Gold to $2000? Should we Jump in the Leaving Train?

First of all, an important update on the US-Iran conflict:

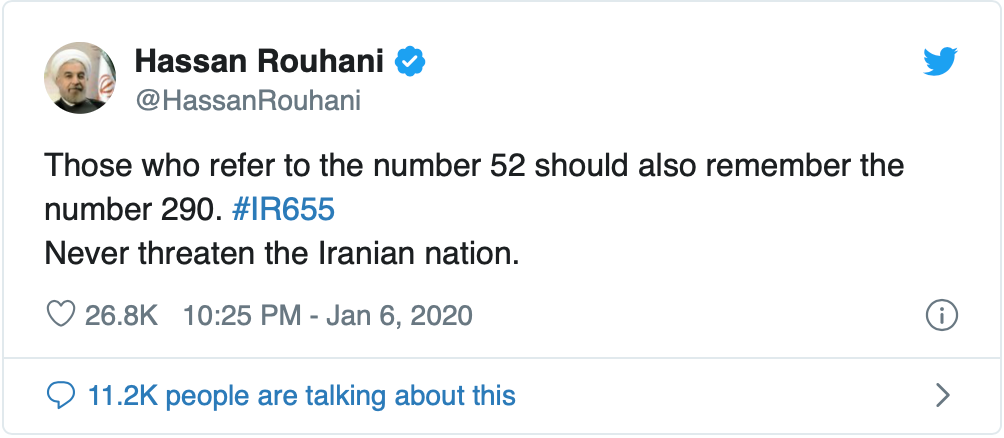

The cause of the crash of Ukrainian Boeing, which disappeared off radar shortly after the takeoff, was indicated as engine failure and consequent fatal loss of control of the plane. A terrorist act was quickly ruled out from the possible reasons. Taking into account all the previous events, as well as the statement by Rouhani that who refers to the number 52 (the number of hostages at the seizure of the US embassy in Iran in 1979), one should also not forget the number 290 (the number of victims of the IR655 flight shot down by an American military ship in 1988), the Boeing crash seems an extraordinary coincidence.

Gold climbs unimpeded the “wall of worry”, piercing through the $1,600 level on Tuesday. As I wrote yesterday there is risk of US-Iran conflict spiraling into uncontrolled escalation, what forms increased and sustained risk premium in Gold, also providing increased demand for gold as a hedge. Subsequently, gold quotes fell below $ 1,600, but now we need to focus on the US response, which will be mainly expressed in Trump’s statement today regarding the response to the missile attacks on the US airbases in Iraq. Recall that earlier US president said that US may take disproportional measures if Iran dares to target any American target. As we observe Iran is basically done with its part of escalation. If Trump moderates rhetoric, both sides basically signal about de-escalation and it’s worth to expect “fall of a cliff” move in Gold.

Important: The government of Iran does it best to show that it takes defensive position in the conflict. Iranian Foreign Minister Javad Zarif said that Iran has conducted and completed retaliatory measures as a means of self-defense (leaving the possible role of the aggressor exclusively to the United States):

Key takeaways from macroeconomic front

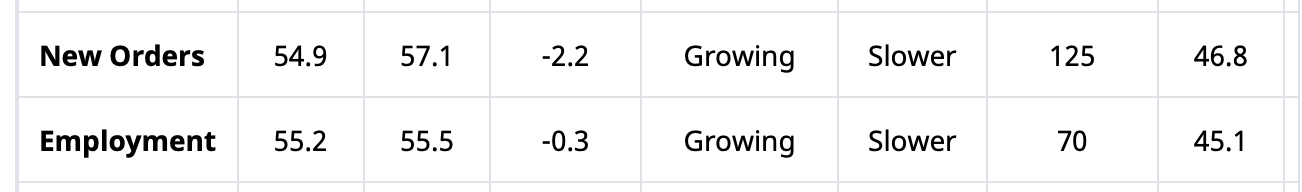

US service activity grew at a slightly faster pace than anticipated in December. The ISM non-manufacturing activity index was 55 points in December, higher than the forecast at 54.5 points and November at 53.9 points. However, optimism was restrained by the leading components of the index, the growth of which slowed down: the rate of new orders fell from 57.1 points to 54.9 points, labor hiring - from 55.5 to 55.2 points. Pressure in prices has not changed compared to November - 58.5 points.

The US trade deficit has improved, dropping from $43.9 billion to $43.1 billion in November.

EURUSD buyers seems to have lost unity after the release of production figures related to German economy. Factory orders fell by 6.5% in November, stronger than expected, which casts doubt on the anticipated economic rebound in the first quarter of 2020. EURUSD is likely to continue moving in the range 1.11-1.12 or move lower until the release of NFP report on Friday.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.