Gold Recovery Gathering Pace

-1732009108.png)

Gold Rebounding

Gold prices are enjoying a much better week this week, with gold futures up firmly through yesterday and early trading today. The market has bounced around 4% off last week’s lows and is now back above the 2,604 level. A key driver behind the move higher in gold this week has been the weakness we’ve seen in USD. The rally in the greenback has paused for now with traders awaiting catalysts for a further push higher. In the meantime, we’re seeing some profit taking kicking in with the Dollar pulling back a little from recent YTD highs.

Russia – Ukraine Uncertainty

Gold prices are also being bolstered this week by safe-haven demand linked to heightened uncertainty around the Russia-Ukraine war. The Kremlin today issued a statement on the back of news that Biden has approved Ukraine’s use of US long-range missiles against Russia. The statement provides an update on Russia’s nuclear doctrine and warns of possible nuclear retaliation if Russia comes under attack from conventional missiles, supported by a nuclear power.

Increased Safe Haven Demand

This is a direct reference to Biden’s missiles approval and comes as the war hits its 1000th day mark. While tensions and uncertainty remain elevated, gold prices look likely to continue higher near-term as safe-haven inflows increase. The key now is whether there will be any shift in stance from US/Ukraine or whether Ukraine will push ahead and use the missiles. In the former, gold prices are likely to soften while in the latter, gold could spike firmly higher.

Technical Views

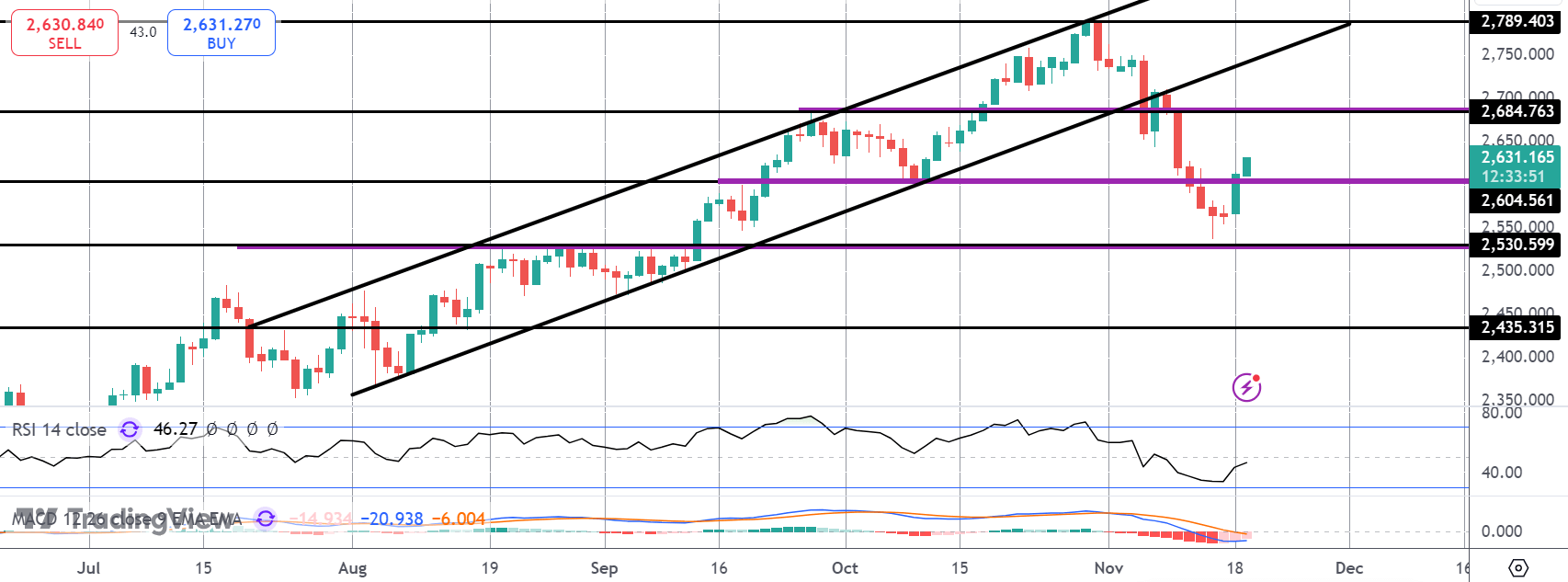

Gold

The sell off in gold has stalled for now into the 2,530 level with price since bouncing back above the 2,604 level. While above here and with momentum studies rebounding, focus is on a test of the 2,684 level next. In the Signal Centre today we have a buy limit at 2592.50 suggesting a preference to stay long into any intra-day dips.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.