Gold Consolidation Continues For Now

Gold Lacking Direction

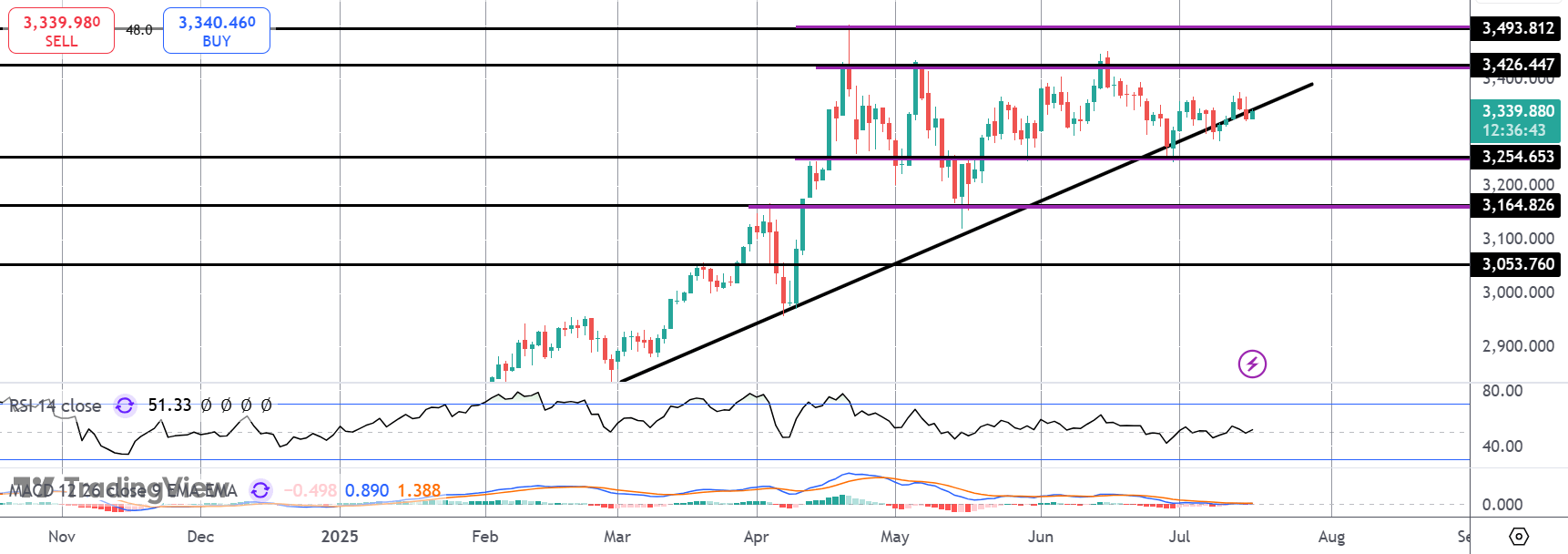

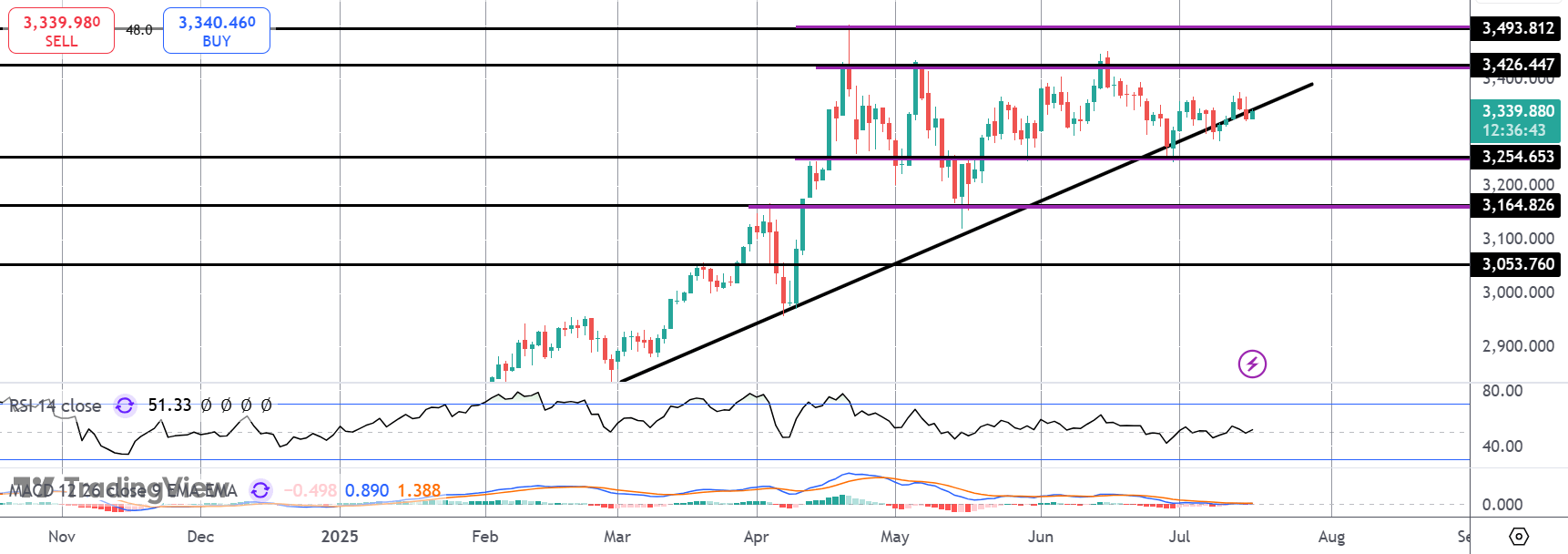

Gold prices remain cautiously bid today with the futures market sitting in the green through early European trading. However, price action remains devoid of any directional bias with the market trading at the same levels we saw late April. Following the correction from the all-time highs printed that month, the futures market has settled into a range between support at 3,254.65 and resistance around the 3,426.44 level.

Competing Market Drivers

Uncertainty around US trade tariffs, potential Fed action and geopolitical tensions mean that it’s been difficult for gold traders to establish a fresh push on either side of the market. For now, it seems the market is in wait and see mode, looking for a clear directional catalyst to help spur a break of the range.

US Inflation & USD

Near-term, gold prices could start to drift lower again if the current USD rally develops further. Yesterday, annualised US CPI for June came in above forecasts at 2.7%, up from 2.4% prior and above the 2.6% the market was looking for. The data is casting some uncertainty over the prospect of a September rate-cut by the Fed. If this narrative gains traction, USD could start to recover more fully, driving gold lower.

Technical Views

Gold

For now, gold prices remain mid-range, straddling the bull trend line off year-to-date lows. Momentum studies remain mostly flat here, reflecting the lack of direction. While 3,254.65 holds, the preferred outlook remains bullish, in line with the broader trend. Below there, however, 3,164.82 will be next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.