Gold Pushing Higher

Gold prices are continuing to tear higher as we move through the final trading session of the week. The futures market is now up more than 6%, rebounding sharply from the lows printed in early November following that correction from YTD highs. The rally comes despite continued strength in USD and reflects a strengthening of safe-haven demand amidst heightened geopolitical uncertainty.

Safe-Haven Demand

A worrying escalation in violence between Ukraine and Russia has fuelled a sharp move back into safe-haven assets recently with gold prices among the key beneficiaries. Ukraine’s use of US missiles against Russia, along with Russia’s assertion that the UK is now directly involved in the war, are worrying signs with many fearing a direct war emerging between US/UK and Russia and its allies.

US Data Up Next

Looking ahead, gold prices look likely to remain supported. With the market shrugging off USD strength and focusing on safe haven demand, there appears to be little to alter the picture near-term. Additionally, any USD weakness should further amplify gold gains. With that in mind, traders will be looking to the latest set of US PMIs due later today. Given the weakness we’ve seen in UK and Eurozone readings this morning, there are downside risks for USD into the data which should offer gold further support if USD takes a knock.

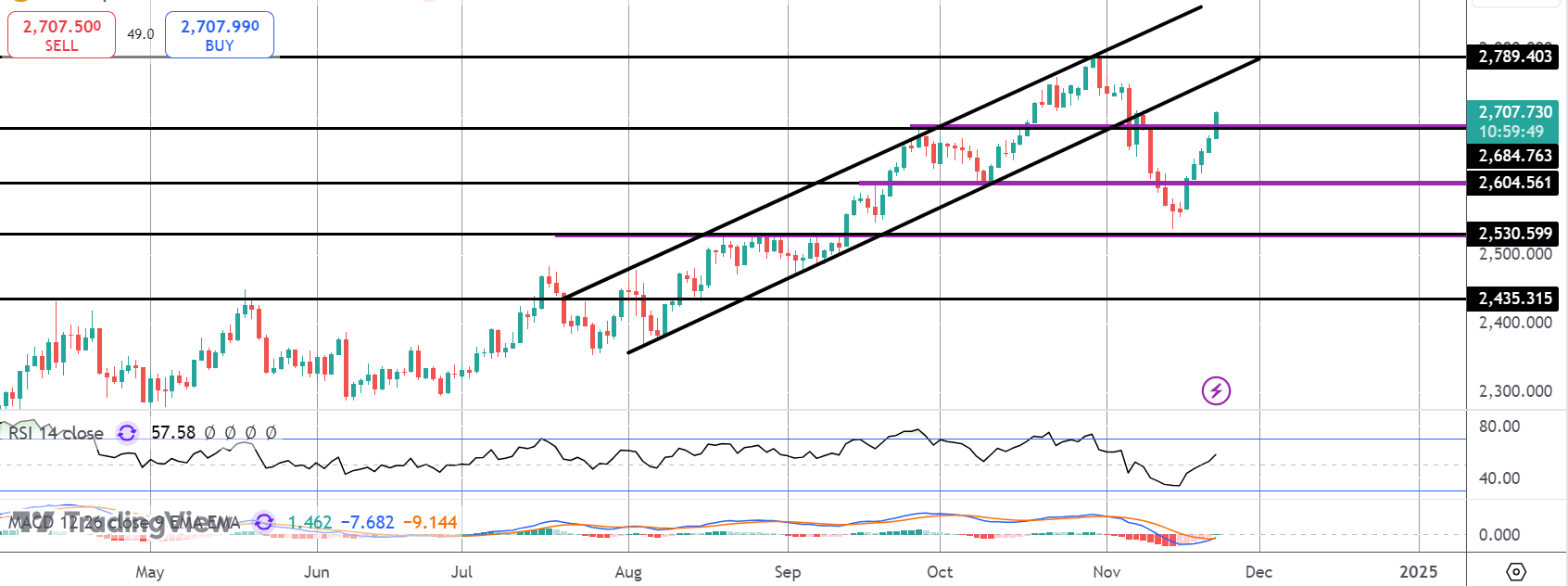

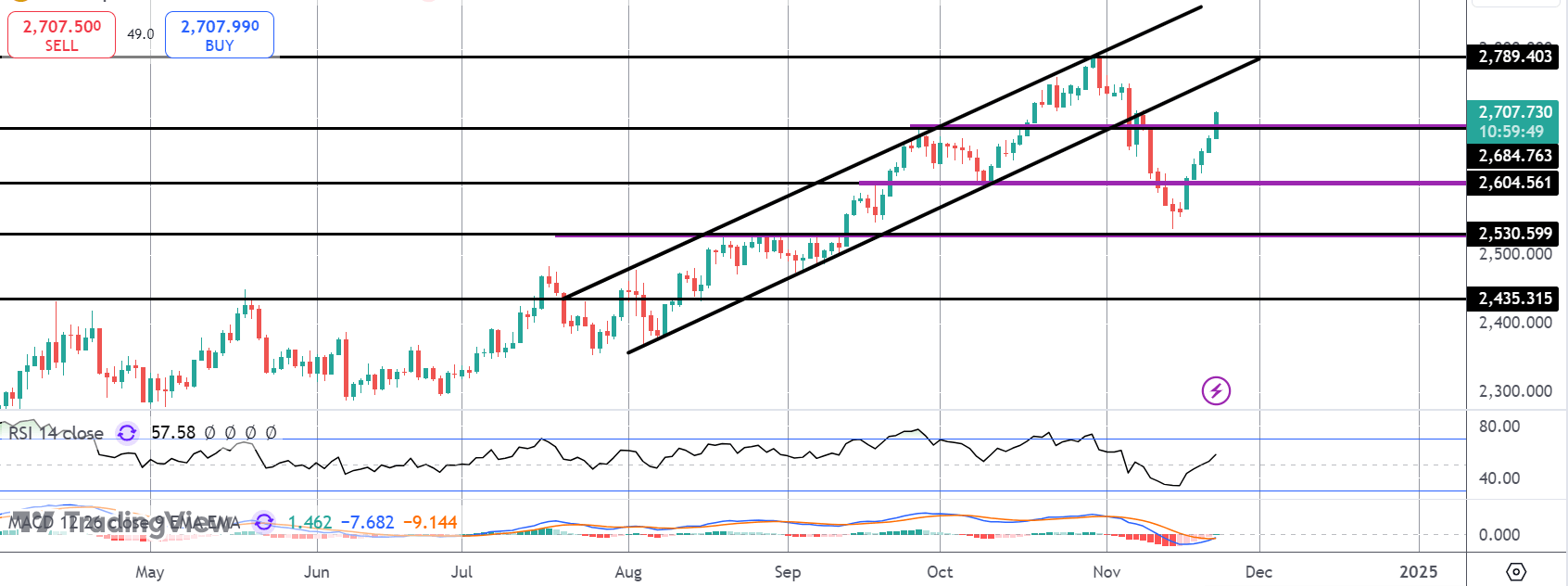

Technical Views

Gold

The rally in gold off the 2,530 level has seen the market breaking back above 2,604 and 2,6784 last. With momentum studies turning higher, focus is on a rest of the broken bull channel and YTD highs around the 2,789 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.