Gold Treading Water Ahead of Fed Minutes & Jackson Hole

Gold Holds Within Range

Gold prices remain little changed so far this week with the futures market sitting around the middle of the July range, having corrected from initial August highs. The market has been lacking direction for months now with prices caught within a roughly 10% range following the correction rom YTD highs in April. A mix of conflicting drivers have sapped the bullish momentum from gold though no downside drivers have proved strong enough to fuel a correction.

FOMC Minutes

Looking ahead this week, focus will be on the Fed with the FOMC minutes due tomorrow before Powell speaks at the Jackson Hoel symposium on Friday. Given the weaker jobs data we’ve seen since that Fed meeting, the minutes might have lost some relevancy. However, traders should be reactive to any dovish details which emerge given the firm expectations for a cut next month. If we do see a dovish tone to the minutes, this should lean on USD through the week, allowing gold prices to rise higher.

Jackson Hole

On Friday, traders will then be looking for a clearer signal from Powell that the Fed is poised to cut rates again next month. If such a signal is given this should reinforce the weak USD/strong gold dynamic through the end of the month. However, if Powell fails to deliver and instead dwells on lingering uncertainty and upside inflation risks, this could fuel a squeeze higher in USD, pulling gold prices lower near-term.

Technical Views

Gold

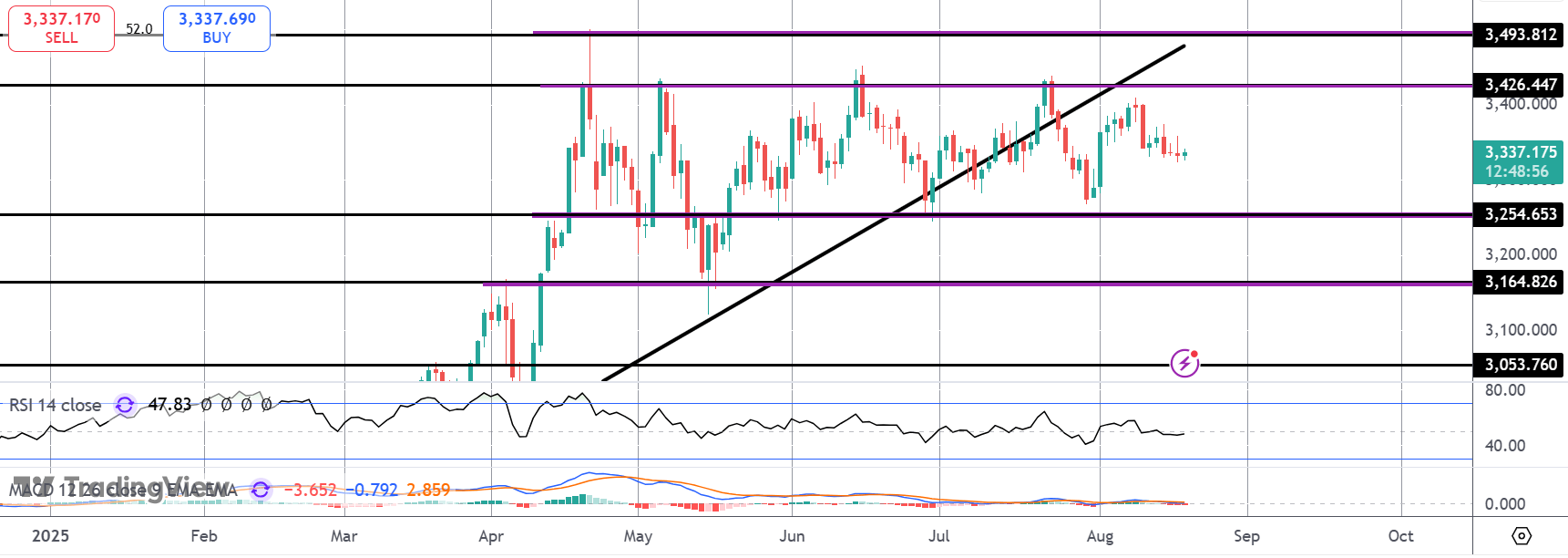

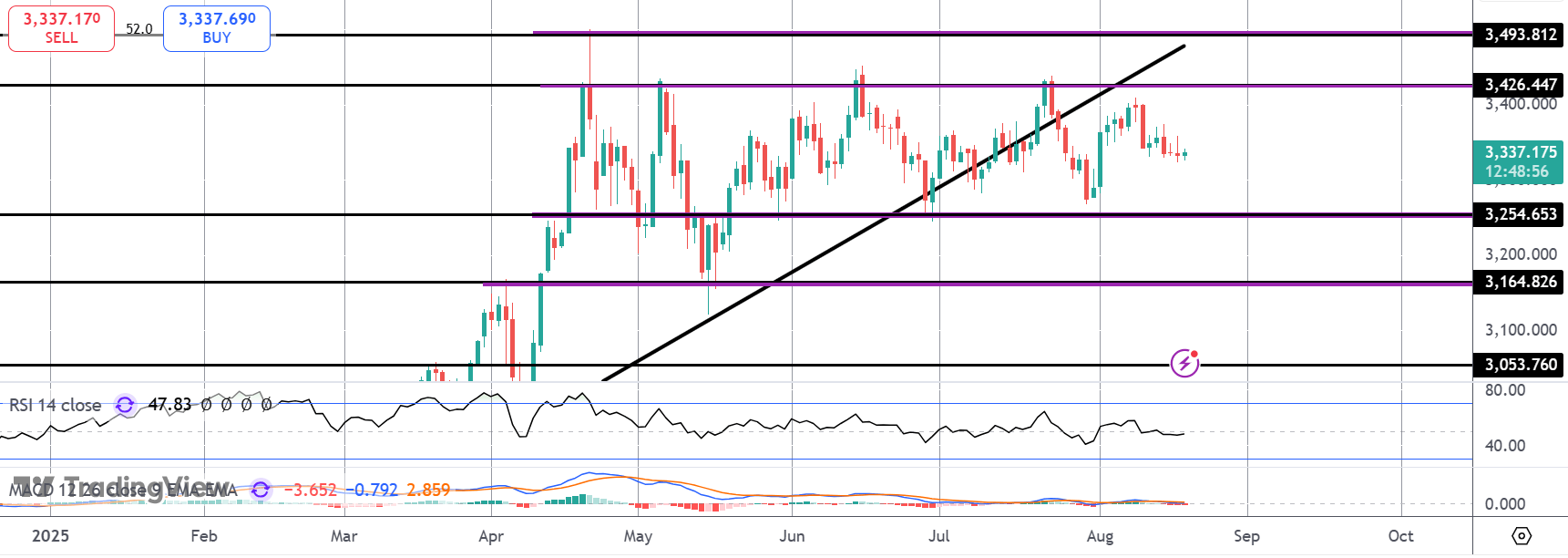

Gold prices continue to trade within the 3,254.65 – 3,426.44 range. Given the prior bull trend, focus is still on an eventual break higher while the range support holds. Below that level, however, focus turns to 3,164.82 and 3,053.76 as the next support zones to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.