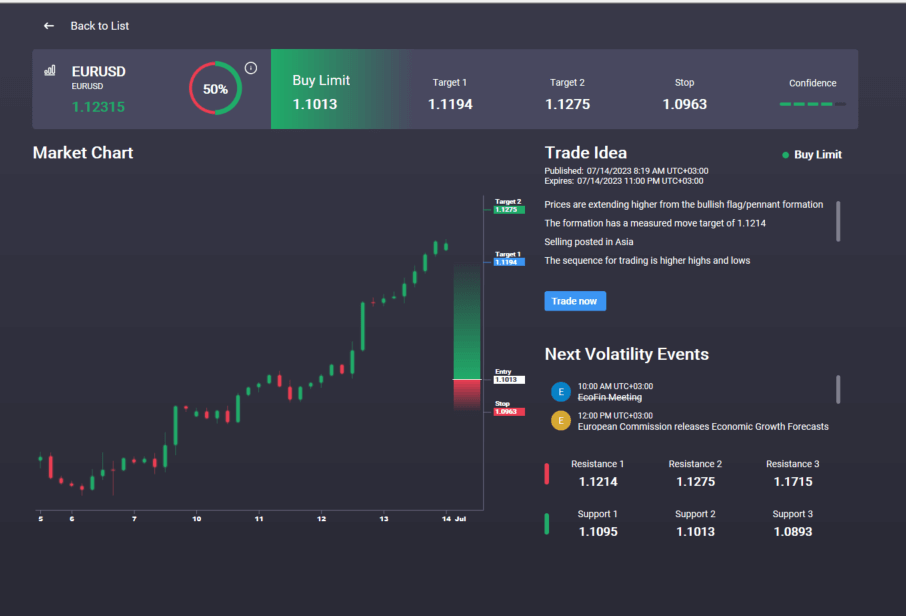

The rally in EURUSD has seen the pair breaking out above 1.1126 level this week. With the pair moving back within the bull channel, the focus is on a continuation higher, in line with bullish momentum studies readings, with 1.1503 the next resistance level to note. To the downside, 1.0785 is the key support to note. We also have an active but signal in the Signal Centre today from 1.1013 targeting 1.1275 next.

.png)

Signal Centre is a proprietary trading-signal suite offered to all Tickmill traders. Signal Centre combines human and AI driven analysis to offer traders actionable entry and exit points that they can use for their trading strategies. Signals are offered across a range of asset classes including Forex, Stocks, Commodities and Crypto.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.