Gold At Record Highs Ahead of FOMC Minutes & Powell

Fresh Highs

Gold prices are starting the week on a softer footing following Friday’s breakout rally to new, record highs. On the back of that move, however, the outlook remains firmly bullish this week with gold bulls looking for a renewed push higher. Weakness in USD was the main driver of the move higher last week, with US CPI seen falling yet again, near-term Fed expectations have soared with traders now pricing in at least .75% worth of cuts ahead of year end. Alongside a weaker USD and heightened Fed easing expectations, gold is also remaining well supported through safe-haven inflows linked to the ongoing conflict in the Middle East as well as between Russia and Ukraine.

What to Watch This Week

Looking ahead this week, there is a busy schedule of US data and events to monitor. US PMIs, July FOMCs, Fed speakers and Fed chairman Powell’s Jackson Hole comments will all be closely watched with traders. For gold bulls, there is big opportunity this week if data and comments lean on the dovish side, driving fresh USD weakness. In particular, the FOMC minutes and Powell’s Jackson Hole comments look likely to stoke dovish expectations, particularly given the fresh fall in inflation we’ve seen. If Powell signals that multiple cuts are now a clear option this year, gold prices look likely to trade firmly higher as USD comes off.

Technical Views

Gold

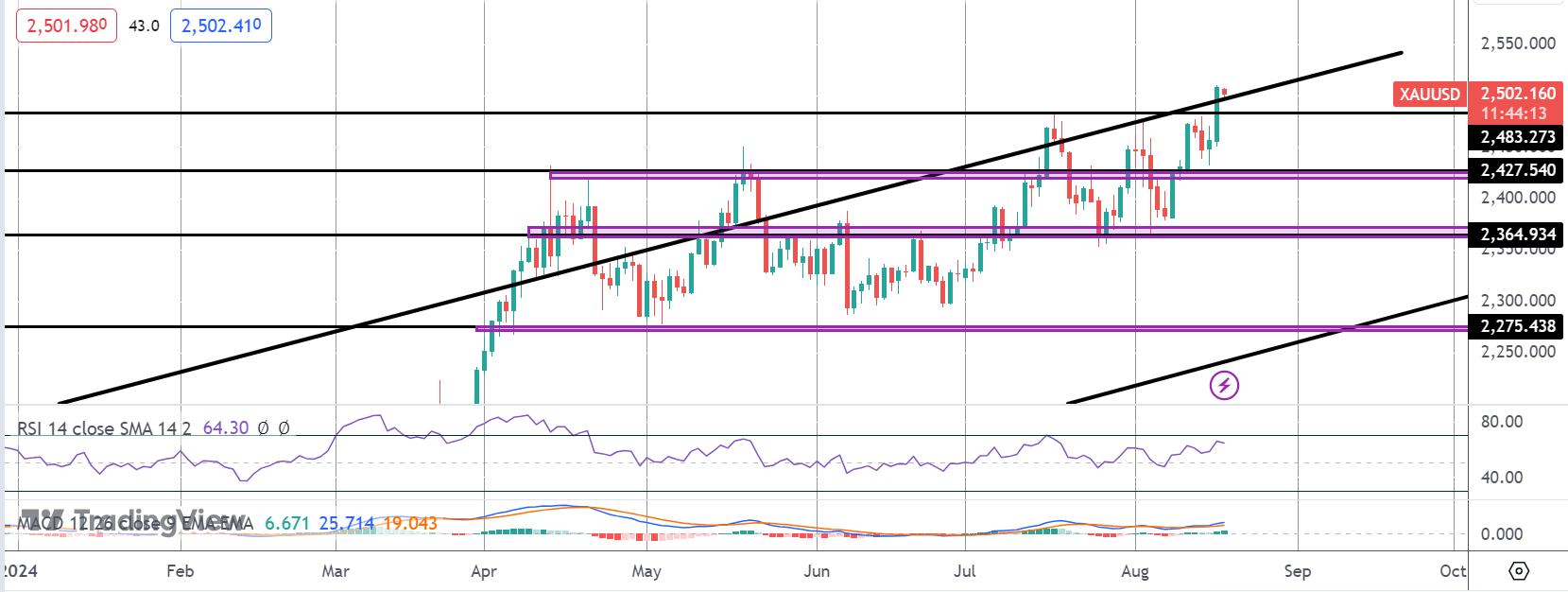

The rally in gold prices has seen the market breaking out above the 2,483.27 level with price now testing above the bull channel highs. Momentum studies are bullish here keeping the focus on further upside while the market holds above 2,427.54.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.