Is Germany on the Brink of Recession?

The latest set of economic data out of Germany has compounded fears that the second largest economy in the eurozone is on the brink of a recession. On Tuesday, German ZEW Survey Current Situation and Expectations both came in below expectations at -13.5 and -44.1 respectively. These readings have been trending lower over the year and highlight the subdued outlook among German businesses.

GDP Down in Q2

This data was followed by headline GDP data this morning which showed the Germany economy having contracted in Q2, in line with recent weakness in sentiment data. The data showed the German economy contracted by 0.1% in Q2 2019, down from +0.4% over Q1. On the annual reading, the economy grew by just 0.4%, down from the prior 0.7% reading.

Although the full breakdown of GDP components will not be available until the end of the month, the German statistical agency noted that there had been positive contributions from household consumption, government expenditure and investment (excluding construction) while net trade had been a drag as exports fell at a faster pace than imports.

Sentiment Data Highlights Recession

This data will be a difficult reading for the ECB, though not surprising given the recent weakness we have seen in indicators such as the Ifo Institute for Economic Research, which already reflect Germany being in recession. Indeed, other leading indicators show that, while the manufacturing sector has been the worst hit for now, the outlook is growing increasingly negative for the services sector. Indeed, with the second half of the year forecast to be weak, another soft reading for Q3 could be likely.

German Exports Down

The weight of the global downturn, in light of ongoing and escalating trade tensions, is creating an incredibly challenging situation for Germany. The German export machine has been hard hit over the last year, with the country’s famed auto sector dwindling rapidly. Indeed, with the uncertainty of a no deal Brexit looming large on the horizon also, the outlook is increasingly bleak.

Substantial Changes

When the German economy first began to show signs of stalling in the second half of last year, it was thought that this was mainly a result of transitory factors. However, it has become increasingly clear that the deepening slowdown in Germany is due to more substantial issues taking place in the sectors which have long ruled the German economic landscape. Furthermore, shifting growth dynamics in China have the potential to further weaken demand for German-made machinery and equipment, especially with global car production and sales growth falling and forecast to fall further over the year. Indeed, while the domestic sector remains supported by a tight labour market and rising real wages, external factors are continuing to weigh on domestic activity, signalling that unemployment is likely to increase in the near term, weighing further on German growth.

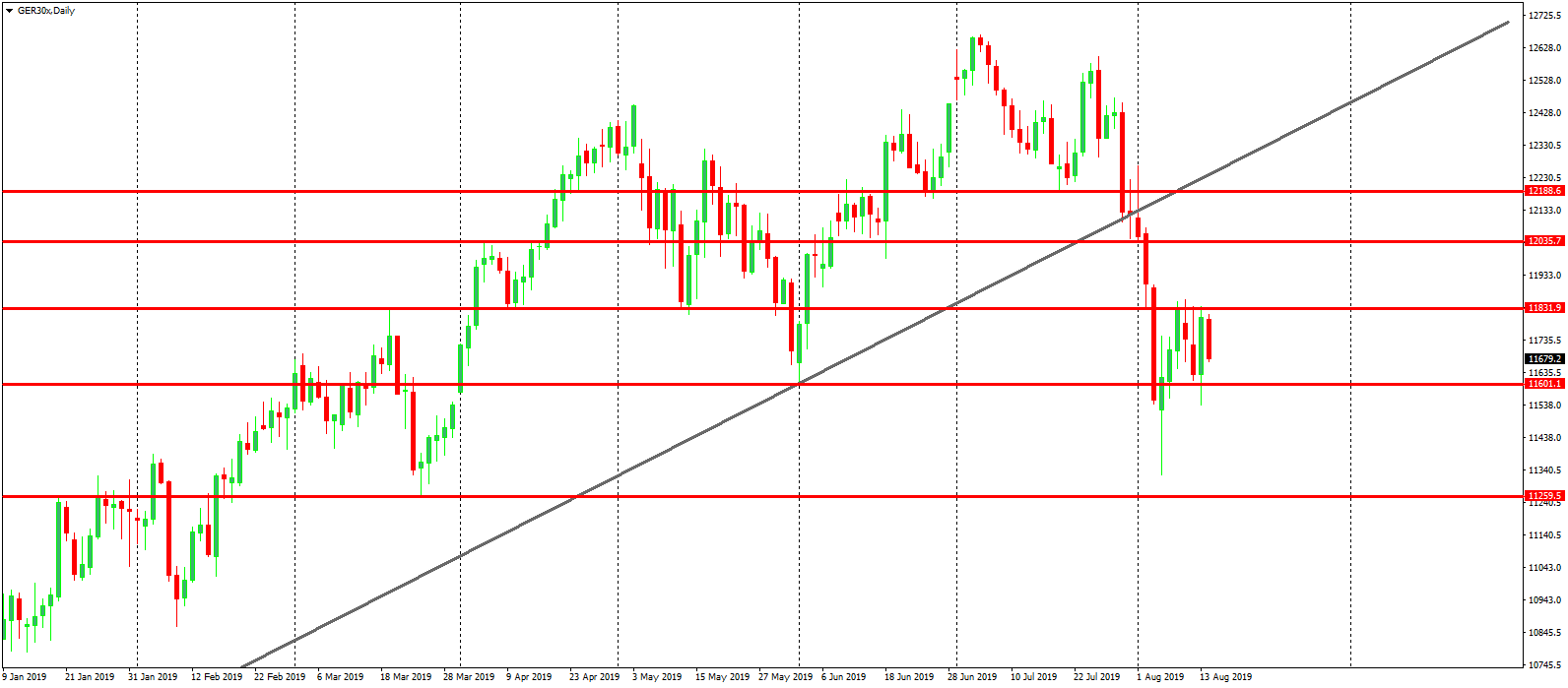

Technical Perspective

The headline German equities market the DAX remains in a precarious position today. Following the heavy declines last week in response to the deteriorating trade situation between the US and China, we had seen some recovery, which was fuelled b news that Trump will now delay some of the new tariff due to start in September. However, the DAX has turned lower once again today with price failing to get back above the 11831.9. While above the 11601.1 support, we are likely to continue in this tight block of consolidation, reflecting the opposing forces at work in the DAX. Below that level, focus will turn to a test of the 11259.5 level next.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.